Radio Shack 2008 Annual Report Download - page 70

Download and view the complete annual report

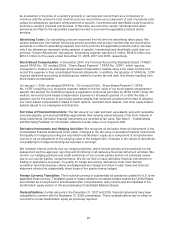

Please find page 70 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Transactions”). The convertible note hedges and warrants will generally have the effect of increasing the

economic conversion price of the Convertible Notes to $36.60 per share of our common stock,

representing a 100% conversion premium based on the closing price of our common stock on August 12,

2008. See Note 6 - “Stockholders’ Equity,” for more information on the Call Spread Transactions.

Because the principal amount of the Convertible Notes will be settled in cash upon conversion, the

Convertible Notes will only impact diluted earnings per share when the price of our common stock

exceeds the conversion price (initially $24.25 per share). We will include the effect of the additional shares

that may be issued from conversion in our diluted net income per share calculation using the treasury

stock method.

As discussed in Note 2, in May 2008 the FASB issued FASB Staff Position No. APB 14-1, “Accounting for

Convertible Debt Instruments That May Be Settled in Cash Upon Conversion.” The staff position will require

us to separately account for the liability and equity components of the instrument in a manner that reflects

our nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. The staff

position will be effective for fiscal years beginning after December 15, 2008. On January 1, 2009, as a

result of adopting this staff position, we recorded an adjustment to reduce the carrying value of the debt

and increase additional paid-in capital by $73 million. Due to the accretion of the resulting discount on the

debt, we will recognize additional interest expense of $14 million for the year ended December 31, 2009.

For federal income tax purposes, the issuance of the Convertible Notes and the purchase of the

convertible note hedges are treated as a single transaction whereby we are considered to have issued

debt with an original issue discount. The amortization of this discount in future periods is deductible for tax

purposes. Therefore, upon issuance of the debt, we recorded an adjustment to increase our deferred tax

assets and additional paid-in capital by $33.5 million for these future tax deductions. Upon adoption of

FASB Staff Position No. APB 14-1 in the first quarter of 2009, this deferred tax asset was substantially

reduced because the increased interest expense recognized for book purposes more closely aligns with the

above tax treatment.

Long-Term Notes: On May 11, 2001, we issued $350 million of 10-year 7.375% notes in a private

offering to qualified institutional buyers under SEC Rule 144A. The annual interest rate on the notes is

7.375% per annum with interest payable on November 15 and May 15 of each year. The notes contain

certain non-financial covenants and mature on May 15, 2011. In August 2001, under the terms of an

exchange offering filed with the SEC, we exchanged substantially all of these notes for a similar amount of

publicly registered notes. The exchange resulted in substantially all of the notes becoming registered with

the SEC and did not result in additional debt being issued.

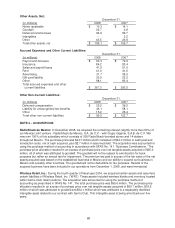

In June and August 2003, we entered into interest rate swap agreements with underlying notional amounts of

debt of $100 million and $50 million, respectively, and both with maturities in May 2011. These swaps

effectively convert a portion of our long-term fixed rate debt to a variable rate. We entered into these

agreements to balance our fixed versus floating rate debt portfolio to continue to take advantage of lower

short-term interest rates. Under these agreements, we have contracted to pay a variable rate of LIBOR plus

a markup and to receive a fixed rate of 6.95% for the swap entered into in 2001 and 7.375% for the swaps

entered into in 2003. We have designated these agreements as fair value hedging instruments. We recorded

$6.7 million in other non-current assets, net at December 31, 2008, and $1.5 million in other non-current

liabilities at December 31, 2007, for the fair value of these agreements and adjusted the carrying value of the

related debt by the same amounts.

In August 1997 we filed a $300 million debt shelf registration statement and issued $150 million of 10-year

unsecured long-term notes under this shelf registration. The interest rate on the notes was 6.95% per

annum with interest payable on September 1 and March 1 of each year. These notes contained customary

non-financial covenants. In September 2007, our $150 million ten-year unsecured note payable came due.

Upon maturity, we paid off the $150 million note payable utilizing our available cash and cash equivalents.

During the third quarter of 2001, we entered into an interest rate swap agreement with an underlying notional

amount of $110.5 million. This interest rate swap agreement expired in conjunction with the maturity of the

note payable.

Medium-Term Notes: We also issued, in various amounts and on various dates from December 1997

through September 1999, medium-term notes totaling $150 million under the shelf registration described

63