Radio Shack 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

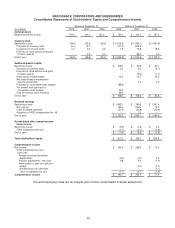

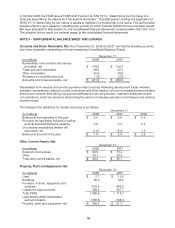

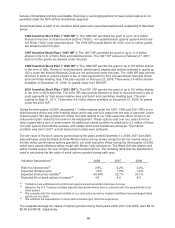

Other Assets, Net:

December 31,

(In millions) 2008 2007

Notes receivable $ 10.3 $ 14.1

Goodwill 36.7 2.9

Deferred income taxes 94.6 59.7

Intangibles -- 2.2

Other 43.5 26.8

Total other assets, net $ 185.1 $ 105.7

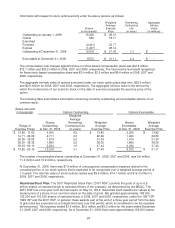

Accrued Expenses and Other Current Liabilities:

December 31,

(In millions) 2008 2007

Payroll and bonuses $ 50.3 $ 72.9

Insurance 84.2 83.4

Sales and payroll taxes 41.5 51.0

Rent 41.0 41.6

Advertising 31.7 38.0

Gift card liability 20.5 23.2

Other 98.1 83.4

Total accrued expenses and other

current liabilities

$ 367.3

$ 393.5

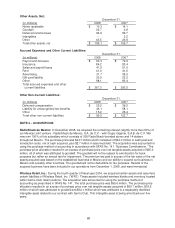

Other Non-Current Liabilities:

December 31,

(In millions) 2008 2007

Deferred compensation $ 35.2 $ 39.2

Liability for unrecognized tax benefits 46.1 58.1

Other 15.2 26.4

Total other non-current liabilities $ 96.5 $ 123.7

NOTE 4 – ACQUISITIONS

RadioShack de Mexico: In December 2008, we acquired the remaining interest (slightly more than 50%) of

our Mexican joint venture - RadioShack de Mexico, S.A. de C.V. - with Grupo Gigante, S.A.B. de C.V. We

now own 100% of this subsidiary which consists of 200 RadioShack-branded stores and 14 dealers

throughout Mexico. The purchase price was $44.7 million which consisted of $42.0 million in cash paid and

transaction costs, net of cash acquired, plus $2.7 million in assumed debt. The acquisition was accounted for

using the purchase method of accounting in accordance with SFAS No. 141, “Business Combinations.” The

purchase price allocation resulted in an excess of purchase price over net tangible assets acquired of $35.2

million, all of which was attributed to goodwill. The goodwill will not be subject to amortization for book

purposes but rather an annual test for impairment. The premium we paid in excess of the fair value of the net

assets acquired was based on the established business in Mexico and our ability to expand our business in

Mexico and possibly other countries. The goodwill will not be deductible for tax purposes. Results of the

acquired business have been included in our operations from December 1, 2008, and were immaterial.

Wireless Retail, Inc.: During the fourth quarter of fiscal year 2004, we acquired certain assets and assumed

certain liabilities of Wireless Retail, Inc. (“WRI”). These assets included wireless kiosks and inventory located

within Sam’s Club retail locations. The acquisition was accounted for using the purchase method of

accounting as prescribed in SFAS No. 141. The total purchase price was $59.6 million. The purchase price

allocation resulted in an excess of purchase price over net tangible assets acquired of $50.7 million, $18.6

million of which was attributed to goodwill and $32.1 million which was attributed to a separately identified

intangible asset related to our contract with Sam’s Club. This intangible asset is being amortized over five

years.

60