Radio Shack 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RadioShack Corporation

2008 Annual Report

Table of contents

-

Page 1

RadioShack Corporation 2008 Annual Report -

Page 2

... Corporation, headquartered in Fort Worth, Texas, is one of the nation's most experienced and trusted consumer electronics specialty retailers. RadioShack connects technology with consumers by selling the products and accessories that people want. For those on the go, RadioShack simplifies life... -

Page 3

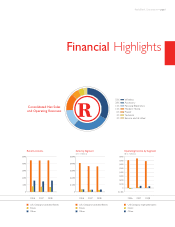

... Corporation-page 1 Financial Highlights Consolidated Net Sales and Operating Revenues 33% 28% 13% 13% 6% 4% 3% Wireless Accessory Personal Electronics Modern Home Power Technical Service and all other Retail Locations 5,000 $5,000 Sales by Segment ($ in millions) $800 $700 Operating Income... -

Page 4

...to strengthen its balance sheet during a period of general economic and specific industry turmoil. We reduced our inventory level from the previous year while improving our in-stock position. Diluted Earnings Per Share $2.0 $1.5 $1.0 $0.5 0 2006 2007 2008 Net Sales & Operating Revenues ($ in... -

Page 5

...both risks to our business and possibilities offered by the unfolding economic situation. In closing, I want to thank the more than 34,000 RadioShack employees who are helping us build a more efficient and productive company that is better positioned to serve the technology needs of our customers in... -

Page 6

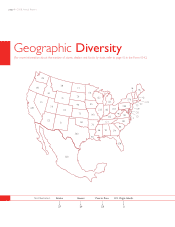

page 4-2008 Annual Report Geographic Diversity (For more information about the number of stores, dealers and kiosks by state, refer to page 15 in the Form 10-K.) 135 38 14 40 25 ...179 20 121 376 42 22 119 16 36 80 80 200 Not Illustrated: Alaska 27 Hawaii 24 Puerto Rico 53 U.S. Virgin Islands 3 -

Page 7

Form 10-K RadioShack Corporation -

Page 8

... ACT OF 1934 For the fiscal year ended December 31, 2008 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission file number 1-5571 _____ RADIOSHACK CORPORATION (Exact name of registrant as specified in... -

Page 9

..., 2008, the aggregate market value of the voting common stock of the registrant held by non-affiliates of the registrant was $1,008,064,132 based on the New York Stock Exchange closing price. For the purposes of this disclosure only, the registrant has assumed that its directors, executive officers... -

Page 10

... Signatures Index to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm 44 45 46 47 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 11

...sale of consumer electronics goods and services through our RadioShack store chain and non-RadioShack branded kiosk operations. Our strategy is to provide cost-effective solutions to meet the routine electronics needs and distinct electronics wants of our customers. Throughout this report, the terms... -

Page 12

... support the point-of-sale ("POS") system. The majority of our U.S. company-operated stores communicate through a broadband network, which provides efficient access to customer support data. This design also allows store management to track sales and inventory at the product or sales associate level... -

Page 13

... business strategy depends, in part, upon our ability to offer name brand and private brand products, as well as to provide our customers access to third-party services. We utilize a large number of suppliers located in various parts of the world to obtain raw materials and private brand merchandise... -

Page 14

... copies of any material we have filed with the SEC by mail at prescribed rates from: Public Reference Section Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549-0213 You may obtain these materials electronically by accessing the SEC's home page on the Internet at: http... -

Page 15

...our comparable store sales and our business generally Our inability to keep our extensive store distribution system updated and conveniently located near our target customers Our employees' inability to provide solutions, answers, and information related to increasingly complex consumer electronics... -

Page 16

...increased sales of lower margin products such as personal electronics products and name brand products or declines in average selling prices of key products. If sales of lower margin items continue to increase and replace sales of higher margin items, our gross margin and overall gross profit levels... -

Page 17

...it is possible that new products or technologies will never achieve widespread consumer acceptance, also adversely affecting our sales and profitability. Finally, the lack of innovative consumer electronics products, features or services that can be effectively featured in our store model could also... -

Page 18

... products, we may not be able to meet the demands of our customers and our sales and profitability could be adversely affected. We purchase a significant portion of our inventory from manufacturers located in China. Changes in trade regulations (including tariffs on imports) could increase the cost... -

Page 19

... the number of individual transactions we process each year. Our information systems include an in-store point-of-sale system that provides information used to track sales performance, inventory replenishment, e-commerce product availability, product margin information and customer information. In... -

