Radio Shack 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are managed on a company-wide level and are not allocated to each segment for management reporting

purposes.

Amounts in the other category reflect our business activities that are not separately reportable, which

include our dealer network, e-commerce, third-party service centers, manufacturing and foreign

operations.

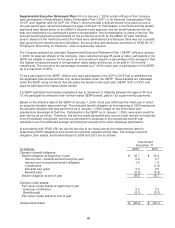

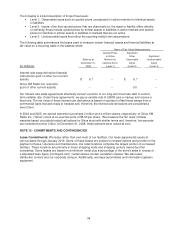

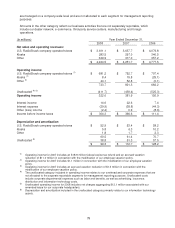

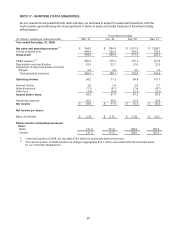

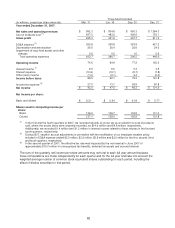

(In millions) Year Ended December 31,

2008 2007 2006

Net sales and operating revenues:

U.S. RadioShack company-operated stores $ 3,611.1 $ 3,637.7 $ 4,079.8

Kiosks 283.5 297.0 340.5

Other 329.9 317.0 357.2

$ 4,224.5 $ 4,251.7 $ 4,777.5

Operating income:

U.S. RadioShack company-operated stores (1) $ 681.2 $ 752.7 $ 707.4

Kiosks (2) 8.4 15.8 (25.1)

Other (3) 44.1 52.8 (0.1)

733.7 821.3 682.2

Unallocated (4) (5) (411.7) (439.4) (525.3)

Operating income 322.0 381.9 156.9

Interest income 14.6 22.6 7.4

Interest expense (29.9) (38.8) (44.3)

Other (loss) income (2.4) 0.9 (8.6)

Income before income taxes $ 304.3 $ 366.6 $ 111.4

Depreciation and amortization:

U.S. RadioShack company-operated stores $ 52.9 $ 53.4 $ 58.2

Kiosks 5.8 6.3 10.2

Other 1.8 1.7 2.3

60.5 61.4 70.7

Unallocated (6) 38.8 51.3 57.5

$ 99.3 $ 112.7 $ 128.2

(1) Operating income for 2007 includes an $18.8 million federal excise tax refund and an accrued vacation

reduction of $11.0 million in connection with the modification of our employee vacation policy.

(2) Operating income for 2007 includes $1.1 million in connection with the modification of our employee vacation

policy.

(3) Operating income for 2007 includes an accrued vacation reduction of $1.3 million in connection with the

modification of our employee vacation policy.

(4) The unallocated category included in operating income relates to our overhead and corporate expenses that are

not allocated to the separate reportable segments for management reporting purposes. Unallocated costs

include corporate departmental expenses such as labor and benefits, as well as advertising, insurance,

distribution and information technology costs.

(5) Unallocated operating income for 2008 includes net charges aggregating $12.1 million associated with our

amended lease for our corporate headquarters.

(6) Depreciation and amortization included in the unallocated category primarily relate to our information technology

assets.

79