Radio Shack 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

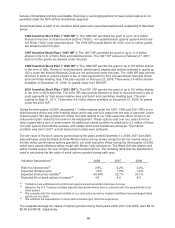

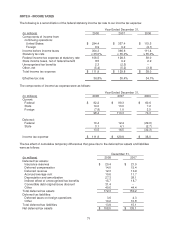

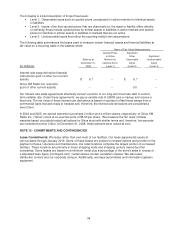

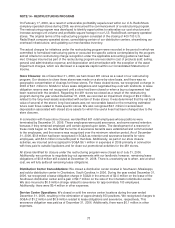

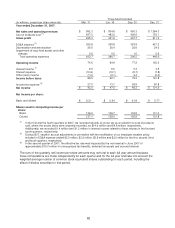

Future minimum rent commitments at December 31, 2008, under non-cancelable operating leases (net of

immaterial amounts of sublease rent income), are included in the following table.

(In millions)

Operating

Leases

2009 $ 193.5

2010 166.2

2011 117.0

2012 73.2

2013 41.9

2014 and thereafter 48.5

Total minimum lease payments $ 640.3

On June 25, 2008, Tarrant County College District (“TCC”) announced that it had purchased from Kan Am

Grund Kapitalanlagegesellschaft mbH (“Kan Am”) the buildings and real property comprising our corporate

headquarters in Fort Worth, Texas, which we had previously sold to Kan Am and then leased for a period of

20 years in a sale and lease-back transaction in December 2005.

In connection with the above sale to TCC, we entered into an agreement with TCC to convey certain

personal property located in the corporate headquarters and certain real property located in close proximity to

the corporate headquarters in exchange for an amended and restated lease to occupy a reduced portion of

the corporate headquarters for a shorter time period. The amended and restated lease agreement provides

for us to occupy approximately 40% of the corporate headquarters complex for a primary term of three years

with no rental payments required during the term. The agreement also provides for a renewal option on

approximately half of this space for an additional two years at market rents.

This agreement resulted in a non-cash net charge to SG&A of $12.1 million for the second quarter of 2008.

This net amount consisted of a net loss of $2.8 million related to the assets conveyed to TCC and a $9.3

million charge to reduce a receivable for economic development incentives associated with the corporate

headquarters to its net realizable value. As a result of the amended and restated lease agreement, the

minimum lease payments required by the corporate headquarters lease have decreased from $289.7 million

at December 31, 2007, to zero.

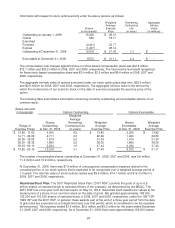

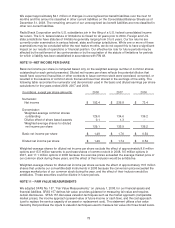

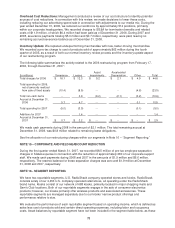

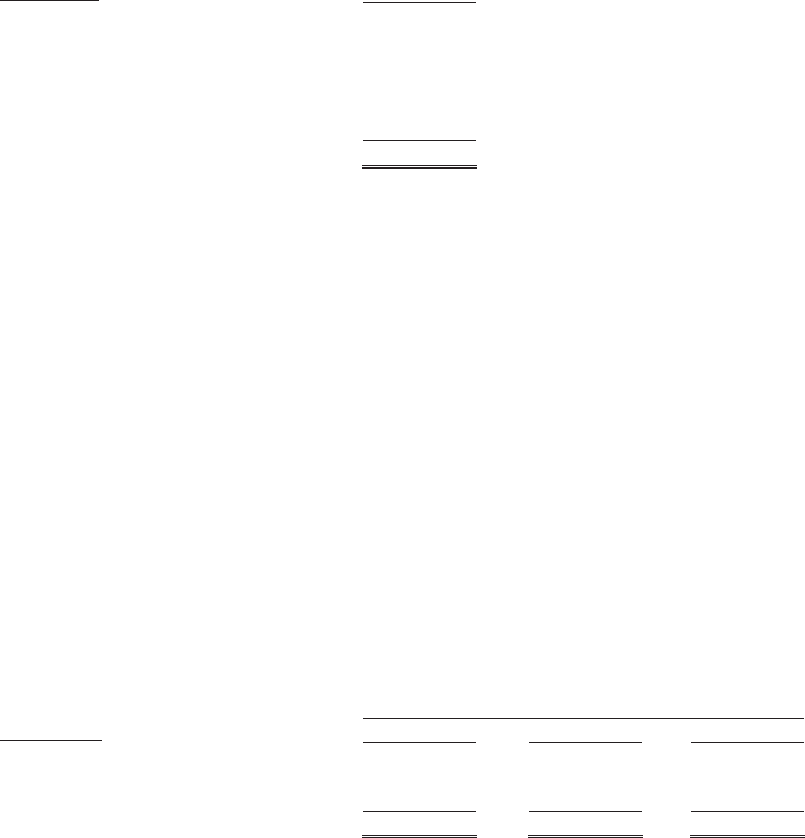

Rent Expense:

Year Ended December 31,

(In millions) 2008 2007 2006

Minimum rents $ 228.8 $ 237.1 $ 243.1

Occupancy cost 46.5 46.5 47.8

Contingent rents 27.8 24.2 24.9

Total rent expense $ 303.1 $ 307.8 $ 315.8

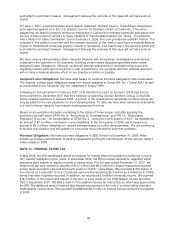

Litigation: On October 10, 2008, the Los Angeles County Superior Court granted RadioShack's Motion

for Class Decertification in the class action lawsuit of Brookler v. RadioShack Corporation. The action,

which involves allegations that RadioShack violated California's wage and hour laws relating to meal

periods, was originally certified as a class action on February 8, 2006. RadioShack's Motion for

Decertification of the class initially was denied on August 29, 2007. However, after the California

Appellate Court's favorable decision on similar facts in Brinker Restaurant Corporation v. Superior Court,

RadioShack again sought class decertification. The court granted RadioShack’s Motion for Class

Decertification based on the California Appellate Court’s decision in Brinker, and the plaintiffs in Brookler

have appealed this ruling. Following the Brinker decision, the Brinker plaintiffs appealed the California

Appellate Court’s decision in that case to the Supreme Court of California. Due to the continuing unsettled

nature of California state law regarding the standard of liability for meal period violations, RadioShack and

the Brookler plaintiffs agreed to a stay with respect to the plaintiff’s appeal of the class decertification

ruling, pending the outcome of the appeal of the California Appellate court’s decision in Brinker. The

outcome of this action is uncertain and the ultimate resolution of this matter could have a material adverse

impact on RadioShack’s financial position, results of operations, and cash flows in the period in which any

75