Radio Shack 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to cost of products sold proportionately as the revenues are

recognized. A loss is recognized on extended service contracts

if the sum of the expected costs of providing services pur-

suant to the contracts exceeds the related unearned revenue.

Cost of Products Sold: Cost of products sold includes the

total cost of merchandise inventory sold; costs of services

provided; external and internal freight expenses; distribution

costs; warehousing costs; customer shipping and handling

charges; certain vendor allowances that are not specific,

incremental and identifiable; and physical inventory valua-

tion adjustments and losses.

Vendor Allowances: We receive allowances from third-party

service providers and product vendors through a variety of

promotional programs and arrangements as a result of pur-

chasing and promoting their products and services in the nor-

mal course of business. We consider vendor allowances

received to be a reduction in the price of a vendor's products

or services and record them as a component of cost of prod-

ucts sold when the related product or service is sold, unless

the allowances represent reimbursement of specific, incre-

mental and identifiable costs incurred to promote a vendor's

products and services, in which case we record them when

earned as an offset to the associated expense incurred to pro-

mote the applicable products and/or services.

Advertising Costs: Our advertising costs are expensed the first

time the advertising takes place. We receive allowances from

certain third-party service providers and product vendors

which we record when earned as an offset to advertising

expense incurred to promote the applicable products and/or

services only if the allowances represent reimbursement of

specific, incremental and identifiable costs (see our previous

“Vendor Allowances” discussion). Advertising expense was

$271.5 million, $254.4 million and $241.0 million for the years

ended December 31, 2004, 2003 and 2002, respectively, net

of vendor allowances of $33.9 million, $40.9 million and

$59.6 million, respectively.

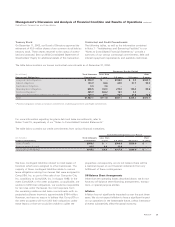

Stock-Based Compensation: At December 31, 2004, we had

various stock-based employee compensation plans in use. We

measure stock-based compensation costs under Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for

Stock Issued to Employees,” and its related interpretations.

Accordingly, no compensation expense has been recognized

for our fixed price stock option plans, as the exercise price of

options must be equal to or greater than the stock price on

the date of grant under our incentive stock plans. The table

below illustrates the effect on net income and net income

available per common share as if we had accounted for our

employee stock options under the fair value recognition

provisions of Statement of Financial Accounting Standards

(“SFAS”) No. 123, “Accounting for Stock-Based Compen-

sation.” For purposes of the pro forma disclosures below,

the estimated fair value of the options is amortized to

expense over the vesting period. We will adopt the provisions

of SFAS No. 123R, “Share-Based Payment,” which was

issued in December 2004, effective July 1, 2005, and will

modify our accounting for stock options and other equity

awards accordingly. See “Recently Issued Accounting

Pronouncements” below.

Year Ended December 31,

(In millions,except per share amounts) 2004 2003 2002

Net income, as reported $337.2 $298.5 $263.4

Stock-based employee compen-

sation expense included in

reported net income,

net of related tax effects 12.8 14.2 14.0

Total stock-based compensation

expense determined under fair

value method for all awards,

net of related tax effects (34.7) (51.1) (60.5)

Pro forma net income $315.3 $261.6 $216.9

Net income available

per common share:

Basic – as reported $ 2.09 $ 1.78 $ 1.50

Basic – pro forma $ 1.96 $ 1.56 $ 1.23

Diluted – as reported $ 2.08 $ 1.77 $ 1.45

Diluted – pro forma $ 1.94 $ 1.55 $ 1.19

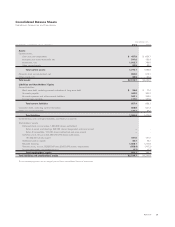

The pro forma amounts in the preceding table were

estimated using the Black-Scholes option-pricing model

with the following weighted average assumptions:

Year Ended December 31,

2004 2003 2002

Expected life in years 666

Expected volatility 48.0% 48.3% 46.1%

Annual dividend paid per share $ 0.25 $0.25 $ 0.22

Risk free interest rate 3.3% 3.1% 4.5%

Fair value of options granted

during year $16.28 $9.63 $13.53

Earnings per Share: Basic earnings per share is computed

based only on the weighted average number of common shares

outstanding for each period presented. Diluted earnings per

share reflects the potential dilution that would have occurred

if securities or other contracts to issue common stock were

exercised, converted, or resulted in the issuance of common

stock that would have then shared in the earnings of the entity.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

39

AR2004