Radio Shack 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

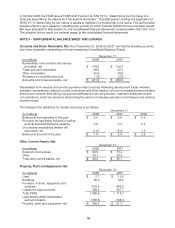

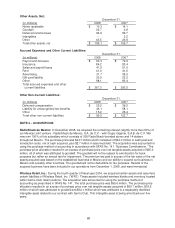

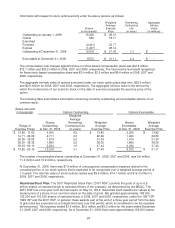

Long-term borrowings outstanding at December 31, 2008, mature as follows:

Long-Term

(In millions) Borrowings

2009 $ --

2010 --

2011 350.0

2012 --

2013 375.0

2014 and thereafter 1.0

Total $ 726.0

The fair value of our long-term debt of $726.0 million and $356.0 million (including current portion) at

December 31, 2008 and 2007, was approximately $653.4 million and $358.8 million, respectively. The fair

values for 2008 were based on quoted market prices. The fair values for 2007 were computed using interest

rates which were in effect at the balance sheet dates for similar debt instruments.

Convertible Notes: In August 2008, we issued $375 million principal amount of convertible senior notes

due August 1, 2013, (the “Convertible Notes”) in a private offering to qualified institutional buyers under

SEC Rule 144A. The Convertible Notes were issued at par and bear interest at a rate of 2.50% per

annum. Interest is payable semiannually, in arrears, on February 1 and August 1, beginning February 1,

2009.

Each $1,000 of principal of the Convertible Notes is initially convertible, under certain circumstances, into

41.2414 shares of our common stock (or a total of approximately 15.5 million shares), which is the

equivalent of $24.25 per share, subject to adjustment upon the occurrence of specified events set forth

under terms of the Convertible Notes. Upon conversion, we would pay the holder the cash value of the

applicable number of shares of our common stock, up to the principal amount of the note. Amounts in

excess of the principal amount, if any, (the “excess conversion value”) may be paid in cash or in stock, at

our option. Holders may convert their Convertible Notes into common stock on the net settlement basis

described above at any time from May 1, 2013, until the close of business on July 29, 2013, or if, and only

if, one of the following conditions occurs:

• During any calendar quarter, and only during such calendar quarter, if the closing price of our

common stock for at least 20 trading days in the period of 30 consecutive trading days ending on

the last trading day of the preceding calendar quarter exceeds 130% of the conversion price per

share of common stock in effect on the last day of such preceding calendar quarter

• During the five consecutive business days immediately after any 10 consecutive trading day

period in which the average trading price per $1,000 principal amount of Convertible Notes was

less than 98% of the product of the closing price of the common stock on such date and the

conversion rate on such date

• We make specified distributions to holders of our common stock or specified corporate

transactions occur

Holders who convert their Convertible Notes in connection with a change in control may be entitled to a

make-whole premium in the form of an increase in the conversion rate. In addition, upon a change in

control, liquidation, dissolution or delisting, the holders of the Convertible Notes may require us to

repurchase for cash all or any portion of their Convertible Notes for 100% of the principal amount of the

notes plus accrued and unpaid interest, if any. As of December 31, 2008, none of the conditions allowing

holders of the Convertible Notes to convert or requiring us to repurchase the Convertible Notes had been

met.

Debt issuance costs of $9.4 million were originally capitalized and are being amortized to interest expense

over the term of the Convertible Notes. Unamortized debt issuance costs were $8.7 million at December

31, 2008.

In connection with the issuance of the Convertible Notes, we entered into separate convertible note hedge

transactions and separate warrant transactions with respect to our common stock to reduce the potential

dilution upon conversion of the Convertible Notes (collectively referred to as the “Call Spread

62