Radio Shack 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

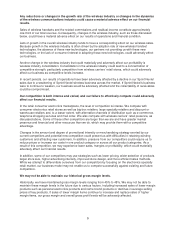

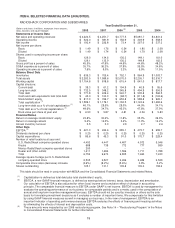

ITEM 6. SELECTED FINANCIAL DATA (UNAUDITED).

RADIOSHACK CORPORATION AND SUBSIDIARIES

Year Ended December 31,

(Dollars and shares in millions, except per share amounts,

ratios, locations and square footage) 2008 2007 2006

(3) 2005 2004

Statements of Income Data

Net sales and operating revenues $ 4,224.5 $ 4,251.7 $ 4,777.5 $ 5,081.7 $ 4,841.2

Operating income $ 322.0 $ 381.9 $ 156.9 $ 349.9 $ 558.3

Net income $ 192.4 $ 236.8 $ 73.4 $ 267.0 $ 337.2

Net income per share:

Basic $ 1.49 $ 1.76 $ 0.54 $ 1.80 $ 2.09

Diluted $ 1.49 $ 1.74 $ 0.54 $ 1.79 $ 2.08

Shares used in computing income per share:

Basic 129.0 134.6 136.2 148.1 161.0

Diluted 129.1 135.9 136.2 148.8 162.5

Gross profit as a percent of sales 45.5% 47.6% 44.6% 44.6% 48.2%

SG&A expense as a percent of sales 35.7% 36.2% 37.9% 35.5% 34.8%

Operating income as a percent of sales 7.6% 9.0% 3.3% 6.9% 11.5%

Balance Sheet Data

Inventories $ 636.3 $ 705.4 $ 752.1 $ 964.9 $ 1,003.7

Total assets $ 2,283.5 $ 1,989.6 $ 2,070.0 $ 2,205.1 $ 2,516.7

Working capital $ 1,154.8 $ 818.8 $ 615.4 $ 641.0 $ 817.7

Capital structure:

Current debt $ 39.3 $ 61.2 $ 194.9 $ 40.9 $ 55.6

Long-term debt $ 732.5 $ 348.2 $ 345.8 $ 494.9 $ 506.9

Total debt $ 771.8 $ 409.4 $ 540.7 $ 535.8 $ 562.5

Cash and cash equivalents less total debt $ 43.0 $ 100.3 $ (68.7) $ (311.8) $ (124.6)

Stockholders' equity $ 817.3 $ 769.7 $ 653.8 $ 588.8 $ 922.1

Total capitalization

(1) $ 1,589.1 $ 1,179.1 $ 1,194.5 $ 1,124.6 $ 1,484.6

Long-term debt as a % of total capitalization (1) 46.1% 29.5% 29.0% 44.0% 34.1%

Total debt as a % of total capitalization (1) 48.6% 34.7% 45.3% 47.6% 37.9%

Book value per share at year end $ 6.53 $ 5.87 $ 4.81 $ 4.36 $ 5.83

Financial Ratios

Return on average stockholders' equity 23.8% 33.2% 11.8% 35.3% 39.9%

Return on average assets 9.4% 12.3% 3.4% 11.3% 14.2%

Annual inventory turnover 3.5 3.3 2.9 2.7 2.6

Other Data

EBITDA (2) $ 421.3 $ 494.6 $ 285.1 $ 473.7 $ 659.7

Dividends declared per share $ 0.25 $ 0.25 $ 0.25 $ 0.25 $ 0.25

Capital expenditures $ 85.6 $ 45.3 $ 91.0 $ 170.7 $ 229.4

Number of retail locations at year end:

U.S. RadioShack company-operated stores 4,453 4,447 4,467 4,972 5,046

Kiosks 688 739 772 777 599

Mexico RadioShack company-operated stores 200 -- -- -- --

Dealer and other outlets 1,411 1,484 1,596 1,711 1,788

Total 6,752 6,670 6,835 7,460 7,433

Average square footage per U.S. RadioShack

company-operated store

2,505

2,527

2,496

2,489

2,529

Comparable store sales (decrease) increase (0.6%) (8.2%) (5.6%) 0.9% 3.2%

Shares outstanding 125.1 131.1 135.8 135.0 158.2

This table should be read in conjunction with MD&A and the Consolidated Financial Statements and related Notes.

(1) Capitalization is defined as total debt plus total stockholders' equity.

(2) EBITDA, a non-GAAP financial measure, is defined as earnings before interest, taxes, depreciation and amortization.

Our calculation of EBITDA is also adjusted for other (loss) income and cumulative effect of change in accounting

principle. The comparable financial measure to EBITDA under GAAP is net income. EBITDA is used by management to

evaluate the operating performance of our business for comparable periods and is a metric used in the computation of

annual and long-term incentive management bonuses. EBITDA should not be used by investors or others as the sole

basis for formulating investment decisions as it excludes a number of important items. We compensate for this limitation

by using GAAP financial measures as well in managing our business. In the view of management, EBITDA is an

important indicator of operating performance because EBITDA excludes the effects of financing and investing activities

by eliminating the effects of interest and depreciation costs.

(3) These amounts were impacted by our 2006 restructuring program. See Note 14 – “Restructuring Program” in the Notes

to Consolidated Financial Statements for further information.

19