Radio Shack 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

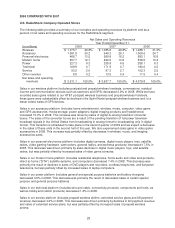

In connection with the above sale to TCC, we entered into an agreement with TCC to convey certain

personal property located in the corporate headquarters and certain real property located in close

proximity to the corporate headquarters in exchange for an amended and restated lease to occupy a

reduced portion of the corporate headquarters for a shorter time period. The amended and restated lease

agreement provides for us to occupy approximately 40% of the corporate headquarters complex for a

primary term of three years with no rental payments required during the term. The agreement also

provides for a renewal option on approximately half of this space for an additional two years at market

rents.

This agreement resulted in a non-cash net charge to other SG&A of $12.1 million for the second quarter of

2008. This net amount consisted of a net loss of $2.8 million related to the assets conveyed to TCC and a

$9.3 million charge to reduce a receivable for economic development incentives associated with the

corporate headquarters to its net realizable value.

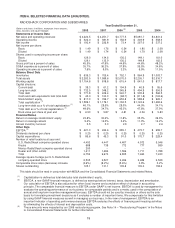

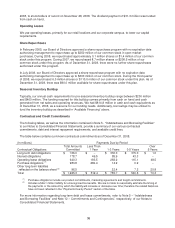

DEPRECIATION AND AMORTIZATION

The table below gives a summary of our total depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2008 2007

2006

U.S. RadioShack company-operated stores $ 52.9 $ 53.4 $ 58.2

Kiosks 5.8 6.3 10.2

Other 1.8 1.7 2.3

Unallocated 38.8 51.3 57.5

Total depreciation and amortization $ 99.3 $ 112.7 $ 128.2

The table below provides an analysis of total depreciation and amortization.

Year Ended December 31,

(In millions) 2008 2007

2006

Depreciation and amortization expense $ 88.1 $ 102.7 $ 117.5

Depreciation and amortization included in

cost of products sold

11.2

10.0

10.7

Total depreciation and amortization $ 99.3 $ 112.7 $ 128.2

Total depreciation and amortization for 2008 declined $13.4 million or 11.9%. This decrease was primarily

due to reduced capital expenditures in 2006 and 2007 when compared with prior years.

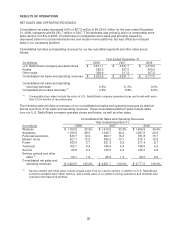

IMPAIRMENT OF LONG-LIVED ASSETS AND OTHER CHARGES

Impairment of long-lived assets and other charges was $2.8 million and $2.7 million for 2008 and 2007,

respectively. These amounts were related primarily to our Sprint Nextel kiosk operations and

underperforming U.S. RadioShack company-operated stores. We recorded this amount based on the

remaining estimated future cash flows related to these specific stores. It was determined that the net book

value of many of the stores' long-lived assets was not recoverable. For the stores with insufficient estimated

cash flows, we wrote down the associated long-lived assets to their estimated fair value.

NET INTEREST EXPENSE

Consolidated interest expense, net of interest income, was $15.3 million for 2008 versus $16.2 million for

2007, a decrease of $0.9 million or 5.6%.

Interest expense decreased $8.9 million to $29.9 million in 2008 from $38.8 million in 2007. This decrease

was primarily attributable to lower interest rates on our floating rate debt exposure resulting from our

interest rate swaps. Due to the implementation of FASB Staff Position No. APB 14-1, “Accounting for

Convertible Debt Instruments That May Be Settled in Cash Upon Conversion,” for our convertible notes, we

will recognize additional non-cash interest expense of $14 million for the year ended December 31, 2009.

26