Radio Shack 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

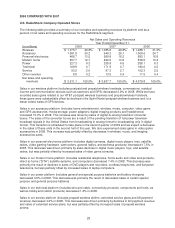

Kiosks

Kiosk sales consist primarily of handset sales, postpaid and prepaid commission revenue and related

wireless accessory sales. Kiosk sales decreased 4.5% or $13.5 million in 2008. This sales decrease was

driven primarily by a decline in the number of our Sprint Nextel branded kiosks, but was partially offset by

sales gains at our Sam’s Club kiosks. Our contract to operate Sprint Nextel kiosks expires in June of 2009.

We are currently in discussion with Sprint Nextel to renew this contract, but the ultimate resolution is

unknown at this time. The possible outcomes include renewing the contract under the same terms and

conditions, modifying the contract, or ceasing operations.

In February 2009, we signed a contract extension through March 31, 2011, with a transition period ending

June 30, 2011, with Sam’s Club to continue operating kiosks in certain Sam’s Club locations. As part of the

terms of the contract extension, we will assign the operation of 66 kiosk locations to Sam’s Club by July

2009. Upon the execution of this agreement, Sam’s Club had the right to assume the operation of

approximately 25 kiosk locations. Based on certain performance metrics, Sam’s Club could acquire the right

to assume approximately 25 additional kiosk locations in 2010. The total number of locations assumed by

Sam’s Club, for any reason, may not exceed 51 kiosk locations during term of the contract.

Other Sales

Other sales include sales to our independent dealers, outside sales through our service centers, sales

generated by our www.radioshack.com Web site and our Mexican subsidiary, sales to commercial

customers, and outside sales of our global sourcing operations and manufacturing. Other sales increased

$12.9 million or 4.1% in 2008. This sales increase was driven primarily by increased sales at our

RadioShack.com Web site and the recognition of 100% of the sales for RadioShack de Mexico in the

month of December. If we had owned 100% of RadioShack de Mexico for all of 2008, we would have

recognized a total of approximately $120 million in net sales and operating revenues for the year. Sales to

independent dealers did not significantly change from 2007.

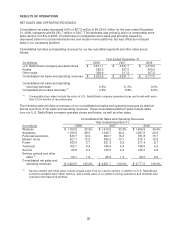

GROSS PROFIT

Consolidated gross profit and gross margin are as follows:

Year Ended December 31,

(In millions) 2008 2007

2006

Gross profit $ 1,922.7 $ 2,025.8 $ 2,129.4

Gross profit decrease 5.1% 4.9% 6.1%

Gross margin 45.5% 47.6% 44.6%

Consolidated gross profit and gross margin for 2008 were $1,922.7 million and 45.5%, respectively,

compared with $2,025.8 million and 47.6% in 2007, resulting in a 5.1% decrease in gross profit dollars and

a 210 basis point decrease in our gross margin.

This decrease was primarily driven by increased sales of lower margin products such as digital-to-analog

television converter boxes, video gaming products and accessories, and laptop computers, as well as a

product shift away from higher-rate new activations to lower-rate existing customer upgrades in our

postpaid wireless business. Gross margin was also negatively impacted by lower average selling prices in

GPS and media storage and by aggressive pricing required in our wireless platform in the first quarter to

respond to a more competitive market environment.

Additionally, the 2007 gross margin was favorably impacted by refunds for federal telecommunications

excise taxes we recorded in 2007. A portion of these refunds totaling $18.8 million was recorded as a

reduction to cost of products sold, which accounted for a 44 basis point increase in our gross margin. See

Note 13 – “Federal Excise Tax” in Notes to Consolidated Financial Statements for a discussion of the

impact of the federal telecommunications excise tax.

24