Regions Bank 2009 Annual Report Download - page 189

Download and view the complete annual report

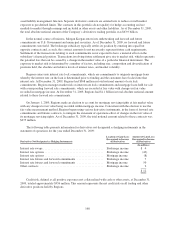

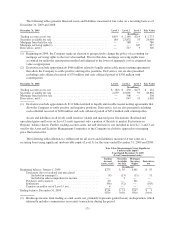

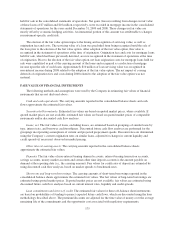

Please find page 189 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.held for sale in the consolidated statements of operations. Net gains (losses) resulting from changes in fair value

of these loans of $7 million and $16 million, respectively, were recorded in mortgage income in the consolidated

statements of operations for the years ended December 31, 2009 and 2008. These changes in fair value are

mostly offset by economic hedging activities. An immaterial portion of this amount was attributable to changes

in instrument-specific credit risk.

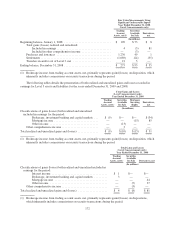

The election of the fair value option impacts the timing and recognition of servicing value, as well as

origination fees and costs. The servicing value of a loan was precluded from being recognized until the sale of

the loan prior to the election of the fair value option. After adoption of the fair value option, this value is

recognized in the statement of operations at the time of origination. Origination fees and costs for mortgage loans

held for sale, which had been previously deferred, are now recognized in the statement of operations at the time

of origination. Prior to the election of the fair value option, net loan origination costs for mortgage loans held for

sale were capitalized as part of the carrying amount of the loans and recognized as a reduction of mortgage

income upon the sale of such loans. Approximately $10 million of loan servicing value was recognized in

non-interest income during 2008 related to the adoption of the fair value option. The net impact of ceasing

deferrals of origination fees and costs during 2008 related to the adoption of the fair value option was not

material.

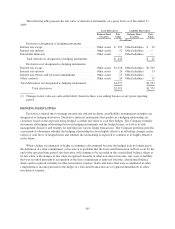

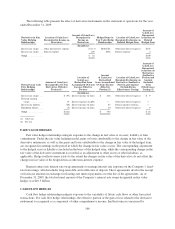

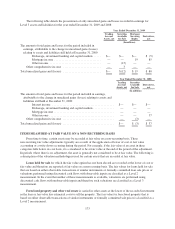

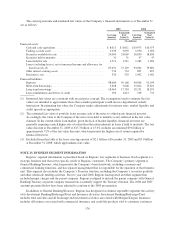

FAIR VALUE OF FINANCIAL INSTRUMENTS

The following methods and assumptions were used by the Company in estimating fair values of financial

instruments that are not disclosed above:

Cash and cash equivalents: The carrying amounts reported in the consolidated balance sheets and cash

flows approximate the estimated fair values.

Securities held to maturity: Estimated fair values are based on quoted market prices, where available. If

quoted market prices are not available, estimated fair values are based on quoted market prices of comparable

instruments and/or discounted cash flow analyses.

Loans, net: The fair values of loans, excluding leases, are estimated based on groupings of similar loans by

type, interest rate, and borrower creditworthiness. Discounted future cash flow analyses are performed for the

groupings incorporating assumptions of current and projected prepayment speeds. Discount rates are determined

using the Company’s current origination rates on similar loans, adjusted for changes in current liquidity and

credit spreads (if necessary) observed in market pricing.

Other interest-earning assets: The carrying amounts reported in the consolidated balance sheets

approximate the estimated fair values.

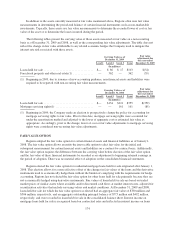

Deposits: The fair value of non-interest bearing demand accounts, interest-bearing transaction accounts,

savings accounts, money market accounts and certain other time deposit accounts is the amount payable on

demand at the reporting date (i.e., the carrying amount). Fair values for certificates of deposit are estimated by

using discounted cash flow analyses, based on market spreads to benchmark rates.

Short-term and long-term borrowings: The carrying amounts of short-term borrowings reported in the

consolidated balance sheets approximate the estimated fair values. The fair values of long-term borrowings are

estimated using quoted market prices. If quoted market prices are not available, fair values are estimated using

discounted future cash flow analyses based on current interest rates, liquidity and credit spreads.

Loan commitments and letters of credit: The estimated fair values for these off-balance sheet instruments

are based on probabilities of funding to project expected future cash flows, which are discounted using the loan

methodology described above. The premium/discounts are adjusted for the time value of money over the average

remaining life of the commitments and the opportunity cost associated with regulatory requirements.

175