Radio Shack 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

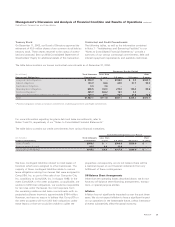

Advertising expense increased in both dollars and as a

percent of net sales and operating revenues. This increase

is primarily related to an increase in expenditures associated

with the holiday selling season. Additionally, we received

fewer contributions from our vendors. We expect our adver-

tising expense to increase in 2005 in dollars but decrease

as a percentage of net sales and operating revenues, as a

result of increased sales from our kiosk operations and an

improvement in operating efficiencies.

Rent expense increased in dollars, but decreased as a percent

of net sales and operating revenues. The dollar increase was

due primarily to lease renewals and relocations at higher rates,

as well as the acquisition of the SAM’S CLUB kiosk business

in October 2004. We expect an increase in 2005 rent expense,

primarily as a result of the full-year effect of the acquisition of

the SAM’S CLUB kiosk business and Sprint kiosk expansion.

Insurance expense decreased in both dollars and as a percent

of net sales and operating revenues, as a result of both fewer

claims and a decrease in the number of participants in our

insurance programs. Our insurance expense relates to losses,

claims and insurance premiums, which are partially offset by

contributions from health insurance participants.

In 2005, we expect SG&A expense to increase in dollars, due

to the full-year effect of our acquisition of the SAM’S CLUB

kiosk business and our planned Sprint kiosk expansion. We

anticipate a slight decrease as a percentage of net sales and

operating revenues, due to anticipated increased sales volume

and a continued focus on leveraging our fixed expense base.

Depreciation and Amortization

Depreciation and amortization expense increased $9.4 million

dollars to $101.4 million and increased to 2.1% of net sales

and operating revenues, compared to 2.0% for 2003. The

increase in depreciation was primarily attributable to new

store fixtures for existing company-operated stores, as well

as the hardware and software associated with information

systems upgrades. We expect depreciation and amortization

expense to increase by at least 10% in 2005 due to increases

associated with our new corporate headquarters, which is

now substantially complete and occupied, increased spend-

ing for our store remodel program, information system proj-

ects, and the amortization of intangibles related to our

SAM’S CLUB kiosk business acquisition.

Gain on Contract Termination

There was no gain on contract termination in 2004. For

information on the prior year gain on contract termination,

see the discussion below under the section titled “2003

Compared with 2002.”

Impairment of Long-Lived Assets

There was no significant impairment of long-lived assets in

2004. For information on the prior year impairment of long-

lived assets, see the discussion below under the section

titled “2003 Compared with 2002.”

Net Interest Expense

Interest expense, net of interest income, was $18.2 million

for 2004 versus $22.9 million for 2003, a decrease of $4.7

million or 20.5%.

Interest expense decreased to $29.6 million in 2004 from $35.7

million in 2003. This decrease was primarily the result of a

reduction in the average debt outstanding throughout 2004. In

addition, the capitalization of $6.6 million of interest expense

related to the construction of our new corporate campus also

lowered overall interest expense for the year ended December

31, 2004, when compared to the same prior year period.

Interest income decreased approximately 11% to $11.4

million in 2004 from $12.8 million in 2003, despite an

increase in investment rates. This was primarily the result

of a $1.3 million decrease in interest received from tax

settlements in 2004 compared to 2003, as well as a lower

average investment balance.

Interest expense, net of interest income, is expected to

increase by more than $6 million in 2005, when compared

to 2004, due to the elimination of capitalized interest expense

as a result of the substantial completion of the construction

of our corporate headquarters.

Other Income, Net

During the year ended December 31, 2004, we received pay-

ments and recorded income of $2.0 million under our tax

sharing agreement with O’Sullivan Industries Holdings, Inc.

(“O’Sullivan”), compared to $3.1 million received and record-

ed in the corresponding prior year period. Future payments

under the tax sharing agreement will vary based on the level

of O’Sullivan’s future earnings and are also dependent on

O’Sullivan’s overall financial condition and ability to pay. We

cannot give any assurances as to the amount or frequency

of payment, if any, that we may receive from O’Sullivan in

future periods.

Provision for Income Taxes

Our provision for income taxes reflects an effective income

tax rate of 37.8% for 2004 and 36.9% for 2003. The increase

in the effective tax rate for 2004, when compared to 2003,

was the result of a favorable tax settlement during 2003,

relating to prior year tax matters. We anticipate that the

effective tax rate for 2005 will be approximately 38.2%.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

RadioShack Corporation and Subsidiaries

22 AR2004