Regions Bank 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Assets, consisting principally of loans and securities, are funded by customer deposits, purchased funds,

borrowed funds and stockholders’ equity. Regions’ goal in liquidity management is to satisfy the cash flow

requirements of depositors and borrowers, while at the same time meeting its cash flow needs. This is

accomplished through the active management of both the asset and liability sides of the balance sheet. The

liquidity position of Regions is monitored on a daily basis by Regions’ Treasury Division. In addition, the

ALCO, which consists of members of Regions’ senior management team, reviews liquidity on a regular basis and

approves any changes in strategy that are necessary as a result of asset/liability composition or anticipated cash

flow changes. Management also compares Regions’ liquidity position to established corporate liquidity policies

on a monthly basis.

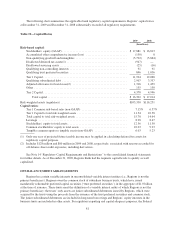

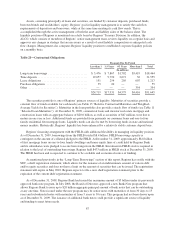

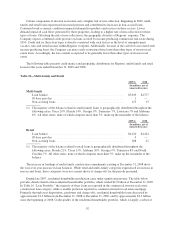

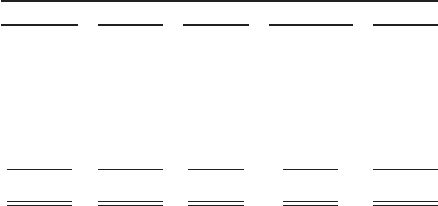

Table 21—Contractual Obligations

Payments Due By Period

Less than 1 1-3 Years 4-5 Years More than 5 Total

(In millions)

Long-term borrowings ........................... $ 5,476 $ 7,867 $1,702 $3,419 $18,464

Time deposits .................................. 19,057 9,790 2,672 36 31,555

Lease obligations ............................... 151 254 205 607 1,217

Purchase obligations ............................ 35 20 — — 55

Other ........................................ — — — 354 354

$24,719 $17,931 $4,579 $4,416 $51,645

The securities portfolio is one of Regions’ primary sources of liquidity. Maturities of securities provide a

constant flow of funds available for cash needs (see Table 13 “Relative Contractual Maturities and Weighted-

Average Yields for Securities”). Maturities in the loan portfolio also provide a steady flow of funds (see Table 11

“Selected Loan Maturities”). At December 31, 2009, commercial loans and investor real estate mortgage and

construction loans with an aggregate balance of $20.0 billion, as well as securities of $47 million, were due to

mature in one year or less. Additional funds are provided from payments on consumer loans and one-to-four

family residential first mortgage loans. Liquidity needs can also be met by borrowing funds in state and national

money markets. Historically, Regions’ liquidity has been enhanced by a relatively stable customer deposit base.

Regions’ financing arrangement with the FHLB adds additional flexibility in managing its liquidity position.

As of December 31, 2009, borrowings from the FHLB totaled $8.4 billion. FHLB borrowing capacity is

contingent on the amount of collateral pledged to the FHLB. At December 31, 2009, approximately $8.8 billion

of first mortgage loans on one-to-four family dwellings and home equity lines of credit held by Regions Bank

and its subsidiaries were pledged to secure borrowings from the FHLB. Investment in FHLB stock is required in

relation to the level of outstanding borrowings. Regions held $473 million in FHLB stock at December 31, 2009.

The FHLB has been and is expected to continue to be a reliable and economical source of funding.

As mentioned previously in the “Long-Term Borrowings” section of this report, Regions has on file with the

SEC, a shelf registration statement, which allows for the issuance of an indeterminate amount of various debt

and/or equity securities and does not have a limit on the amount of securities that can be issued. The registration

statement will expire in May 2010. Regions expects to file a new shelf registration statement prior to the

expiration of the current shelf registration statement.

As of December 31, 2009, Regions Bank had issued the maximum amount of $5 billion under its previously

approved bank note program. In July 2008, the Board of Directors approved a new Bank Note program that

allows Regions Bank to issue up to $20 billion aggregate principal amount of bank notes that can be outstanding

at any one time. Notes issued under the new program may be senior notes with maturities of from 30 days to 15

years and subordinated notes with maturities of from 5 years to 30 years. This program had not been drawn upon

as of December 31, 2009. The issuance of additional bank notes could provide a significant source of liquidity

and funding to meet future needs.

87