Radio Shack 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

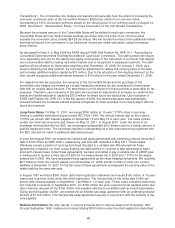

We expect approximately $4.1 million of changes in unrecognized tax benefit liabilities over the next 12

months and this amount is classified in other current liabilities on the Consolidated Balance Sheets as of

December 31, 2008. The remaining amount of our unrecognized tax benefit liabilities are now classified in

other non-current liabilities.

RadioShack Corporation and its U.S. subsidiaries join in the filing of a U.S. federal consolidated income

tax return. The U.S. federal statute of limitations is closed for all years prior to 2004. Foreign and U.S.

state jurisdictions have statutes of limitations generally ranging from 3 to 5 years. Our tax returns are

currently under examination in various federal, state and foreign jurisdictions. While one or more of these

examinations may be concluded within the next twelve months, we do not expect this to have a significant

impact on our results of operations or financial position. Our effective tax rate for future periods may be

affected by the settlement of tax controversies or by the expiration of the statute of limitations for periods

for which a liability has been established in accordance with FIN 48.

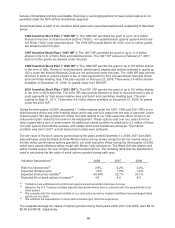

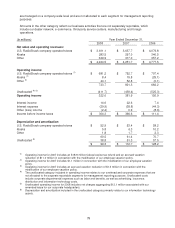

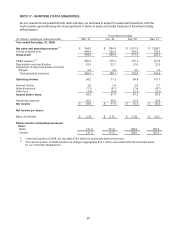

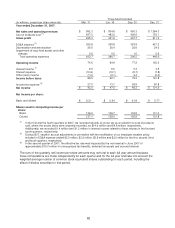

NOTE 10 –NET INCOME PER SHARE

Basic net income per share is computed based only on the weighted average number of common shares

outstanding for each period presented. Diluted net income per share reflects the potential dilution that

would have occurred if securities or other contracts to issue common stock were exercised, converted, or

resulted in the issuance of common stock that would have then shared in the earnings of the entity. The

following table reconciles the numerator and denominator used in the basic and diluted earnings per share

calculations for the years ended 2008, 2007 and 2006.

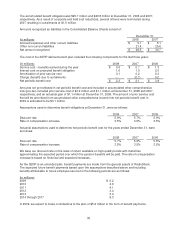

(In millions, except per share amounts) 2008 2007 2006

Numerator:

Net income $ 192.4 $ 236.8 $ 73.4

Denominator:

Weighted-average common shares

outstanding

129.0

134.6

136.2

Dilutive effect of share based awards 0.1 1.3 --

Weighted average shares for diluted

net income per share 129.1

135.9

136.2

Basic net income per share $ 1.49 $ 1.76 $ 0.54

Diluted net income per share $ 1.49 $ 1.74 $ 0.54

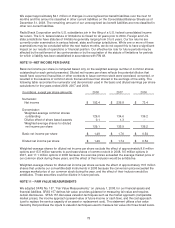

Weighted-average shares for diluted net income per share exclude the effect of approximately 8.6 million

options and 15.5 million warrants to purchase shares of common stock in 2008, 9.5 million options in

2007, and 17.1 million options in 2006 because the exercise prices exceeded the average market price of

our common stock during these years, and the effect of their inclusion would be antidilutive.

Weighted-average shares for diluted net income per share exclude the effect of approximately 15.5 million

shares that underlie our convertible debt instruments in 2008 because the conversion price exceeded the

average market price of our common stock during the year, and the effect of their inclusion would be

antidilutive. These securities could be dilutive in future periods.

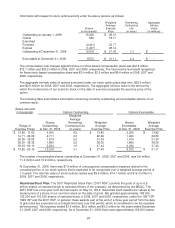

NOTE 11 – FAIR VALUE MEASUREMENTS

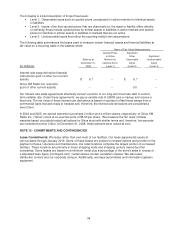

We adopted SFAS No. 157, “Fair Value Measurements,” on January 1, 2008, for our financial assets and

financial liabilities. SFAS 157 defines fair value, provides guidance for measuring fair value and requires

certain disclosures. SFAS 157 discusses valuation techniques such as the market approach (comparable

market prices), the income approach (present value of future income or cash flow), and the cost approach

(cost to replace the service capacity of an asset or replacement cost). The statement utilizes a fair value

hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels.

73