Radio Shack 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (“MD&A”).

This MD&A section discusses our results of operations, liquidity and financial condition, risk management

practices, critical accounting policies, and estimates and certain factors that may affect our future results,

including economic and industry-wide factors. Our MD&A should be read in conjunction with our

consolidated financial statements and accompanying notes, included in this Annual Report on Form 10-K,

as well as the Risk Factors set forth in Item 1A above.

OVERVIEW

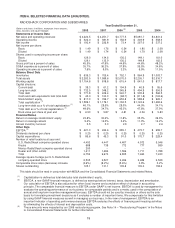

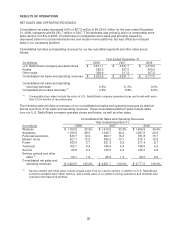

Highlights related to the year ended December 31, 2008, include:

• Net sales and operating revenues decreased $27.2 million, or 0.6%, to $4,224.5 million when

compared with last year. Comparable store sales decreased 0.6% as well. This decrease was driven

by lower sales in the fourth quarter primarily due to the global credit crisis and economic downturn,

but was substantially offset by sales gains during the first nine months of the year. We recorded

sales of approximately $200 million in digital-to-analog television converter boxes and significant

sales increases in AT&T postpaid wireless handsets, video gaming products and accessories, laptop

computers, and prepaid wireless handsets. We recorded sales declines in Sprint Nextel postpaid

wireless handsets, digital music players and toys.

• Gross margin decreased 210 basis points to 45.5% from last year. This decrease was primarily

driven by increased sales of lower margin products such as digital-to-analog television converter

boxes, video gaming products and accessories, and laptop computers, as well as a continued shift

away from higher-rate new activations to lower-rate existing customer upgrades in our postpaid

wireless business.

• Selling, general and administrative (“SG&A”) expense decreased $28.7 million to $1,509.8 million

when compared with last year. This decrease was driven in part by lower compensation expense.

Other factors included decreased rent expense for our corporate headquarters for the last half of

the year and an $8.2 million sales and use tax benefit from the settlement of a sales tax issue.

Additionally, SG&A expense for 2007 included an $8.5 million charge for employee separation

packages. As a percentage of net sales and operating revenues, SG&A declined 50 basis points to

35.7%.

• As a result of the factors above, operating income decreased $59.9 million, or 15.7%, to $322.0

million when compared with last year.

• Net income decreased $44.4 million to $192.4 million when compared with last year. Net income per

diluted share was $1.49 compared with $1.74 last year.

21