Radio Shack 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

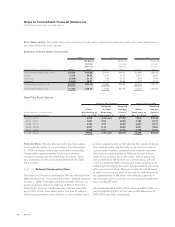

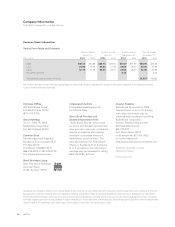

Compensation and interest expense related to the 401(k)

Plan before the reduction for the allocation of dividends are

presented below for each year ended December 31:

(In millions) 2004 2003 2002

Compensation expense $– $– $4.3

Accrued additional contribution –– 4.1

Interest expense –– 0.2

The last allocation of TESOP Preferred Stock to participants

was made as of the 401(k) Plan year ended March 31, 2003,

and was based on the total debt service made on the indebt-

edness. As shares of the TESOP Preferred Stock were

allocated to 401(k) Plan participants, compensation expense

was recorded and unearned compensation was reduced.

Interest expense on the Refinanced Notes was also recog-

nized as a cost of the 401(k) Plan. The compensation

component of the 401(k) Plan expense was reduced by

the amount of dividends accrued on the TESOP Preferred

Stock, with any dividends in excess of the compensation

expense reflected as a reduction of interest expense.

Contributions made by us to the 401(k) Plan for the year

ended December 31, 2002, totaled $4.0 million. Dividends

paid on the TESOP Preferred Stock were $4.5 million.

As of December 31, 2002, all of the original 100,000 shares

of TESOP Preferred Stock were converted into 5.1 million

shares of our common stock and allocated to participants’

accounts in the 401(k) Plan.

NOTE 21 Treasury Stock Repurchase Program

In February 2003, our Board of Directors authorized a repur-

chase program for 15.0 million shares, which was in addition

to our 25.0 million share repurchase program that was com-

pleted during the second quarter of 2003. The 15.0 million

share repurchase program has no expiration date and allows

shares to be repurchased in the open market. We repur-

chased 6.9 million shares of our common stock for $210.9

million for the year ended December 31, 2004, under the

15.0 million share repurchase program. The funding required

for these repurchases came from cash generated from net

sales and operating revenues and cash and cash equivalents.

We also repurchase shares in the open market to offset the

sales of shares to our employee benefit plans. At February

18, 2005, there were 2.5 million shares available to be

repurchased under the 15.0 million share repurchase program.

On February 25, 2005, our Board of Directors approved a

new share repurchase program. This new program authorizes

management to repurchase up to $250 million in open market

purchases and has no expiration date.

NOTE 22 Preferred Share Purchase Rights

In July 1999, we amended and restated a stockholder rights

plan which declared a dividend of one right for each out-

standing share of our common stock. The rights plan, as

amended and restated, will expire on July 26, 2009. The

rights are currently represented by our common stock cer-

tificates. When the rights become exercisable, they will

entitle each holder to purchase 1/10,000th of a share of our

Series A Junior Participating Preferred Stock for an exercise

price of $250 (subject to adjustment). The rights will

become exercisable and will trade separately from the com-

mon stock only upon the date of public announcement that

a person, entity or group (“Person”) has acquired 15% or

more of our outstanding common stock without the con-

sent or approval of the disinterested directors (“Acquiring

Person”) or ten days after the commencement or public

announcement of a tender or exchange offer which would

result in any Person becoming an Acquiring Person. In the

event that any Person becomes an Acquiring Person, the

rights will be exercisable for 60 days thereafter for our com-

mon stock with a market value (as determined under the

rights plan) equal to twice the exercise price. In the event

that, after any Person becomes an Acquiring Person, we

engage in certain mergers, consolidations, or sales of assets

representing 50% or more of our assets or earning power

with an Acquiring Person (or Persons acting on behalf of or

in concert with an Acquiring Person) or in which all holders

of common stock are not treated alike, the rights will be

exercisable for common stock of the acquiring or surviving

company with a market value (as determined under the

rights plan) equal to twice the exercise price. The rights will

not be exercisable by any Acquiring Person. The rights are

redeemable at a price of $0.01 per right prior to any Person

becoming an Acquiring Person or, under certain circum-

stances, after a Person becomes an Acquiring Person.

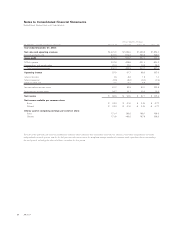

NOTE 23 Dividends Declared

We declared dividends of $0.25, $0.25 and $0.22 for the

years 2004, 2003 and 2002, respectively. Dividends declared

in 2002 and thereafter have been paid annually in December.

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

52 AR2004