Radio Shack 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If the current economic conditions persist or worsen, it could have an adverse impact on our business and

on the financial condition of some of our customers, wireless and other service providers, and

merchandise suppliers. Although we have not experienced a material increase in customer bad debts or

non-performance by suppliers or service providers, current market conditions increase the probability that

we could experience losses from customer, supplier, or service provider defaults.

If a scenario as described above occurred, it could cause the rating agencies to lower our credit ratings,

thereby increasing our borrowing costs, or even causing a further reduction in or elimination of our access

to debt and/or equity markets.

We do not have any debt maturities until 2011 and, as discussed above, our liquidity needs are generally

met through cash provided by operations and our cash on hand. If we need additional funds, we can draw

on our credit facility expiring in 2011.

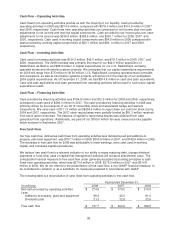

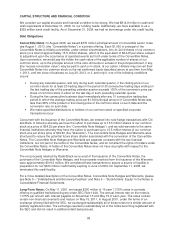

Capitalization

The following table sets forth information about our capitalization on the dates indicated.

December 31,

2008 2007

(Dollars in millions)

Dollars

% of Total

Capitalization

Dollars

% of Total

Capitalization

Current debt $ 39.3 2.5% $ 61.2 5.2%

Long-term debt 732.5 46.1 348.2 29.5

Total debt 771.8 48.6 409.4 34.7

Stockholders’ equity 817.3 51.4 769.7 65.3

Total capitalization $ 1,589.1 100.0% $ 1,179.1 100.0%

Our debt-to-total capitalization ratio increased in 2008 from 2007, due to the issuance of $375 million of

Convertible Notes.

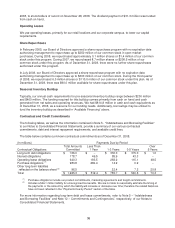

Debt Ratings

Below are the agencies’ ratings by category, as well as their respective current outlook for the ratings, as

of February 5, 2009.

Rating Agency Rating Outlook

Standard and Poor’s BB Stable

Moody's Ba1 Stable

Fitch BB Negative

On August 11, 2008, Standard and Poor’s revised their outlook to stable from negative and affirmed our

BB corporate credit and senior unsecured ratings. The remaining ratings and outlooks are consistent with

those reported in our Annual Report on Form 10-K for the calendar year ended December 31, 2007, and

were affirmed by Moody’s and Fitch on August 11, 2008, and August 7, 2008, respectively.

Factors that could impact our future credit ratings include free cash flow and cash levels, changes in our

operating performance, the adoption of a more aggressive financial strategy, the economic environment,

conditions in the retail and consumer electronics industries, continued sales declines in comparable

stores, our financial position and changes in our business strategy. If further downgrades occur, they will

adversely impact, among other things, our future borrowing costs, access to debt capital markets, vendor

financing terms and future new store occupancy costs. Due to improvements in liquidity, we terminated

our commercial paper program during the third quarter of 2007.

Dividends

We have paid common stock cash dividends for 22 consecutive years. On November 6, 2008, our Board

of Directors declared an annual dividend of $0.25 per share. The dividend was paid on December 17,

35