Radio Shack 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adoption of this statement to have a material impact on

our financial condition or results of operations.

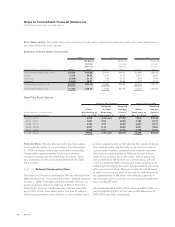

NOTE 3 Accounts and Notes Receivable, Net

As of December 31, 2004 and 2003, we had the following

accounts and notes receivable outstanding in the accompany-

ing Consolidated Balance Sheets:

December 31,

(In millions) 2004 2003

Receivables from vendors and service providers

$131.4 $ 92.3

Trade accounts receivable 80.6 75.6

Other receivables 30.4 18.6

Allowance for doubtful accounts (1.4) (4.1)

Accounts and notes receivable, net $241.0 $182.4

Receivables from vendors and service providers relate to mar-

keting development funds, residual income, customer acquisi-

tion fees, rebates and other promotions from our third-party

service providers and product vendors, after taking into account

estimates for service providers’ customer deactivations and

non-activations, which are factors in determining the amount

of customer acquisition fees and residual income earned.

Allowance for Doubtful Accounts

December 31,

(In millions) 2004 2003 2002

Balance at the beginning of the year $ 4.1 $7.4 $ 6.8

(Recovery of) provision for bad

debts included in selling, general

and administrative expense (0.3) 0.4 4.7

Uncollected receivables written off,

net of recoveries (2.4) (3.7) (4.1)

Balance at the end of the year $ 1.4 $4.1 $ 7.4

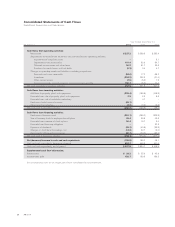

NOTE 4 Property, Plant and Equipment (“PP&E”), Net

The following table outlines the ranges of estimated useful

lives and balances of each major fixed asset category:

Range Of December 31,

(In millions) Estimated Useful Life 2004 2003

Land – $ 35.1 $ 35.0

Buildings 10 – 40 years 288.5 169.1

Furniture, fixtures

and equipment 2 – 15 years 704.1 631.8

Leasehold improvements The shorter of the life

of the improvements

or the term of the re-

lated lease and certain

renewal periods 356.7 345.8

Total PP&E 1,384.4 1,181.7

Less accumulated depreciation

and amortization (732.4) (668.6)

PP&E, net $ 652.0 $ 513.1

as special-purpose entities for periods ending after December

31, 2003. Applications by public entities for all other types of

entities are required in financial statements for periods ending

after March 15, 2004. The application of FIN 46R did not have a

material impact on our results of operations, financial position

or liquidity, and does not apply to our dealer outlets.

In December 2004, the FASB issued SFAS No. 123R. SFAS

No. 123R establishes standards for the accounting for trans-

actions in which an entity exchanges its equity instruments

for goods or services. This Statement focuses primarily on

accounting for transactions in which an entity obtains

employee services in share-based payment transactions.

SFAS No. 123R requires that the fair value of such equity

instruments be recognized as an expense in the historical

financial statements as services are performed. Prior to SFAS

No. 123R, only certain pro forma disclosures of fair value

were required. We will adopt the provisions of SFAS No.

123R beginning with the third quarter of fiscal year 2005,

which begins on July 1, 2005. We intend to elect the modi-

fied prospective transition method which will require that we

recognize compensation expense for all new and unvested

share-based payment awards from the effective date. Based

on our preliminary analysis of SFAS No. 123R, we anticipate

that the after-tax impact of adoption on our results of opera-

tions for the six months ending December 31, 2005, will be

an expense of approximately $6.8 million.

During fiscal year 2004, we adopted Emerging Issues Task

Force (“EITF”) Issue No. 03-10, “Application of Issue No. 02-

16 by Resellers to Sales Incentives Offered to Consumers by

Manufacturers,” which amends EITF No. 02-16. According to

the amended guidance, if certain criteria are met, considera-

tion received by a reseller in the form of reimbursement from

a vendor for honoring the vendor's sales incentives offered

directly to consumers (i.e., manufacturers' coupons) should

not be recorded as a reduction of the cost of the reseller's

purchases from the vendor. The adoption of EITF No. 03-10

did not materially impact our results of operations, financial

position or liquidity in fiscal year 2004.

In November 2004, the FASB issued SFAS No. 151,

“Inventory Costs.” The new Statement amends Accounting

Research Bulletin No. 43, Chapter 4, “Inventory Pricing,” to

clarify the accounting for abnormal amounts of idle facility

expense, freight, handling costs, and wasted material. SFAS

151 requires that these items be recognized as current-period

charges and requires that allocation of fixed production over-

head to the cost of conversion be based on the normal capac-

ity of the production facilities. This statement is effective for

fiscal years beginning after June 15, 2005. We do not expect

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

42 AR2004