Radio Shack 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of continued company and wireless industry growth challenges, together with changes in our

senior leadership team during the third quarter of 2006 that resulted in a refocus on allocation of capital

and resources towards other areas of our business, we determined that our long-lived assets, including

goodwill associated with our kiosk operations, were impaired. We performed impairment tests on both the

long-lived assets associated with our Sam’s Club agreement, including the intangible asset relating to the

five-year agreement, and the accompanying goodwill.

With respect to the long-lived tangible and intangible assets, we compared their carrying values with their

estimated fair values using a discounted cash flow model, which reflected our lowered expectations of

wireless revenue growth and the ceased expansion of our kiosk business, and determined that the

intangible asset relating to the five-year agreement was impaired. This assessment resulted in a $10.7

million impairment charge to the intangible asset related to our kiosk segment in 2006. The remaining

intangible balance is being amortized over the remaining life of the Sam’s Club agreement, which was

originally scheduled to expire in September 2009. The balance at December 31, 2008, was $2.1 million.

With respect to the goodwill of $18.6 million, we estimated the fair value of the Sam’s Club reporting unit

using a discounted cash flow model similar to that used in the long-lived asset impairment test. We

compared it with the carrying value of the reporting unit and determined that the goodwill was impaired. As

the carrying value of the reporting unit exceeded its estimated fair value, we then compared the implied

fair value of the reporting unit's goodwill with the carrying amount of goodwill. This resulted in an $18.6

million impairment of goodwill related to our kiosk segment in the third quarter of 2006.

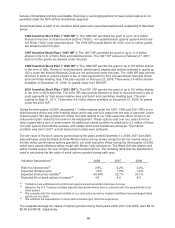

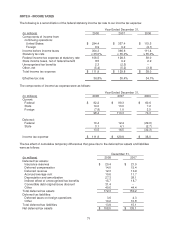

NOTE 5 - INDEBTEDNESS AND BORROWING FACILITIES

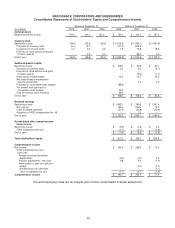

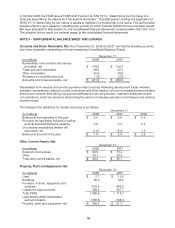

Short-Term Debt, Including Current Maturities of Long-Term Debt:

December 31,

(In millions) 2008 2007

Short-term debt $ 39.3 56.2

Current portion of medium-term notes payable -- 5.0

Total short-term debt, including current maturities

of long-term debt

$ 39.3

$ 61.2

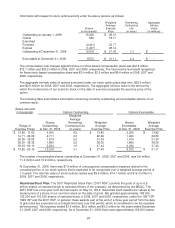

Long-Term Debt, Excluding Current Maturities:

December 31,

(In millions) 2008 2007

Five year 2.5% unsecured convertible notes due in 2013 $ 375.0 $ --

Ten-year 7.375% unsecured note payable due in 2011 350.0 350.0

Medium-term unsecured notes payable with an

interest rate of 6.42% due in 2008

--

5.0

Notes payable with interest rates at December 31, 2008

and 2007, of 1.95% and 4.35%, respectively, due in 2014

1.0

1.0

Unamortized debt discount and other costs (0.2) (1.3)

Fair value of interest rate swaps 6.7 (1.5)

732.5 353.2

Less current portion of:

Notes payable -- 5.0

Total long-term debt, excluding current maturities $ 732.5 $ 348.2

61