Regions Bank 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

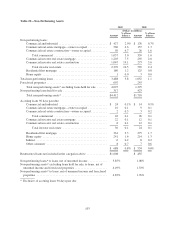

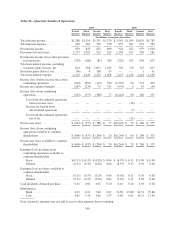

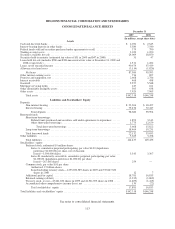

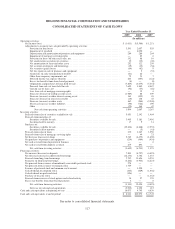

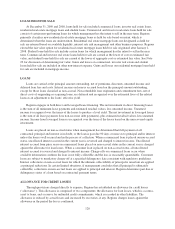

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31

2009 2008

(In millions, except share data)

Assets

Cash and due from banks ....................................................... $ 2,052 $ 2,643

Interest-bearing deposits in other banks ........................................... 5,580 7,540

Federal funds sold and securities purchased under agreements to resell .................. 379 790

Trading account assets ......................................................... 3,039 1,050

Securities available for sale ..................................................... 24,069 18,850

Securities held to maturity (estimated fair value of $31 in 2009 and $47 in 2008) .......... 31 47

Loans held for sale (includes $780 and $506 measured at fair value at December 31, 2009 and

2008, respectively) .......................................................... 1,511 1,282

Loans, net of unearned income .................................................. 90,674 97,419

Allowance for loan losses ...................................................... (3,114) (1,826)

Net loans ............................................................... 87,560 95,593

Other interest-earning assets .................................................... 734 897

Premises and equipment, net .................................................... 2,668 2,786

Interest receivable ............................................................ 468 458

Goodwill ................................................................... 5,557 5,548

Mortgage servicing rights ...................................................... 247 161

Other identifiable intangible assets ............................................... 503 638

Other assets ................................................................. 7,920 7,965

Total assets ............................................................. $142,318 $146,248

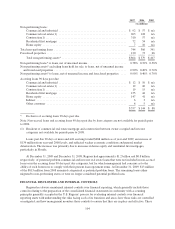

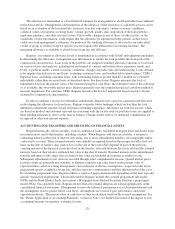

Liabilities and Stockholders' Equity

Deposits:

Non-interest-bearing ...................................................... $ 23,204 $ 18,457

Interest-bearing .......................................................... 75,476 72,447

Total deposits ........................................................ 98,680 90,904

Borrowed funds:

Short-term borrowings:

Federal funds purchased and securities sold under agreements to repurchase ...... 1,893 3,143

Other short-term borrowings ............................................ 1,775 12,679

Total short-term borrowings ........................................ 3,668 15,822

Long-term borrowings ..................................................... 18,464 19,231

Total borrowed funds 22,132 35,053

Other liabilities .............................................................. 3,625 3,478

Total liabilities ........................................................... 124,437 129,435

Stockholders’ equity:

Preferred stock, authorized 10 million shares

Series A, cumulative perpetual participating, par value $1.00 (liquidation

preference $1,000.00) per share, net of discount;

Issued—3,500,000 shares ............................................ 3,343 3,307

Series B, mandatorily convertible, cumulative perpetual participating, par value

$1,000.00 (liquidation preference $1,000.00) per share;

Issued—267,665 shares .............................................. 259 —

Common stock, par value $.01 per share:

Authorized 1.5 billion shares

Issued including treasury stock—1,235,850,589 shares in 2009 and 735,667,650

shares in 2008 ..................................................... 12 7

Additional paid-in capital .................................................. 18,781 16,815

Retained earnings (deficit) .................................................. (3,235) (1,869)

Treasury stock, at cost—43,241,020 shares in 2009 and 44,301,693 shares in 2008 ..... (1,409) (1,425)

Accumulated other comprehensive income (loss), net ............................ 130 (22)

Total stockholders’ equity .............................................. 17,881 16,813

Total liabilities and stockholders’ equity ........................................... $142,318 $146,248

See notes to consolidated financial statements.

113