Radio Shack 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ment whenever events or changes in circumstances indicate

that the net book value of the asset may not be recoverable.

Pursuant to the provisions of SFAS No. 142, “Goodwill and

Other Intangible Assets,” goodwill and intangible assets are

not amortized, but are reviewed annually at the end of our

fiscal year for impairment (and in interim periods if certain

events occur indicating that the carrying value of goodwill

and intangible assets may be impaired).

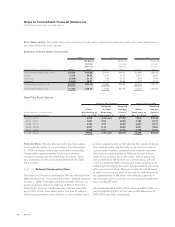

Goodwill and Intangibles: Goodwill represents the excess

of the purchase price over the fair value of net assets

acquired. At December 31, 2004, our net goodwill balance

totaled $26.8 million, comprised primarily of goodwill

resulting from the acquisition of the SAM’S CLUB kiosk

business effective October 1, 2004. Additionally, we had

$25.2 million in intangible assets arising from the SAM’S

CLUB kiosk business acquisition.

Fair Value of Financial Instruments: The fair value of financial

instruments is determined by reference to various market data

and other valuation techniques as appropriate. Unless other-

wise disclosed, the fair values of financial instruments approx-

imate their recorded values, due primarily to the short-term

nature of their maturities or their varying interest rates.

Income Taxes: Income taxes are accounted for using the asset

and liability method. Deferred taxes are recognized for the tax

consequences of “temporary differences” by applying enact-

ed statutory tax rates applicable to future years to differences

between the financial statement carrying amounts and the tax

bases of existing assets and liabilities. The effect on deferred

taxes of a change in tax rates is recognized in income in the

period that includes the enactment date. In addition, we rec-

ognize future tax benefits to the extent that such benefits are

more likely than not to be realized.

Derivatives: We use our interest rate swap agreements to

effectively convert a portion of our long-term fixed rate debt

to a variable rate. Under these agreements, we pay a variable

rate of LIBOR plus a markup and receive fixed rates ranging

from 6.950% to 7.375%. We have designated these agree-

ments as fair value hedging instruments. The accounting for

changes in the fair value of an interest rate swap depends on

the use of the swap. To the extent that a derivative is effective

as a hedge of an exposure to future changes in fair value, the

change in the derivative's fair value is recorded in earnings, as

is the change in fair value of the item being hedged. To the

extent that a swap is effective as a cash flow hedge of an

exposure to future changes in cash flows, the change in fair

value of the swap is deferred in accumulated other compre-

hensive income. Any portion we consider to be ineffective is

immediately reported in our earnings. The differentials to be

received or paid under interest rate swap contracts designat-

ed as hedges are recognized in income over the life of the

contracts as adjustments to interest expense. Gains and loss-

es on terminations of interest rate contracts designated as

hedges are deferred and amortized into interest expense over

the remaining life of the original contracts or until repayment

of the hedged indebtedness. Through the use of interest rate

swap agreements, we have reduced our net interest expense

by $8.7 million, $7.8 million and $5.1 million for the years

ended December 31, 2004, 2003 and 2002, respectively.

We maintain strict internal controls over our hedging activi-

ties, which include policies and procedures for risk assess-

ment and the approval, reporting and monitoring of all deriva-

tive financial instrument activities. We monitor our hedging

positions and credit worthiness of our counter-parties and do

not anticipate losses due to our counter-parties’ nonperfor-

mance. We do not hold or issue derivative financial instru-

ments for trading or speculative purposes. To qualify for

hedge accounting, derivatives must meet defined correlation

and effectiveness criteria, be designated as a hedge and

result in cash flows and financial statement effects that sub-

stantially offset those of the position being hedged.

Foreign Currency Translation: The functional currency of sub-

stantially all operations outside the U.S. is the applicable local

currency. Translation gains or losses related to net assets

located outside the United States are included as a compo-

nent of accumulated other comprehensive loss and are classi-

fied in the stockholders’ equity section of the accompanying

Consolidated Balance Sheets.

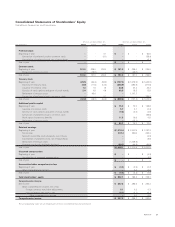

Comprehensive Income: Comprehensive income is defined as

the change in equity (net assets) of a business enterprise dur-

ing a period, except for those changes resulting from invest-

ments by owners and distributions to owners. Comprehensive

income is comprised of the gain (loss) on an interest rate

swap used as a cash flow hedge and foreign currency transla-

tion adjustments, which are shown net of tax in our accompa-

nying Consolidated Statements of Stockholders' Equity.

Recently Issued Accounting Pronouncements: In December

2003, the Financial Accounting Standards Board (the “FASB”)

issued revised FIN 46, “Consolidation of Variable Interest

Entities, an Interpretation of Accounting Research Bulletin No.

51” (“FIN 46R”). FIN 46R requires the consolidation of an entity

in which an enterprise absorbs a majority of the entity's expect-

ed losses, receives a majority of the entity's expected residual

returns, or both, as a result of ownership, contractual or other

financial interests in the entity (variable interest entities or

“VIEs”). FIN 46R is applicable for financial statements of public

entities that have interests in VIEs or potential VIEs referred to

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

41

AR2004