Page 20

... locations and also influence the cost of leasing, building or buying our stores. We also may have difficulty negotiating real estate leases and purchase agreements on acceptable terms. Further, to relocate or open new stores successfully, we must hire and train employees for the new location... -

Page 21

... and certain property at our corporate headquarters located in downtown Fort Worth, Texas. The amended lease is for a reduced amount of space, requires no lease payments, and expires in June of 2011, with one two-year option to renew at market-based rents. RETAIL LOCATIONS The table below shows our... -

Page 22

... Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming District of Columbia Puerto Rico U.S. Virgin Islands... -

Page 23

... to Current Position) Chief Executive Officer and Chairman of the Board (July 2006) Executive Vice President - Chief Marketing Officer (September 2008) Executive Vice President - Store Operations (January 2008) Executive Vice President and Chief Financial Officer (August 2006) Executive Vice... -

Page 24

... as Executive Vice President - Chief Financial Officer of Entertainment Publications from May 2005 to August 2006. From 1996 to May 2005, Mr. Gooch served in various positions at Kmart Corporation, including Vice President, Controller and Treasurer, and Vice President, Corporate Financial Planning... -

Page 25

... presents the high and low trading prices for our common stock, as reported in the composite transaction quotations of consolidated trading for issues on the New York Stock Exchange, for each quarter in the two years ended December 31, 2008. Quarter Ended December 31, 2008 September 30, 2008 June 30... -

Page 26

...operating revenues Operating income Net income Net income per share: Basic Diluted Shares used in computing income per share: Basic Diluted Gross profit as a percent of sales SG&A expense as a percent of sales Operating income as a percent of sales Balance Sheet Data Inventories Total assets Working... -

Page 27

... to net income. (In millions) Reconciliation of EBITDA to Net Income EBITDA Interest expense, net of interest income Provision for income taxes Depreciation and amortization Other (loss) income Cumulative effect of change in accounting principle, net of $1.8 million tax benefit Net income 2008 $ 421... -

Page 28

...this Annual Report on Form 10-K, as well as the Risk Factors set forth in Item 1A above. OVERVIEW Highlights related to the year ended December 31, 2008, include: • Net sales and operating revenues decreased $27.2 million, or 0.6%, to $4,224.5 million when compared with last year. Comparable store... -

Page 29

...store sales decline of 0.6% in 2008. The decrease in comparable store sales was primarily caused by decreased sales in our personal electronics and modern home platforms, but was offset by increased sales in our accessory platform. Consolidated net sales and operating revenues for our two reportable... -

Page 30

... music players, toys, and satellite radios, but was partially offset by increased sales of video game consoles. Sales in our modern home platform (includes residential telephones, home audio and video end-products, direct-to-home ("DTH") satellite systems, and computers) decreased 7.4% in 2008... -

Page 31

... boxes, video gaming products and accessories, and laptop computers, as well as a product shift away from higher-rate new activations to lower-rate existing customer upgrades in our postpaid wireless business. Gross margin was also negatively impacted by lower average selling prices in GPS and media... -

Page 32

..., postage and office supplies 8.1 Recruiting, training & employee relations 6.9 Stock purchase and savings plans 6.5 Travel 5.4 Warranty and product repair 4.2 Other 56.6 $ 1,509.8 Payroll and commissions expense decreased in dollars and as a percentage of net sales and operating revenues. This... -

Page 33

... quarter of 2008. This net amount consisted of a net loss of $2.8 million related to the assets conveyed to TCC and a $9.3 million charge to reduce a receivable for economic development incentives associated with the corporate headquarters to its net realizable value. DEPRECIATION AND AMORTIZATION... -

Page 34

...compared to 35.4% for 2007. The 2008 effective tax rate was impacted by the execution of a closing agreement with respect to a Puerto Rico income tax issue during the year, which resulted in a credit to income tax expense. This discrete item lowered the effective tax rate for 2008 by 95 basis points... -

Page 35

...satellite radios and digital music players, but was partially offset by increased sales of video gaming products. Including the effects of the 2006 store closures, personal electronics platform sales decreased 13.7%. Excluding the effects of the 2006 store closures, sales in our modern home platform... -

Page 36

... of a decline in net sales and operating revenues primarily due to a comparable store sales decrease and store closures associated with our 2006 restructuring. Our 2007 gross margin increased primarily due to an improvement in our inventory management and a shift in product mix. In addition, refunds... -

Page 37

... fair value. In February 2006, as part of our restructuring program, our board of directors approved the closure of 400 to 700 U.S. RadioShack company-operated stores. During the first half of 2006, we identified the stores for closure and subsequently performed the impairment test. Based on... -

