Radio Shack 2008 Annual Report Download - page 65

Download and view the complete annual report

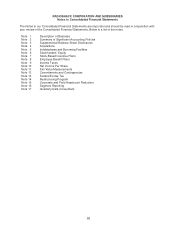

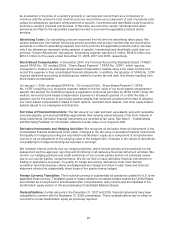

Please find page 65 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recently Issued Accounting Pronouncements: In September 2006, the Financial Accounting

Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 157, "Fair

Value Measurements" ("SFAS 157"). SFAS 157 defines fair value, establishes a framework for measuring

fair value, and expands disclosures about fair value measurements. We adopted SFAS 157 on January 1,

2008, as required for our financial assets and financial liabilities. However, the FASB deferred the effective

date of SFAS 157 for one year as it relates to fair value measurement requirements for nonfinancial

assets and nonfinancial liabilities that are not recognized or disclosed at fair value on a recurring basis.

The adoption of SFAS 157 for our financial assets and financial liabilities did not have a material impact on

our consolidated financial statements. While we are currently evaluating the impact of adopting the

remaining provisions of SFAS No. 157, we do not expect these provisions to have a material impact on

our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, "The Fair Value Option for Financial Assets and

Financial Liabilities" ("SFAS 159"). SFAS 159 permits entities to choose to measure certain financial

instruments and other eligible items at fair value when the items are not otherwise currently required to be

measured at fair value. We adopted SFAS 159 effective January 1, 2008. Upon adoption, we did not elect

the fair value option for any items within the scope of SFAS 159 and, therefore, the adoption of SFAS 159

did not have an impact on our consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS

141R”). SFAS 141R addresses the recognition and accounting for identifiable assets acquired, liabilities

assumed, and noncontrolling interests in business combinations. SFAS 141R also establishes expanded

disclosure requirements for business combinations. SFAS 141R is effective for us on January 1, 2009,

and we will apply SFAS 141R prospectively to all business combinations subsequent to the effective date.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements - an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 establishes accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. SFAS 160 requires that noncontrolling interests in subsidiaries be reported in the equity

section of the controlling company’s balance sheet. It also changes the manner in which the net income of

the subsidiary is reported and disclosed in the controlling company’s income statement. SFAS 160 is

effective for fiscal years beginning after December 15, 2008. We adopted SFAS 160 on January 1, 2009,

and it had no impact on our consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities - an amendment of FASB Statement No. 133” (“SFAS 161”). SFAS 161 amends and expands the

disclosure requirements of Statement 133 to provide a better understanding of how and why an entity uses

derivative instruments, how derivative instruments and related hedged items are accounted for, and their

effect on an entity’s financial position, financial performance, and cash flows. SFAS 161 is effective for fiscal

years beginning after November 15, 2008. We adopted SFAS 161 on January 1, 2009, but we do not

expect it to have a material impact on our consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting

Principles” (“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for

selecting the principles used in the preparation of financial statements that are presented in conformity

with generally accepted accounting principles (“GAAP”) in the United States. SFAS 162 became effective

on November 15, 2008, but did not have a material impact on our consolidated financial statements.

In May 2008, the FASB issued FASB Staff Position No. APB 14-1, “Accounting for Convertible Debt

Instruments That May Be Settled in Cash Upon Conversion.” This staff position will require us to separately

account for the liability and equity components of our convertible notes in a manner that reflects our

nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. This staff position

will require bifurcation of a component of the debt, classification of that component in equity and then

accretion of the resulting discount on the debt as part of interest expense being reflected in the income

statement. This staff position will be effective for fiscal years beginning after December 15, 2008, and we are

required to adopt it in our first quarter of 2009. The staff position does not permit early application and

requires retrospective application to all periods presented. See Note 5 – “Indebtedness and Borrowing

Facilities” for further discussion of the effects of this staff position on our consolidated financial statements.

58