Radio Shack 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following is a brief description of those three levels:

• Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets

or liabilities

• Level 2: Inputs, other than quoted prices, that are observable for the asset or liability, either directly

or indirectly; these include quoted prices for similar assets or liabilities in active markets and quoted

prices for identical or similar assets or liabilities in markets that are not active

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions

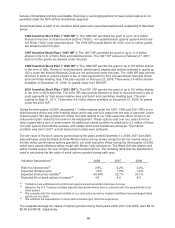

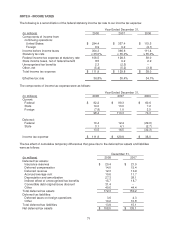

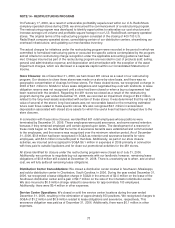

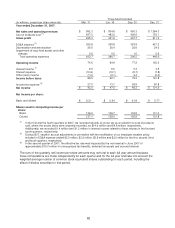

The following table summarizes the bases used to measure certain financial assets and financial liabilities at

fair value on a recurring basis in the balance sheet:

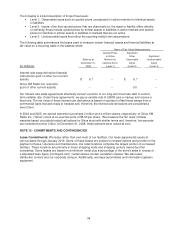

Basis of Fair Value Measurements

Quoted Prices Significant

In Active Other Significant

Balance at Markets for Observable Unobservable

December 31, Identical Items Inputs Inputs

(In millions) 2008 (Level 1) (Level 2) (Level 3)

Interest rate swap derivative financial

instruments (part of other non-current

assets) $ 6.7 -- $ 6.7 --

Sirius XM Radio Inc. warrants

(part of other current assets) -- -- 0.0 --

Our interest rate swap agreements effectively convert a portion of our long-term fixed rate debt to a short-

term variable rate. Under these agreements, we pay a variable rate of LIBOR plus a markup and receive a

fixed rate. The fair value of these interest rate derivatives is based on quotes to offset these swaps from a

commercial bank that was ready to transact and, therefore, the interest rate derivatives are considered a

level 2 item.

In 2006 and 2005, we earned warrants to purchase 2 million and 4 million shares, respectively, of Sirius XM

Radio Inc. (“Sirius”) stock at an exercise price of $5.00 per share. We measure the fair value of these

warrants based on publicly traded call options for Sirius stock with similar terms and, therefore, the warrants

are considered a level 2 item. At December 31, 2008, these warrants were valued at zero.

NOTE 12 - COMMITMENTS AND CONTINGENCIES

Lease Commitments: We lease rather than own most of our facilities. Our lease agreements expire at

various dates through January 2019. Some of these leases are subject to renewal options and provide for the

payment of taxes, insurance and maintenance. Our retail locations comprise the largest portion of our leased

facilities. These locations are primarily in major shopping malls and shopping centers owned by other

companies. Some leases are based on a minimum rental plus a percentage of the store's sales in excess of

a stipulated base figure (contingent rent). Certain leases contain escalation clauses. We also lease

distribution centers and our corporate campus. Additionally, we lease automobiles and information systems

equipment.

74