Page 38

... consolidated financial statements for additional information. This $10.0 million reversal lowered our effective tax rate 273 basis points for the year ended December 31, 2007. Furthermore, the effective tax rate for 2006 was primarily affected by the tax benefit associated with inventory donations... -

Page 39

... cash flow is a relevant indicator of our ability to repay maturing debt, change dividend payments or fund other uses of capital that management believes will enhance shareholder value. The comparable financial measure to free cash flow under generally accepted accounting principles is cash flows... -

Page 40

... the close of business on July 29, 2013, or if, and only if, one of the following conditions occurs: • During any calendar quarter, and only during such calendar quarter, if the closing price of our common stock for at least 20 trading days in the period of 30 consecutive trading days ending on... -

Page 41

...of lower short-term interest rates. Under these agreements, we have contracted to pay a variable rate of LIBOR plus a markup and to receive a fixed rate of 6.95% for the swap entered into in 2001 and 7.375% for the swaps entered into in 2003. We have designated these agreements as fair value hedging... -

Page 42

... cash levels, changes in our operating performance, the adoption of a more aggressive financial strategy, the economic environment, conditions in the retail and consumer electronics industries, continued sales declines in comparable stores, our financial position and changes in our business strategy... -

Page 43

..., 2008. The dividend payment of $31.3 million was funded from cash on hand. Operating Leases We use operating leases, primarily for our retail locations and our corporate campus, to lower our capital requirements. Share Repurchases In February 2005, our Board of Directors approved a share repurchase... -

Page 44

... in January 2008. A portion of the closed stores represents locations where we may be liable for the rent payments on the underlying lease. To date, we have been named as defendants in a total of eleven lawsuits from lessors seeking payment from us. Based on all available information pertaining to... -

Page 45

..., severance payments totaling $5.0 million were paid, leaving an accrued severance balance of $0.7 million as of December 31, 2007. Inventory Update: We replaced underperforming merchandise with new, faster-moving merchandise. We recorded a pre-tax charge to cost of products sold of approximately... -

Page 46

... Compliance Committee of our Board of Directors. Revenue Recognition: Our revenue is derived principally from the sale of name brand and private brand products and services to consumers. Revenue is recognized, net of an estimate for customer refunds and product returns, when persuasive evidence of... -

Page 47

... performance and pricing of our merchandise could result in inventory valuations that differ from the amount recorded at the financial statement date and could also cause fluctuations in the amount of recorded cost of products sold. If our estimates regarding market value are inaccurate or changes... -

Page 48

...-pricing model. The fair value of stock options with service and market conditions is valued utilizing a lattice model with Monte Carlo simulations. The Black-Scholes-Merton and lattice models require management to apply judgment and use highly subjective assumptions, including expected option life... -

Page 49

... market price risks were the interest rate swaps noted in our MD&A. We do not use derivatives for speculative purposes. Our exposure to interest rate risk results from changes in short-term interest rates. Interest rate risk exists with respect to our net investment position at December 31, 2008... -

Page 50

... control over financial reporting. ITEM 9B. OTHER INFORMATION. None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. We will file a definitive proxy statement with the Securities and Exchange Commission on or about April 14, 2009. The information called for by this Item... -

Page 51

... provides a summary of information as of December 31, 2008, relating to our equity compensation plans in which our common stock is authorized for issuance. Equity Compensation Plan Information (a) Number of shares to be issued upon exercise of outstanding options, warrants and rights 5,984 7,003 12... -

Page 52

...2008 /s/ Julian C. Day Julian C. Day Chairman of the Board and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of RadioShack Corporation and in the capacities indicated on this 24th day... -

Page 53

RADIOSHACK CORPORATION INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm Consolidated Statements of Income for each of the three years in the period ended December 31, 2008 Consolidated Balance Sheets at December 31, 2008 and December 31, 2007 ... -

Page 54

... internal control over financial reporting as of December 31, 2008, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for these financial statements... -

Page 55

... CORPORATION AND SUBSIDIARIES Consolidated Statements of Income 2008 (In millions, except per share amounts) Net sales and operating revenues Cost of products sold (includes depreciation amounts of $11.2 million, $10.0 million and $10.7 million, respectively) Gross profit Operating expenses: Selling... -

Page 56

...CORPORATION AND SUBSIDIARIES Consolidated Balance Sheets December 31, (In millions, except for share amounts) Assets Current assets: Cash and cash equivalents Accounts and notes receivable, net Inventories Other current assets Total current assets Property, plant and equipment, net Other assets, net... -

