Regions Bank 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.INCOME TAXES

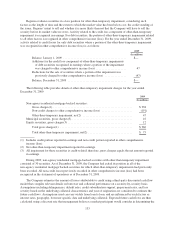

Regions and its subsidiaries file various federal and state income tax returns, including some returns that are

consolidated with subsidiaries. Regions accounts for the current and future tax effects of such returns using the

asset and liability method, recording deferred tax assets and liabilities and applying federal and state tax rates

currently in effect to its cumulative temporary differences. Temporary differences are differences between

financial statement carrying amounts and the corresponding tax bases of assets and liabilities.

From time to time, for certain business plans enacted by Regions, management bases the estimates of related

tax liabilities on its belief that future events will validate management’s current assumptions regarding the

ultimate outcome of tax-related exposures. If the tax effects of a transaction are significant, Regions’ practice is

to obtain the opinion of advisors that the tax effects of such a transaction should prevail if challenged. If the tax

benefits associated with a transaction are not more-likely-than-not of being sustained upon examination by

weighing the facts and circumstances at the reporting date, Regions records a liability for the recognized income

tax benefits associated with that transaction. The examination of Regions’ income tax returns or changes in tax

law may impact the tax benefits of these transactions. Regions recognizes accrued interest and penalties related

to unrecognized tax benefits as tax expense. Regions believes adequate provisions for income tax have been

recorded for all years open for examination.

Regions implemented authoritative accounting literature related to uncertain tax positions which required

that only benefits from tax positions that are more-likely-than-not of being sustained upon examination should be

recognized in the financial statements. As a result of the implementation, the Company recognized an

approximate $259 million increase in the liability for unrecognized tax benefits, which was accounted for as a

reduction to the January 1, 2007 balance of retained earnings.

Management evaluates the realization of deferred tax assets based on all positive and negative evidence

available at the balance sheet date. Realization of deferred tax assets is based on management’s judgments

regarding future events including future projected income, implementation of plans to maximize realization of

deferred tax assets, taxable income within the carryback period and reversal of taxable temporary differences.

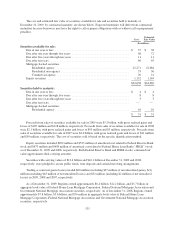

TREASURY STOCK

The purchase of the Company’s common stock is recorded at cost. At the date of retirement or subsequent

reissuance, treasury stock is reduced by the cost of such stock with differences recorded in additional paid-in

capital or retained earnings, as applicable.

SHARE-BASED PAYMENTS

Compensation cost for share-based payments is measured based on the fair value of the award, which most

commonly includes restricted stock (i.e., unvested common stock) and stock options, at the grant date and is

recognized in the consolidated financial statements on a straight-line basis over the requisite service period for

service-based awards. The fair value of restricted stock or restricted stock units is determined based on the

closing price of Regions’ common stock on the date of grant. The fair value of stock options where vesting is

based on service is estimated at the date of grant using a Black-Scholes option pricing model and related

assumptions. Expected volatility considers implied volatility from traded options on the Company’s stock and,

primarily, historical volatility of the Company’s stock. Regions considers historical data to estimate future option

exercise behavior, which is used to derive an option’s expected term. The expected term represents the period of

time that options are expected to be outstanding from the grant date. Historical data is also used to estimate future

employee attrition, which is used to calculate an expected forfeiture rate. Groups of employees that have similar

historical exercise behavior are reviewed and considered for valuation purposes. The risk-free rate is based on the

U.S. Treasury yield curve in effect at the time of grant and the weighted-average expected life of the grant.

Beginning in 2009, Regions issued restricted stock units payable solely in cash (“cash-settled RSUs”), which are

126