Radio Shack 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008, to stockholders of record on November 28, 2008. The dividend payment of $31.3 million was funded

from cash on hand.

Operating Leases

We use operating leases, primarily for our retail locations and our corporate campus, to lower our capital

requirements.

Share Repurchases

In February 2005, our Board of Directors approved a share repurchase program with no expiration date

authorizing management to repurchase up to $250 million of our common stock in open market

purchases. During 2008, we repurchased approximately 0.1 million shares or $1.4 million of our common

stock under this program. During 2007, we repurchased 8.7 million shares or $208.5 million of our

common stock under this program. As of December 31, 2008, there were no further share repurchases

authorized under this program.

In July 2008, our Board of Directors approved a share repurchase program with no expiration date

authorizing management to repurchase up to $200 million of our common stock. During the third quarter

of 2008, we repurchased 6.0 million shares or $110.0 million of our common stock under this plan. As of

December 31, 2008, there was $90.0 million available for share repurchases under this plan.

Seasonal Inventory Buildup

Typically, our annual cash requirements for pre-seasonal inventory buildup range between $200 million

and $400 million. The funding required for this buildup comes primarily from cash on hand and cash

generated from net sales and operating revenues. We had $814.8 million in cash and cash equivalents as

of December 31, 2008, as a resource for our funding needs. Additionally, borrowings may be utilized to

fund the inventory buildup as described in “Available Financing” above.

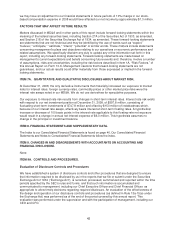

Contractual and Credit Commitments

The following tables, as well as the information contained in Note 5 - "Indebtedness and Borrowing Facilities"

to our Notes to Consolidated Financial Statements, provide a summary of our various contractual

commitments, debt and interest repayment requirements, and available credit lines.

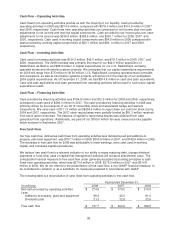

The table below contains our known contractual commitments as of December 31, 2008.

(In millions) Payments Due by Period

Contractual Obligations

Total Amounts

Committed

Less Than

1 Year

1-3 Years

3-5 Years

Over

5 Years

Long-term debt obligations $ 726.0 $ -- $ 350.0 $ 375.0 $ 1.0

Interest obligations 178.7 49.5 85.9 43.3 --

Operating lease obligations 640.3 193.5 283.2 115.1 48.5

Purchase obligations (1) 283.8 269.4 14.2 0.2 --

Other long-term liabilities

reflected on the balance sheet (2)

96.5

--

22.4

7.2

20.8

Total $ 1,925.3 $ 512.4 $ 755.7 $ 540.8 $ 70.3

(1) Purchase obligations include our product commitments, marketing agreements and freight commitments.

(2) Includes a $46.1 million liability for unrecognized tax benefits. We are not able to reasonably estimate the timing of

the payments or the amount by which the liability will increase or decrease over time; therefore the related balances

have not been reflected in the ‘‘Payments Due by Period’’ section of the table.

For more information regarding long-term debt and lease commitments, refer to Note 5 – “Indebtedness

and Borrowing Facilities” and Note 12 – Commitments and Contingencies”, respectively, of our Notes to

Consolidated Financial Statements.

36