Page 57

...notes issuance costs Purchase of convertible notes hedges Sale of common stock warrants Sale of treasury stock to employee benefit plans Proceeds from exercise of stock options Payments of dividends Changes in short-term borrowings and outstanding checks in excess of cash balances, net Repayments of... -

Page 58

... of stock options and grant of stock awards Stock option compensation Net stock-based compensation income tax benefits Purchase of convertible notes hedges Tax benefit from purchase of convertible notes hedges Sale of common stock warrants End of year Retained earnings Beginning of year Net income... -

Page 59

... Description of Business Summary of Significant Accounting Policies Supplemental Balance Sheet Disclosures Acquisitions Indebtedness and Borrowing Facilities Stockholders' Equity Stock-Based Incentive Plans Employee Benefit Plans Income Taxes Net Income Per Share Fair Value Measurements Commitments... -

Page 60

...can purchase, return or exchange various products available through this Web site. Additionally, certain products ordered online may be picked up, exchanged or returned at RadioShack stores. RadioShack Service Centers: We maintain a service and support network to service the consumer electronics and... -

Page 61

... point-of-sale ("POS") system. The majority of our U.S. RadioShack company-operated stores communicate through a broadband network, which provides efficient access to customer support data. This design also allows store management to track sales and inventory at the product or sales associate level... -

Page 62

...industry, direct-to-home satellite systems, and satellite radios due to sales of their products and services. We establish an allowance for doubtful accounts based on factors surrounding the credit risk of specific customers, historical trends and other information. Historically, such losses, in the... -

Page 63

... from the sale of name brand and private brand products and services to consumers. Revenue is recognized, net of an estimate for customer refunds and product returns, when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the sales price is fixed or... -

Page 64

...the Financial Accounting Standards Board ("FASB") issued SFAS No. 123 (revised 2004), "Share-Based Payment" ("SFAS No. 123R"), which requires companies to measure all employee stock-based compensation awards using a fair value method and record this expense in their consolidated financial statements... -

Page 65

...the controlling company's balance sheet. It also changes the manner in which the net income of the subsidiary is reported and disclosed in the controlling company's income statement. SFAS 160 is effective for fiscal years beginning after December 15, 2008. We adopted SFAS 160 on January 1, 2009, and... -

Page 66

... in selling, general and administrative expense Uncollected receivables (written off) recovered, net Balance at the end of the year Other Current Assets, Net: (In millions) Deferred income taxes Other Total other current assets, net Property, Plant and Equipment, Net: (In millions) Land Buildings... -

Page 67

... quarter of fiscal year 2004, we acquired certain assets and assumed certain liabilities of Wireless Retail, Inc. ("WRI"). These assets included wireless kiosks and inventory located within Sam's Club retail locations. The acquisition was accounted for using the purchase method of accounting as... -

Page 68

... remaining life of the Sam's Club agreement, which was originally scheduled to expire in September 2009. The balance at December 31, 2008, was $2.1 million. With respect to the goodwill of $18.6 million, we estimated the fair value of the Sam's Club reporting unit using a discounted cash flow model... -

Page 69

... (including current portion) at December 31, 2008 and 2007, was approximately $653.4 million and $358.8 million, respectively. The fair values for 2008 were based on quoted market prices. The fair values for 2007 were computed using interest rates which were in effect at the balance sheet dates for... -

Page 70

... include the effect of the additional shares that may be issued from conversion in our diluted net income per share calculation using the treasury stock method. As discussed in Note 2, in May 2008 the FASB issued FASB Staff Position No. APB 14-1, "Accounting for Convertible Debt Instruments That May... -

Page 71

...which changes based on our credit ratings. Our bank syndicated credit facilities have customary terms and covenants, and we were in compliance with these covenants at December 31, 2008. NOTE 6 - STOCKHOLDERS' EQUITY Stock Repurchase Programs: In February 2005, our Board of Directors approved a share... -

Page 72

... market value of a share of our common stock on the date of grant. The Management Development and Compensation Committee ("MD&C") of our Board of Directors specifies the terms for grants of options under these ISPs; terms of these options may not exceed ten years. Grants of options generally vest... -

Page 73

...2006 5.0% 1.2% 33.1% 4.9 Risk free interest rate Expected dividend yield (3) Expected stock price volatility (4) Expected life of stock options (in years) (1) (2) (3) (4) (2) Forfeitures are estimated using historical experience and projected employee turnover. Based on the U.S. Treasury constant... -

Page 74

Information with respect to stock options activity under the above plans is as follows: Weighted Average Exercise Price Remaining Contractual Life (in years) Aggregate Intrinsic Value (in millions) Shares (In thousands) Outstanding at January 1, 2008 Grants Exercised Forfeited Expired Outstanding ... -

