Radio Shack 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

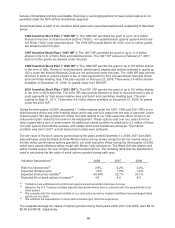

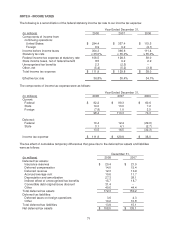

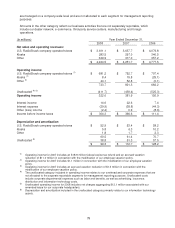

NOTE 9 - INCOME TAXES

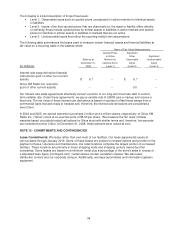

The following is a reconciliation of the federal statutory income tax rate to our income tax expense:

Year Ended December 31,

(In millions) 2008 2007 2006

Components of income from

continuing operations:

United States $ 294.4 $ 357.4 $ 115.5

Foreign 9.9 9.2 (4.1)

Income before income taxes 304.3 366.6 111.4

Statutory tax rate x 35.0% x 35.0% x 35.0%

Federal income tax ex

p

ense at statutor

y

rate 106.5 128.3 39.0

State income taxes, net of federal benefit 8.5 9.2 2.9

Unrecognized tax benefits 2.3 (2.5) --

Other, net (5.4) (5.2) (3.9)

Total income tax expense $ 111.9 $ 129.8 $ 38.0

Effective tax rate 36.8% 35.4% 34.1%

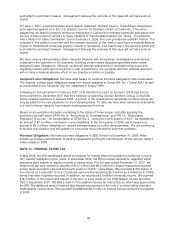

The components of income tax expense were as follows:

Year Ended December 31,

(In millions) 2008 2007 2006

Current:

Federal $ 92.2 $ 99.3 $ 60.6

State 14.0 13.0 7.2

Foreign (7.8) 1.0 2.5

98.4 113.3 70.3

Deferred:

Federal 10.4 12.4 (29.6)

State 3.1 4.1 (2.7)

13.5 16.5 (32.3)

Income tax expense $ 111.9 $ 129.8 $ 38.0

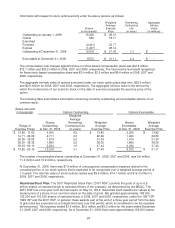

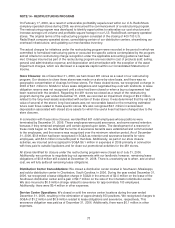

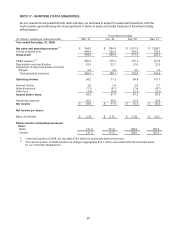

The tax effect of cumulative temporary differences that gave rise to the deferred tax assets and liabilities

were as follows:

December 31,

(In millions) 2008 2007

Deferred tax assets:

Insurance reserves $ 20.4 $ 21.0

Deferred compensation 14.0 15.4

Deferred revenue 12.3 10.9

Accrued average rent 10.6 11.7

Depreciation and amortization 27.3 28.1

Indirect effect of unrecognized tax benefits 15.7 18.7

Convertible debt original issue discount 31.4 --

Other 40.6 44.4

Total deferred tax assets 172.3 150.2

Deferred tax liabilities:

Deferred taxes on foreign operations 3.6 4.3

Other 10.2 10.8

Total deferred tax liabilities 13.8 15.1

Net deferred tax assets $ 158.5 $ 135.1

71