Regions Bank 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

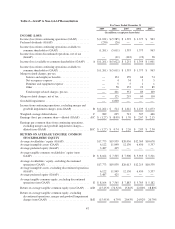

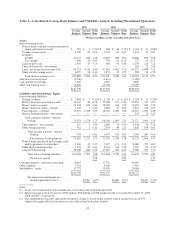

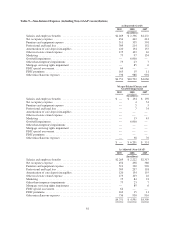

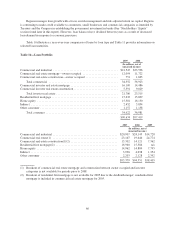

NON-INTEREST INCOME

Non-interest income represents fees and income derived from sources other than interest-earning assets.

Table 5 “Non-Interest Income” provides a detail of the components of non-interest income. Non-interest income

totaled $3.8 billion in 2009 compared to $3.1 billion in 2008. The increase in non-interest income is primarily

due to revenue generated from unwinding certain leveraged lease transactions during the year. However, this

revenue was more than offset by the related income tax expense, resulting in an insignificant aggregate impact to

net income. Excluding the leveraged lease terminations, results reflected an increase in mortgage income,

primarily due to customers taking advantage of historically low mortgage rates, which drove higher mortgage

originations and slightly higher service charges income. In addition, non-interest income was aided by a gain on

the early extinguishment of debt realized in connection with the Company’s issuance of common stock in

exchange for trust preferred securities. Offsetting these increases, brokerage, investment banking and capital

markets revenue declined due to lower fees from investment banking and capital markets. In addition, trust

income fees were negatively impacted by lower asset valuations due to the disarray in the markets during the

year. Non-interest income (excluding securities transactions and leveraged lease gains) as a percent of total

revenue (on a fully taxable-equivalent basis) equaled 44 percent in 2009 compared to 43 percent in 2008. The

increase is primarily due to higher mortgage income and a decline in net interest income in 2009.

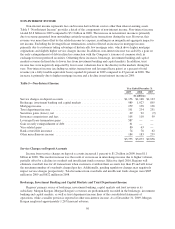

Table 5—Non-Interest Income

Year Ended December 31

2009 2008 2007

(In millions)

Service charges on deposit accounts ....................................... $1,156 $1,148 $1,163

Brokerage, investment banking and capital markets ........................... 989 1,027 895

Mortgage income ...................................................... 259 138 136

Trust department income ................................................ 191 234 251

Securities gains (losses), net ............................................. 69 92 (9)

Insurance commissions and fees .......................................... 105 110 99

Leveraged lease termination gains ......................................... 587 — —

Gain on early extinguishment of debt ...................................... 61 — —

Visa-related gains ...................................................... 80 63 —

Bank-owned life insurance ............................................... 74 78 62

Other miscellaneous income ............................................. 184 183 259

$3,755 $3,073 $2,856

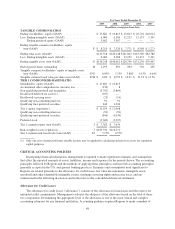

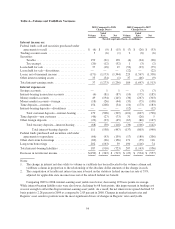

Service Charges on Deposit Accounts

Income from service charges on deposit accounts increased 1 percent to $1.2 billion in 2009 from $1.1

billion in 2008. This modest increase was the result of an increase in interchange income due to higher volumes,

partially offset by a decline in overdraft and insufficient funds revenues. Effective April 2010, Regions will

eliminate overdraft fees for all transactions when customers overdraw their accounts less than $5 and will lower

the maximum number of overdrafts charged per day. Additionally, pending regulatory changes may negatively

impact service charges prospectively. Total revenues from overdrafts and insufficient funds charges were $605

million in 2009 and $622 million in 2008.

Brokerage, Investment Banking and Capital Markets and Trust Department Income

Regions’ primary source of brokerage, investment banking, capital markets and trust revenue is its

subsidiary, Morgan Keegan. Morgan Keegan’s revenues are predominantly recorded in the brokerage, investment

banking and capital markets, as well as trust department income lines of the consolidated statements of

operations, while a smaller portion is reported in other non-interest income. As of December 31, 2009, Morgan

Keegan employed approximately 1,267 financial advisors.

56