Radio Shack 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

above. At December 31, 2007, $5 million of these notes remained outstanding with an interest rate of

6.42%; they contained customary non-financial covenants. As of December 31, 2007, there was no

availability under this shelf registration. In January 2008, the remaining $5 million of the medium-term

notes payable came due, and was paid off utilizing our available cash and cash equivalents.

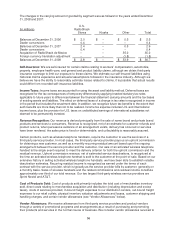

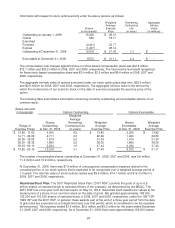

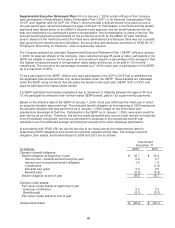

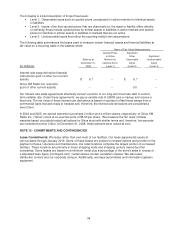

Short-Term Borrowing Facilities:

Year Ended December 31,

(In millions) 2008 2007 2006

Domestic seasonal bank credit lines and

bank money market lines:

Lines available at year end $ 325.0 $ 625.0 $ 675.0

Loans outstanding at year end -- -- --

Weighted average interest rate at year end -- -- --

Weighted average loans outstanding $ -- $ -- $ --

Weighted average interest rate during year -- -- --

Short-term foreign credit lines:

Lines available at year end $ 2.0 $ 8.0 $ 8.0

Loans outstanding at year end $ -- $ -- $ --

Weighted average interest rate at year end -- -- --

Weighted average loans outstanding $ -- $ 0.9 $ 0.2

Weighted average interest rate during year --% 4.88% 5.02%

Letters of credit and banker’s acceptance lines

of credit:

Lines available at year end $ 25.0 $ 57.0 $ 92.0

Acceptances outstanding at year end 1.0 0.3 4.8

Letters of credit open against outstanding

purchase orders at year end

$ 0.4

$ 2.0

$ 15.6

Commercial paper credit facilities:

Commercial paper outstanding at year end N/A N/A $ --

Weighted average interest rate at year end N/A N/A --

Weighted average commercial paper

outstanding

N/A

N/A

$ 35.2

Weighted average interest rate during year N/A N/A 5.50%

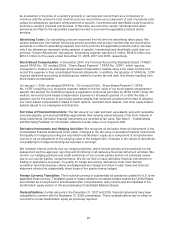

Our short-term credit facilities, including revolving credit lines, are summarized in the short-term borrowing

facilities table above. The method used to compute averages in the short-term borrowing facilities table is

based on a daily weighted average computation that takes into consideration the time period such debt

was outstanding, as well as the amount outstanding. Our financing, primarily short-term debt, if utilized,

would consist primarily of borrowings under our credit facilities, which is described in more detail below.

Credit Facilities: At December 31, 2008, we had $325 million borrowing capacity available under our

existing credit facility. This facility expires in May of 2011.

On September 11, 2008, we terminated our $300 million credit facility which was set to expire in June of

2009. This facility was no longer required due to the issuance of our Convertible Notes.

Our $325 million credit facility provides us a source of liquidity. As of December 31, 2008, there were no

outstanding borrowings under this credit facility, nor were any of our facilities utilized during 2008. Interest

charges under our facilities are derived using a base LIBOR rate plus a margin which changes based on

our credit ratings. Our bank syndicated credit facilities have customary terms and covenants, and we were

in compliance with these covenants at December 31, 2008.

NOTE 6 - STOCKHOLDERS’ EQUITY

Stock Repurchase Programs: In February 2005, our Board of Directors approved a share repurchase

program with no expiration date authorizing management to repurchase up to $250 million of our common

64