Radio Shack 2008 Annual Report Download - page 84

Download and view the complete annual report

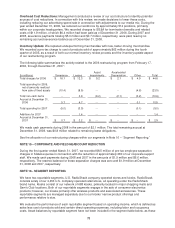

Please find page 84 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 14 - RESTRUCTURING PROGRAM

On February 17, 2006, as a result of unfavorable profitability experienced within our U.S. RadioShack

company-operated stores during 2005, we announced the commencement of a restructuring program.

The restructuring program was developed to identify opportunities to rationalize our cost structure and

increase average unit volume and profitable square footage in our U.S. RadioShack company-operated

stores. The original terms of the restructuring program consisted of the closing of 400-700 U.S.

RadioShack company-operated stores, consolidating certain of our distribution centers, streamlining our

overhead infrastructure, and updating our merchandise inventory.

The actual charges for initiatives under the restructuring program were recorded in the period in which we

committed to formalized restructuring plans or executed the specific actions contemplated by the program

and all criteria for restructuring charge recognition under the applicable accounting guidance had been

met. Charges incurred as part of the restructuring program are recorded in cost of products sold; selling,

general and administrative expense; and depreciation and amortization with the exception of the asset

impairment charges, which are disclosed in a separate caption within our Consolidated Statements of

Income.

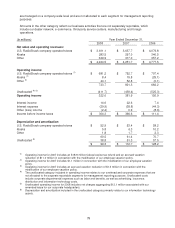

Store Closures: As of December 31, 2006, we had closed 481 stores as a result of our restructuring

program. Our decision to close these stores was made on a store-by-store basis, and there was no

geographic concentration of closings for these stores. For these closed stores, we recognized a charge in

2006 of $9.1 million to SG&A for future lease obligations and negotiated buy-outs with landlords. A lease

obligation reserve was not recognized until a store had been closed or when a buy-out agreement had

been reached with the landlord. Regarding the 481 stores we closed as a result of the restructuring

program during the year ended December 31, 2006, we recorded an impairment charge of $9.2 million

related to the long-lived assets associated with certain of these stores. It was determined that the net book

value of several of the stores' long-lived assets was not recoverable based on the remaining estimated

future cash flows related to these specific stores. We also recognized $2.1 million in accelerated

depreciation associated with closed store assets for which the useful lives had been changed due to the

store closures.

In connection with these store closures, we identified 601 retail employees whose positions were

terminated by December 31, 2006. These employees were paid severance, and some earned retention

bonuses if they remained employed until certain agreed-upon dates. The development of a reserve for

these costs began on the date that the terms of severance benefits were established and communicated

to the employees, and the reserve was recognized over the minimum retention period. As of December

31, 2006, $3.8 million had been recognized in SG&A as retention and severance benefits for store

employees, with $3.6 million in benefits paid to that date. Additionally, as part of our store closure

activities, we incurred and recognized in SG&A $6.1 million in expenses in 2006 primarily in connection

with fees paid to outside liquidators and for close-out promotional activities for the 481 stores.

All stores identified for closure under the restructuring program were closed as of July 31, 2006.

Additionally, we continue to negotiate buy-out agreements with our landlords; however, remaining lease

obligations of $0.8 million still existed at December 31, 2008. There is uncertainty as to when, and at what

cost, we will fully settle all remaining lease obligations.

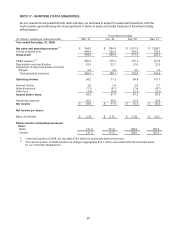

Distribution Center Consolidations: We closed a distribution center located in Southaven, Mississippi,

and sold a distribution center in Charleston, South Carolina, in 2006. During the year ended December 31,

2006, we recognized a lease obligation charge in SG&A in the amount of $2.0 million on the lease of the

Southaven distribution center and a gain of $2.7 million on the sale of the Charleston distribution center.

We also incurred a $0.5 million charge related to severance for approximately 100 employees.

Additionally, there were $0.4 million in other expenses.

Service Center Operations: We closed or sold five service center locations during the year ended

December 31, 2006, resulting in the elimination of approximately 350 positions. We recognized charges to

SG&A of $1.2 million and $0.9 million related to lease obligations and severance, respectively. This

severance obligation was paid as of December 31, 2006. Additionally, there were $0.1 million in other

expenses.

77