Radio Shack 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

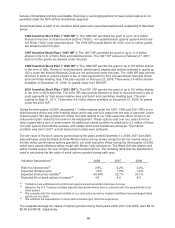

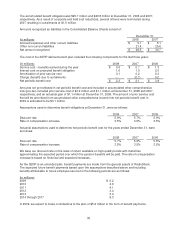

The accumulated benefit obligation was $25.7 million and $29.8 million at December 31, 2008 and 2007,

respectively. As a result of corporate and field cost reductions, several officers were terminated during

2007 resulting in curtailments of $1.5 million.

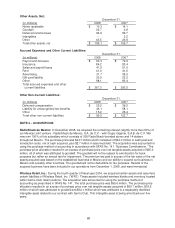

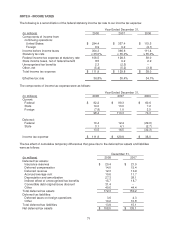

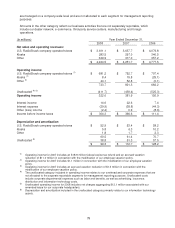

Amounts recognized as liabilities in the Consolidated Balance Sheets consist of:

December 31,

(In millions) 2008 2007

Accrued expenses and other current liabilities $ 5.1 $ 5.1

Other non-current liabilities 21.4 25.6

Net amount recognized $ 26.5 $ 30.7

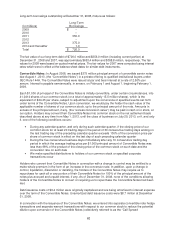

The cost of the SERP defined benefit plan included the following components for the last three years:

(In millions) 2008 2007 2006

Service cost – benefits earned during the year $ 0.6 $ 0.7 $ 1.3

Interest cost on projected benefit obligation 1.6 1.9 2.0

Amortization of prior service cost 0.1 0.2 0.3

Charge (benefit) due to curtailments -- (0.7) 0.2

Net periodic benefit cost $ 2.3 $ 2.1 $ 3.8

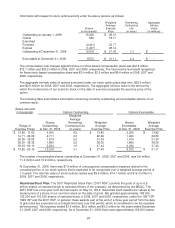

Amounts not yet reflected in net periodic benefit cost and included in accumulated other comprehensive

loss (pre-tax) included prior service cost of $0.9 million and $1.1 million at December 31, 2008 and 2007,

respectively, and an actuarial gain of $1.1 million at December 31, 2008. The amount of prior service cost

that will be amortized from accumulated other comprehensive income into net periodic benefit cost in

2009 is estimated to be $0.1 million.

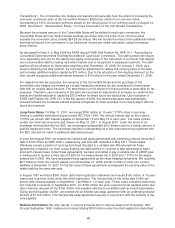

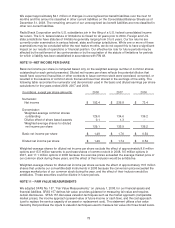

Assumptions used to determine benefit obligations at December 31, were as follows:

2008 2007 2006

Discount rate 5.9% 5.7% 5.9%

Rate of compensation increase 3.5% 3.5% 3.5%

Actuarial assumptions used to determine net periodic benefit cost for the years ended December 31, were

as follows:

2008 2007 2006

Discount rate 5.7% 5.9% 5.5%

Rate of compensation increase 3.5% 3.5% 3.5%

We base our discount rate on the rates of return available on high-quality bonds with maturities

approximating the expected period over which the pension benefits will be paid. The rate of compensation

increase is based on historical and expected increases.

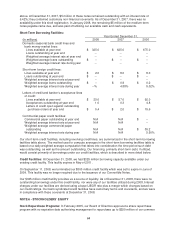

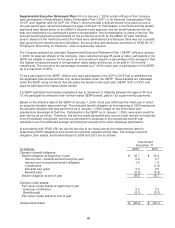

As the SERP is an unfunded plan, benefit payments are made from the general assets of RadioShack.

The expected future benefit payments based upon the assumptions described above and including

benefits attributable to future employee service for the following periods are as follows:

(In millions)

2009 $ 5.2

2010 4.9

2011 4.1

2012 3.4

2013 3.4

2014 through 2017 8.3

In 2009, we expect to make contributions to the plan of $5.2 million in the form of benefit payments.

70