Radio Shack 2008 Annual Report Download - page 34

Download and view the complete annual report

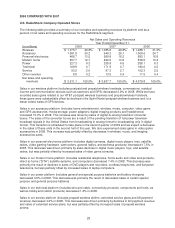

Please find page 34 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest income decreased $8.0 million to $14.6 million in 2008 from $22.6 million in 2007. This decrease

was primarily due to a lower interest rate environment. Additionally, we recorded interest income related to

the federal telecommunications excise tax refund of $0.5 million in the first quarter of 2008 and $1.4

million in the first nine months of 2007.

OTHER (LOSS) INCOME

During 2008 we recorded a loss of $2.4 million compared with income of $0.9 million in 2007. These

amounts represent unrealized losses and gains related to our derivative exposure to Sirius XM Radio, Inc.

warrants as a result of our fair value measurements of these warrants. At December 31, 2008, the fair

value of these warrants was zero.

INCOME TAX PROVISION

Our effective tax rate for 2008 was 36.8% compared to 35.4% for 2007. The 2008 effective tax rate was

impacted by the execution of a closing agreement with respect to a Puerto Rico income tax issue during

the year, which resulted in a credit to income tax expense. This discrete item lowered the effective tax rate

for 2008 by 95 basis points. In addition, the 2008 effective tax rate was impacted by the net reversal of

approximately $4.1 million in unrecognized tax benefits, deferred tax assets and accrued interest related

to the settlement of various state income tax issues and the expiration of the statute of limitations with

respect to our 2002 taxable year. This net reversal lowered the effective tax rate for 2008 by 137 basis

points. The 2007 effective tax rate was impacted by the net reversal in June 2007 of approximately $10.0

million in unrecognized tax benefits, deferred tax assets and accrued interest. Refer to Note 9 – “Income

Taxes” of our consolidated financial statements for additional information. This $10.0 million reversal

lowered our effective tax rate 273 basis points for the year ended December 31, 2007.

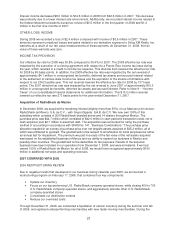

Acquisition of RadioShack de Mexico

In December 2008, we acquired the remaining interest (slightly more than 50%) of our Mexican joint venture -

RadioShack de Mexico, S.A. de C.V. - with Grupo Gigante, S.A.B. de C.V. We now own 100% of this

subsidiary which consists of 200 RadioShack-branded stores and 14 dealers throughout Mexico. The

purchase price was $44.7 million which consisted of $42.0 million in cash paid and transaction costs, net of

cash acquired, plus $2.7 million in assumed debt. The acquisition was accounted for using the purchase

method of accounting in accordance with SFAS No. 141, “Business Combinations.” The purchase price

allocation resulted in an excess of purchase price over net tangible assets acquired of $35.2 million, all of

which was attributed to goodwill. The goodwill will not be subject to amortization for book purposes but rather

an annual test for impairment. The premium we paid in excess of the fair value of the net assets acquired

was based on the established business in Mexico and our ability to expand our business in Mexico and

possibly other countries. The goodwill will not be deductible for tax purposes. Results of the acquired

business have been included in our operations from December 1, 2008, and were immaterial. If we had

owned 100% of RadioShack de Mexico for all of 2008, we would have recognized approximately $100

million in additional net sales and operating revenues.

2007 COMPARED WITH 2006

2006 RESTRUCTURING REVIEW

Due to negative trends that developed in our business during calendar year 2005, we announced a

restructuring program on February 17, 2006, that contained four key components:

• Update our inventory

• Focus on our top-performing U.S. RadioShack company-operated stores, while closing 400 to 700

U.S. RadioShack company-operated stores, and aggressively relocate other U.S. RadioShack

company-operated stores

• Consolidate our distribution centers

• Reduce our overhead costs

Through December 31, 2006, we conducted a liquidation of certain inventory during the summer and fall

of 2006, and replaced underperforming merchandise with new faster-moving merchandise. During the

27