Regions Bank 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

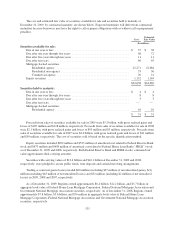

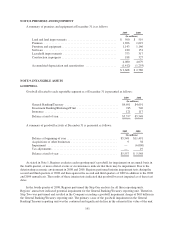

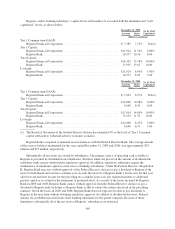

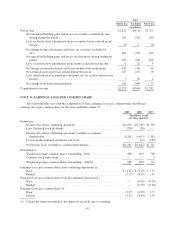

NOTE 13. LONG-TERM BORROWINGS

Long-term borrowings at December 31 consist of the following:

2009 2008

(In millions)

Federal Home Loan Bank structured advances ..................................... $ 2,884 $ 1,628

Other Federal Home Loan Bank advances ........................................ 4,520 6,469

6.375% subordinated notes due May 2012 ........................................ 598 598

7.75% subordinated notes due March 2011 ....................................... 512 523

7.00% subordinated notes due March 2011 ....................................... 500 499

7.375% subordinated notes due December 2037 ................................... 300 300

6.125% subordinated notes due March 2009 ...................................... — 175

6.75% subordinated debentures due November 2025 ................................ 163 163

7.75% subordinated notes due September 2024 .................................... 100 100

7.50% subordinated notes due May 2018 (Regions Bank) ............................ 750 750

6.45% subordinated notes due June 2037 (Regions Bank) ............................ 497 497

4.85% subordinated notes due April 2013 (Regions Bank) ........................... 491 490

5.20% subordinated notes due April 2015 (Regions Bank) ........................... 346 345

3.25% senior bank notes due December 2011 ..................................... 2,001 2,001

2.75% senior bank notes due December 2010 ..................................... 999 999

LIBOR floating rate senior bank notes due June 2010 ............................... 250 250

LIBOR floating rate senior bank notes due December 2010 .......................... 500 500

7.75% senior notes due November 2014 .......................................... 690 —

4.375% senior notes due December 2010 ......................................... 497 495

LIBOR floating rate senior notes due June 2012 ................................... 350 350

LIBOR floating rate senior notes due June 2009 ................................... — 250

6.625% junior subordinated notes due May 2047 ................................... 498 700

8.875% junior subordinated notes due June 2048 ................................... 345 345

Other long-term debt ......................................................... 454 484

Valuation adjustments on hedged long-term debt ................................... 219 320

$18,464 $19,231

Long-term FHLB structured advances have stated maturities ranging from 2010 to 2013, but are convertible

quarterly at the option of the FHLB. The convertible feature provides that after a specified date in the future, the

advances will remain at a fixed rate, or Regions will have the option to either pay off the advance or convert from

a fixed rate to a variable rate based on the LIBOR index. The FHLB structured advances have a weighted-

average interest rate of 3.1% at December 31, 2009 and 5.4% at both December 31, 2008 and 2007. Other FHLB

advances at December 31, 2009, 2008 and 2007 have a weighted-average interest rate of 3.4%, 3.8% and 4.8%,

respectively, with maturities of one to twenty years. FHLB borrowings are contingent upon the amount of

collateral pledged to the FHLB. Regions has pledged certain residential first mortgage loans on one-to-four

family dwellings and home equity lines of credit as collateral for the FHLB advances outstanding. See Note 5 for

loans pledged to the FHLB at December 31, 2009 and 2008. Additionally, membership in the FHLB requires an

institution to hold FHLB stock, which was $473 million at December 31, 2009 and $458 million at December 31,

2008.

As of December 31, 2009, Regions had ten issuances of subordinated notes totaling $4.3 billion, with stated

interest rates ranging from 4.85% to 7.75%. In May 2008, Regions Bank issued $750 million of subordinated

notes bearing an initial fixed rate of 7.50%, with a final maturity of May 15, 2018. All issuances of these notes

are, by definition, subordinated and subject in right of payment of both principal and interest to the prior payment

in full of all senior indebtedness of the Company, which is generally defined as all indebtedness and other

obligations of the Company to its creditors, except subordinated indebtedness. Payment of the principal of the

145