Radio Shack 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.be a reduction in the price of a vendor's products or services and record them as a component of

inventory until the product is sold, at which point we record them as a component of cost of products sold

unless the allowances represent reimbursement of specific, incremental and identifiable costs incurred to

promote a vendor's products and services. In this case, we record the vendor reimbursement when

earned as an offset to the associated expense incurred to promote the applicable products and/or

services.

Advertising Costs: Our advertising costs are expensed the first time the advertising takes place. We

receive allowances from certain third-party service providers and product vendors that we record when

earned as an offset to advertising expense incurred to promote the applicable products and/or services

only if the allowances represent reimbursement of specific, incremental and identifiable costs (see our

previous “Vendor Allowances” discussion). Advertising expense was $214.5 million, $208.8 million and

$216.3 million for the years ended December 31, 2008, 2007 and 2006, respectively.

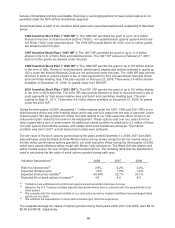

Stock-Based Compensation: In December 2004, the Financial Accounting Standards Board (“FASB”)

issued SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”), which requires

companies to measure all employee stock-based compensation awards using a fair value method and

record this expense in their consolidated financial statements. In addition, the adoption of SFAS No. 123R

requires additional accounting and disclosures related to income tax and cash flow effects resulting from

stock-based compensation.

On January 1, 2006, we adopted SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS

No. 123R”) requiring us to recognize expense related to the fair value of our stock-based compensation

awards. We elected the modified prospective application method as permitted by SFAS 123R. Under this

method, we record stock-based compensation expense for all awards granted on or after the date of

adoption and for the portion of previously granted awards that remained unvested at the date of adoption.

Our stock-based compensation relates to stock options, restricted stock awards, and other equity-based

awards issued to our employees and directors.

Fair Value of Financial Instruments: The fair value of our cash and cash equivalents, accounts receivable,

accounts payable, and accrued liabilities approximate their carrying values because of the short maturity of

these instruments. Derivative financial instruments are recorded at fair value. See Note 5 - “Indebtedness

and Borrowing Facilities” for information related to the fair value of our long-term debt.

Derivative Instruments and Hedging Activities: We recognize all derivative financial instruments in the

consolidated financial statements at fair value. Changes in the fair value of derivative financial instruments

that qualify for hedge accounting are recorded in stockholders’ equity as a component of comprehensive

income or as an adjustment to the carrying value of the hedged item. Changes in fair values of derivatives

not qualifying for hedge accounting are reported in earnings.

We maintain internal controls over our hedging activities, which include policies and procedures for risk

assessment and the approval, reporting and monitoring of all derivative financial instrument activities. We

monitor our hedging positions and credit worthiness of our counter-parties and do not anticipate losses

due to our counter-parties’ nonperformance. We do not hold or issue derivative financial instruments for

trading or speculative purposes. To qualify for hedge accounting, derivatives must meet defined

correlation and effectiveness criteria, be designated as a hedge and result in cash flows and financial

statement effects that substantially offset those of the position being hedged.

Foreign Currency Translation: The functional currency of substantially all operations outside the U.S. is the

applicable local currency. Translation gains or losses related to net assets located outside the United States

are included as a component of accumulated other comprehensive (loss) income and are classified in the

stockholders’ equity section of the accompanying Consolidated Balance Sheets.

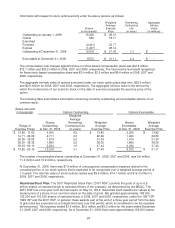

Reclassifications: Certain amounts in the December 31, 2007 and 2006, financial statements have been

reclassified to conform with the December 31, 2008, presentation. These reclassifications had no effect on

net income or total stockholders’ equity as previously reported.

57