Radio Shack 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.such effect is recorded; however, management believes the outcome of this case will not have such an

impact.

On June 7, 2007, a purported class action lawsuit captioned, Richard Stuart v. RadioShack Corporation,

et al, was filed against us in the U.S. District Court for the Northern District of California. This action

alleges that we failed to properly reimburse employees in California for mileage expenses associated with

the use of their personal vehicles to make transfers of merchandise between our stores. The plaintiffs

filed a Motion for Class Certification, and on February 9, 2009, the court granted the plaintiffs’ motion. The

outcome of this action is uncertain and the ultimate resolution of this matter could have a material adverse

impact on RadioShack’s financial position, results of operations, and cash flows in the period in which any

such effect is recorded; however, management believes the outcome of this case will not have such an

impact.

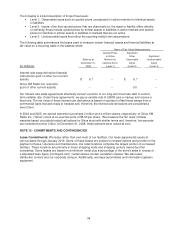

We have various other pending claims, lawsuits, disputes with third parties, investigations and actions

incidental to the operation of our business, including certain cases discussed generally below under

Assigned Lease Obligations. Although occasional adverse settlements or resolutions may occur and

negatively impact earnings in the period or year of settlement, it is our belief that their ultimate resolution

will not have a material adverse effect on our financial condition or liquidity.

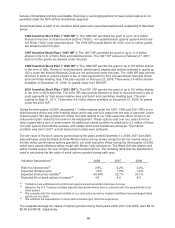

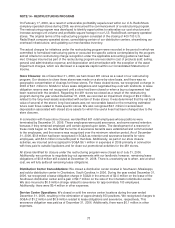

Assigned Lease Obligations: We have retail leases for locations that were assigned to other businesses.

The majority of these lease obligations arose from leases assigned to CompUSA, Inc. (“CompUSA”) as part

of its purchase of our Computer City, Inc. subsidiary in August 1998.

Following an announcement in February 2007 of its intentions to close as many as 126 stores and an

announcement in December 2007 that they had been acquired by Gordon Brothers Group, CompUSA

stores ceased operations in January 2008. A portion of the closed stores represents locations where we

may be liable for the rent payments on the underlying lease. To date, we have been named as defendants

in a total of eleven lawsuits from lessors seeking payment from us.

Based on all available information pertaining to the status of these leases, and after applying the

provisions set forth within SFAS No. 5, “Accounting for Contingencies,” and FIN 14, “Reasonable

Estimation of a Loss – an Interpretation of SFAS No. 5,” during the fourth quarter of 2007, we established

an accrual of $7.5 million, recorded in current liabilities. In the first quarter of 2008, we increased our

accrual to $9.0 million, reflecting our revised estimate based on further developments. We are continuing

to monitor this situation and will update our accrual as more information becomes available.

Purchase Obligations: We have purchase obligations of $283.8 million at December 31, 2008, which

include our product commitments, marketing agreements and freight commitments. Of this amount, $269.4

million relates to 2009.

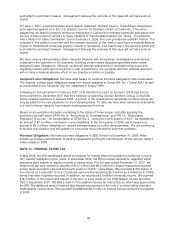

NOTE 13 – FEDERAL EXCISE TAX

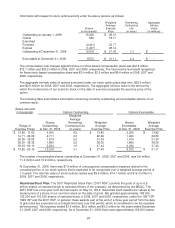

In May 2006, the IRS established refund procedures for federal telecommunications excise tax (“excise

tax”) paid by taxpayers in prior years. In December 2006, the IRS provided clarification regarding which

taxpayers were eligible to request refunds of excise taxes. For the year ended December 31, 2007, we

determined we were entitled to refunds of $14.0 million and $5.2 million for federal telecommunications

excise taxes recorded in the first and fourth quarters of 2007, respectively. We recorded $18.8 million of

the refunds as a reduction to cost of products sold and the remaining $0.4 million as a reduction in SG&A,

where they were originally recorded. In addition, we recorded $2.6 million in interest income. We claimed

$15.4 million of this refund and interest in the form of a tax credit on our 2006 federal income tax return

filed in September 2007. We filed a claim for the additional excise tax refund due us, which was approved by

the IRS. The additional amount claimed plus interest was received in the form of a refund rather than as a

credit against income taxes. We recorded an additional $0.5 million in interest income during the first quarter

of 2008.

76