Regions Bank 2009 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

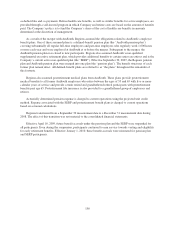

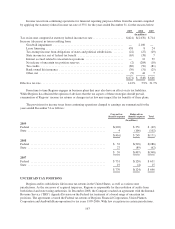

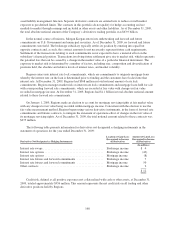

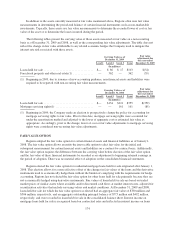

The following table presents the fair value of derivative instruments on a gross basis as of December 31,

2009:

Asset Derivatives Liability Derivatives

Balance Sheet

Location

Fair

Value

Balance Sheet

Location

Fair

Value

(In millions)

Derivatives designated as hedging instruments

Interest rate swaps ................................... Other assets $ 390 Other liabilities $ 22

Interest rate options ................................. Other assets 52 Other liabilities —

Eurodollar futures(1) ................................ Other assets — Other liabilities —

Total derivatives designated as hedging instruments .... $ 442 $ 22

Derivatives not designated as hedging instruments

Interest rate swaps ................................... Other assets $1,518 Other liabilities $1,505

Interest rate options ................................. Other assets 26 Other liabilities 33

Interest rate futures and forward commitments ............ Other assets 13 Other liabilities —

Other contracts ..................................... Other assets 20 Other liabilities 19

Total derivatives not designated as hedging instruments ..... $1,577 $1,557

Total derivatives ............................ $2,019 $1,579

(1) Changes in fair value are cash-settled daily; therefore there is no ending balance at any given reporting

period.

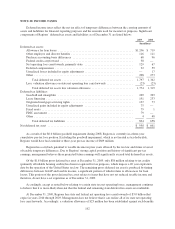

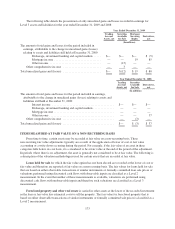

HEDGING DERIVATIVES

Derivatives entered into to manage interest rate risk and facilitate asset/liability management strategies are

designated as hedging derivatives. Derivative financial instruments that qualify in a hedging relationship are

classified, based on the exposure being hedged, as either fair value or cash flow hedges. The Company formally

documents all hedging relationships between hedging instruments and the hedged items, as well as its risk

management objective and strategy for entering into various hedge transactions. The Company performs periodic

assessments to determine whether the hedging relationship has been highly effective in offsetting changes in fair

values or cash flows of hedged items and whether the relationship is expected to continue to be highly effective

in the future.

When a hedge is terminated or hedge accounting is discontinued because the hedged item no longer meets

the definition of a firm commitment, or because it is probable that the forecasted transaction will not occur by the

end of the specified time period, the derivative will continue to be recorded in the consolidated balance sheets at

its fair value, with changes in fair value recognized currently in other non-interest income. Any asset or liability

that was recorded pursuant to recognition of the firm commitment is removed from the consolidated balance

sheets and recognized currently in other non-interest expense. Gains and losses that were accumulated in other

comprehensive income pursuant to the hedge of a forecasted transaction are recognized immediately in other

non-interest expense.

165