Page 75

...February 2007, the board of directors amended the Deferred Plan to provide that, in lieu of the original amounts described above, each non-employee director now receives a one-time initial grant of units equal to the number of shares of our common stock that represent a fair market value of $150,000... -

Page 76

...of year Service cost - benefits earned during the year Interest cost on projected benefit obligation Curtailments Actuarial loss (gain) Benefits paid Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Employer contribution Benefits paid Fair value... -

Page 77

... increase Actuarial assumptions used to determine net periodic benefit cost for the years ended December 31, were as follows: 2008 5.7% 3.5% 2007 5.9% 3.5% 2006 5.5% 3.5% Discount rate Rate of compensation increase We base our discount rate on the rates of return available on high-quality bonds... -

Page 78

...31, (In millions) Deferred tax assets: Insurance reserves Deferred compensation Deferred revenue Accrued average rent Depreciation and amortization Indirect effect of unrecognized tax benefits Convertible debt original issue discount Other Total deferred tax assets Deferred tax liabilities: Deferred... -

Page 79

... current period tax positions Settlements Lapse in applicable statute of limitations Balance at end of year 2008 45.6 1.5 (2.8) 4.6 (8.8) (2.0) 38.1 2007 49.0 3.8 -3.9 (1.7) (9.4) 45.6 $ $ $ $ The amounts of net unrecognized tax benefits that, if recognized, would impact the effective tax rate... -

Page 80

... (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). The statement utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to... -

Page 81

...item. In 2006 and 2005, we earned warrants to purchase 2 million and 4 million shares, respectively, of Sirius XM Radio Inc. ("Sirius") stock at an exercise price of $5.00 per share. We measure the fair value of these warrants based on publicly traded call options for Sirius stock with similar terms... -

Page 82

... that it had purchased from Kan Am Grund Kapitalanlagegesellschaft mbH ("Kan Am") the buildings and real property comprising our corporate headquarters in Fort Worth, Texas, which we had previously sold to Kan Am and then leased for a period of 20 years in a sale and lease-back transaction in... -

Page 83

... in January 2008. A portion of the closed stores represents locations where we may be liable for the rent payments on the underlying lease. To date, we have been named as defendants in a total of eleven lawsuits from lessors seeking payment from us. Based on all available information pertaining to... -

Page 84

... restructuring plans or executed the specific actions contemplated by the program and all criteria for restructuring charge recognition under the applicable accounting guidance had been met. Charges incurred as part of the restructuring program are recorded in cost of products sold; selling, general... -

Page 85

... brand name. Kiosks consist of our network of 688 kiosks, primarily located in major shopping malls and Sam's Club locations. Both of our reportable segments engage in the sale of consumer electronics products; however, our kiosks primarily offer wireless products and associated accessories... -

Page 86

... for management reporting purposes. Unallocated costs include corporate departmental expenses such as labor and benefits, as well as advertising, insurance, distribution and information technology costs. Unallocated operating income for 2008 includes net charges aggregating $12.1 million associated... -

Page 87

... Personal electronics Modern home Power Technical Service Service centers and other sales Consolidated net sales and operating revenues 34.6% 22.8 15.7 12.8 5.7 4.2 2.2 2.0 100.0% 2006 Restructuring: The table below shows our 2006 restructuring program costs and impairments allocated by reportable... -

Page 88

... quarter generally being the most significant in terms of sales and profits because of the winter holiday selling season. (In millions, except per share amounts) Year ended December 31, 2008: Net sales and operating revenues Cost of products sold Gross profit (2) (1) Mar. 31 Three Months Ended Jun... -

Page 89

...per share amounts) Year ended December 31, 2007: Net sales and operating revenues (1) Cost of products sold Gross profit SG&A expense Depreciation and amortization Impairment of long-lived assets and other charges Total operating expenses Operating income Interest income Interest expense Other (loss... -

Page 90

....com RadioShack Corporation is an Equal Opportunity Employer. Printed in the USA. RADIOSHACK has included as Exhibit 31 to its Annual Report on Form 10-K for fiscal year 2008 filed with the Securities and Exchange Commission certificates of the Chief Executive Officer and Chief Financial Officer... -

Page 91

...Corporate Executive Management Team RadioShack Corporation Julian C. Day Chairman and Chief Executive Officer Lee D. Applbaum Executive Vice President Chief Marketing Officer Bryan Bevin Executive Vice President Store Operations James F. Gooch Executive Vice President and Chief Financial Officer... -

Page 92

RadioShack Corporation 300 Radio Shack Circle Fort Worth Texas 76102 www.radioshackcorporation.com