Regions Bank 2009 Annual Report Download - page 183

Download and view the complete annual report

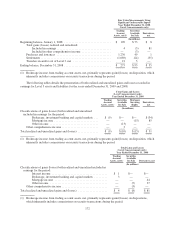

Please find page 183 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CREDIT DERIVATIVES

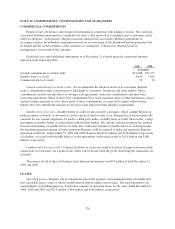

Regions has both bought and sold credit protection in the form of participations on interest rate swaps (swap

participations). These swap participations, which meet the definition of credit derivatives, were entered into in

the ordinary course of business to serve the credit needs of customers. Credit derivatives, whereby Regions has

purchased credit protection, entitle Regions to receive a payment from the counterparty when the customer fails

to make payment on any amounts due to Regions upon early termination of the swap transaction and have

maturities between 2012 and 2026. Credit derivatives whereby Regions has sold credit protection have maturities

between 2010 and 2015. For contracts where Regions sold credit protection, Regions would be required to make

payment to the counterparty when the customer fails to make payment on any amounts due to the counterparty

upon early termination of the swap transaction. Regions bases the current status of the prepayment/performance

risk on bought and sold credit derivatives on recently issued internal risk ratings consistent with the risk

management practices of unfunded commitments.

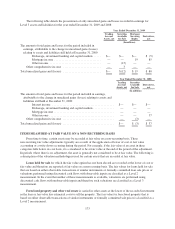

Regions’ maximum potential amount of future payments under these contracts is approximately $49 million.

This scenario would only occur if variable interest rates were at zero percent and all counterparties defaulted with

zero recovery. The fair value of sold protection at December 31, 2009, was immaterial. In transactions where

Regions has sold credit protection, recourse to collateral associated with the original swap transaction is available

to offset some or all of Regions’ obligation.

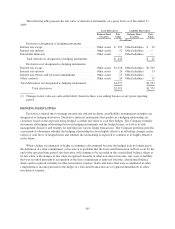

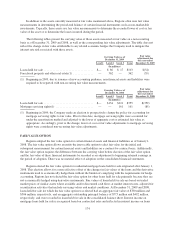

CONTINGENT FEATURES

Certain Regions’ derivative instruments contain provisions that require Regions Bank’s debt to maintain an

investment grade credit rating from major credit rating agencies. If Regions Bank’s debt were to fall below

investment grade, it would be in violation of these provisions, and the counterparties to the derivative instruments

could request immediate payment or demand immediate and ongoing full overnight collateralization on

derivative instruments in net liability positions. The aggregate fair value of all derivative instruments with credit-

risk-related contingent features that are in a liability position on December 31, 2009, was $347 million, for which

Regions had posted collateral of $336 million in the normal course of business. If the credit-risk-related

contingent features underlying these agreements were triggered on December 31, 2009, Regions would be

required to post an additional $11 million of collateral to its counterparties.

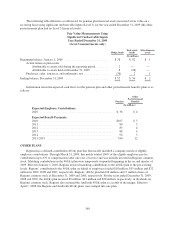

NOTE 22. FAIR VALUE MEASUREMENTS

Authoritative accounting literature establishes a framework for using fair value to measure assets and

liabilities and defines fair value as the price that would be received to sell an asset or paid to transfer a liability

(an exit price) as opposed to the price that would be paid to acquire the asset or received to assume the liability

(an entry price). A fair value measure should reflect the assumptions that market participants would use in

pricing the asset or liability, including the assumptions about the risk inherent in a particular valuation technique,

the effect of a restriction on the sale or use of an asset and the risk of nonperformance. Required disclosures

include stratification of balance sheet amounts measured at fair value based on inputs the Company uses to

derive fair value measurements. These strata include:

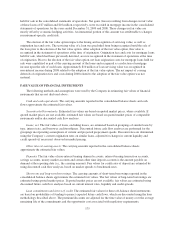

• Level 1 valuations, where the valuation is based on quoted market prices for identical assets or

liabilities traded in active markets (which include exchanges and over-the-counter markets with

sufficient volume),

• Level 2 valuations, where the valuation is based on quoted market prices for similar instruments traded

in active markets, quoted prices for identical or similar instruments in markets that are not active and

model-based valuation techniques for which all significant assumptions are observable in the market,

and

• Level 3 valuations, where the valuation is generated from model-based techniques that use significant

assumptions not observable in the market, but observable based on Company-specific data. These

169