Radio Shack 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

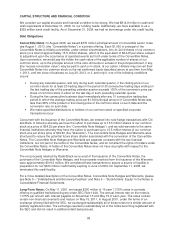

The table below contains our credit commitments from various financial institutions.

(In millions) Commitment Expiration per Period

Credit Commitments

Total Amounts

Committed

Less Than

1 Year

1-3 Years

3-5 Years

Over

5 Years

Lines of credit $ 325.0 $ -- $ 325.0 $ -- $ --

Standby letters of credit 33.7 33.7 -- -- --

Total commercial commitments $ 358.7 $ 33.7 $ 325.0 $ -- $ --

Assigned Lease Obligations

We have retail leases for locations that were assigned to other businesses. The majority of these lease

obligations arose from leases assigned to CompUSA, Inc. (“CompUSA”) as part of its purchase of our

Computer City, Inc. subsidiary in August 1998.

Following an announcement in February 2007 of its intentions to close as many as 126 stores and an

announcement in December 2007 that they had been acquired by Gordon Brothers Group, CompUSA

stores ceased operations in January 2008. A portion of the closed stores represents locations where we

may be liable for the rent payments on the underlying lease. To date, we have been named as

defendants in a total of eleven lawsuits from lessors seeking payment from us.

Based on all available information pertaining to the status of these leases, and after applying the

provisions set forth within SFAS No. 5, “Accounting for Contingencies,” and FIN 14, “Reasonable

Estimation of a Loss – an Interpretation of SFAS No. 5,” during the fourth quarter of 2007, we established

an accrual of $7.5 million, recorded in current liabilities. In the first quarter of 2008, we increased our

accrual to $9.0 million, reflecting our revised estimate based on further developments. We are continuing

to monitor this situation and will update our accrual as more information becomes available.

FINANCIAL IMPACT OF 2006 RESTRUCTURING PROGRAM

As discussed previously, our 2006 restructuring program, as originally stated in February 2006, contained

four key components:

• Update our inventory

• Focus on our top-performing U.S. RadioShack company-operated stores, while closing 400 to 700

U.S. RadioShack company-operated stores and aggressively relocate other U.S. RadioShack

company-operated stores

• Consolidate our distribution centers

• Reduce our overhead costs

Store Closures: As of December 31, 2006, we had closed 481 stores as a result of our restructuring

program. Our decision to close these stores was made on a store-by-store basis, and there was no

geographic concentration of closings for these stores. For these closed stores, we recognized a charge in

2006 of $9.1 million to SG&A for future lease obligations and negotiated buy-outs with landlords. A lease

obligation reserve was not recognized until a store had been closed or when a buy-out agreement had

been reached with the landlord. Regarding the 481 stores we closed as a result of the restructuring

program during the year ended December 31, 2006, we recorded an impairment charge of $9.2 million

related to the long-lived assets associated with certain of these stores. It was determined that the net book

value of several of the stores' long-lived assets was not recoverable based on the remaining estimated

future cash flows related to these specific stores. We also recognized $2.1 million in accelerated

depreciation associated with closed store assets for which the useful lives had been changed due to the

store closures.

In connection with these store closures, we identified 601 retail employees whose positions were

terminated by December 31, 2006. These employees were paid severance, and some earned retention

bonuses if they remained employed until certain agreed-upon dates. The development of a reserve for

these costs began on the date that the terms of severance benefits were established and communicated

to the employees, and the reserve was recognized over the minimum retention period. As of December

31, 2006, $3.8 million had been recognized in SG&A as retention and severance benefits for store

37