Radio Shack 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

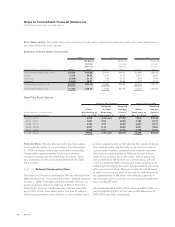

NOTE 18 Termination Protection Plans

In August 1990 and in May 1995, our Board of Directors

approved termination protection plans and amendments to

the termination protection plans, respectively. These plans

provide for defined termination benefits to be paid to our eli-

gible employees who have been terminated, without cause,

following a change in control of our company. In addition, for

a certain period of time following an employee's termination,

we, at our expense, must continue to provide on behalf of the

terminated employee certain employment benefits. In general,

during the twelve months following a change in control, we

may not terminate or change existing employee benefit plans

in any way which would affect accrued benefits or decrease

the rate of our contribution to the plans. There have been no

payments under these protection plans for the years shown.

NOTE 19 RadioShack Investment Plan

On April 30, 2004, we amended our employee stock purchase

plan and renamed it the RadioShack Investment Plan (the

“Investment Plan”). Only employees participating in the

former plan as of April 29, 2004, may participate in the

Investment Plan. New employees are not eligible to partici-

pate in the Investment Plan. Participants contribute from 1%

to 7% of their annual compensation, based on the amount of

their election in the employee stock purchase plan as of April

29, 2004. Participants may decrease, but not increase, the

amount of their election. Participants may annually elect to

receive their contributions either in the form of cash or our

common stock. We match 40%, 60% or 80% of each partici-

pant’s contribution, depending on the participant’s length of

continuous participation in the employee stock purchase plan

as of April 29, 2004. This matching contribution is in the form

of either cash or our common stock, based on the partici-

pant’s election to receive his or her contribution in cash or

common stock, as described above. Our contributions to the

Investment Plan amounted to $13.6 million, $15.4 million

and $15.1 million for the years ended December 31, 2004,

2003 and 2002, respectively.

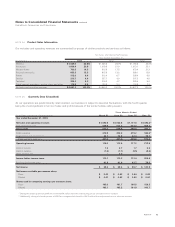

NOTE 20 RadioShack 401(k) Plan

The RadioShack 401(k) Plan (“401(k) Plan”) is a defined contri-

bution plan. Eligible employees may direct their contributions

into various investment options, including investing in our

common stock. Participants may defer, via payroll deductions,

1% to 15% of their annual compensation; however, officers

may only defer from 1% to 8% of their annual compensation.

Contributions per participant are limited to certain annual

maximums permitted by the Internal Revenue Code. We

presently contribute an amount to each participant’s account

maintained under the 401(k) Plan equal to 30% of the partici-

pant’s contributions on up to 8% of their annual compensation.

This percentage contribution by us is discretionary and may

change in future years. Any contributions by us are made

directly to the 401(k) Plan and are made in cash and invested

in an age appropriate retirement fund for each participant;

however, participants may immediately reinvest our contribu-

tion into other investment alternatives provided by the 401(k)

Plan. Effective April 1, 2002, a participant becomes fully

vested in the 401(k) Plan contributions we made on his

on her behalf on the third anniversary of the participant’s

employment date. At January 1, 2004, the 401(k) Plan year

was changed to a calendar year basis.

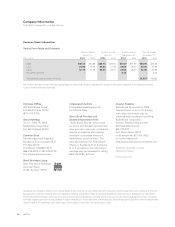

(In millions) 2004 2003 2002

401(k) company contribution $4.7 $4.7 $3.9

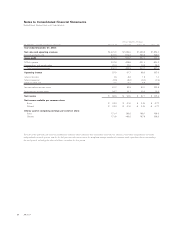

TESOP Portion of the 401(k) Plan: On July 31, 1990, the

trustee of the 401(k) Plan borrowed $100.0 million at an

interest rate of 9.34%; this amount was paid off on June 30,

2000 (“TESOP Notes”). The 401(k) Plan trustee used the pro-

ceeds from the 1990 issuance of the TESOP Notes to pur-

chase from us 100,000 shares of TESOP Preferred Stock at

a price of $1,000 per share. In December 1994, the 401(k)

Plan entered into an agreement with an unrelated third-party

to refinance up to $16.7 million of the TESOP Notes in a

series of six annual notes (the “Refinanced Notes”), beginning

December 30, 1994. As of December 31, 1999, the 401(k)

Plan had borrowed all of the $16.7 million for the refinancing

of the TESOP Notes. As of December 31, 2002, the 401(k)

Plan had repaid all of the Refinanced Notes. Dividend pay-

ments and contributions received by the 401(k) Plan from

us were used to repay the indebtedness.

Each share of TESOP Preferred Stock was convertible into

87.072 shares of our common stock. The annual cumulative

dividend on TESOP Preferred Stock was $75.00 per share,

payable semiannually. Because we had guaranteed the

repayment of the Refinanced Notes, the indebtedness of the

401(k) Plan was recognized as a liability in the accompanying

Consolidated Balance Sheets. An offsetting charge was made

in the stockholders' equity section of the 2001 Consolidated

Balance Sheet to reflect unearned compensation related to

the 401(k) Plan. On December 31, 2002, all shares of TESOP

Preferred Stock were converted into our common stock and

all unearned compensation related to the Plan was recog-

nized as of that date.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

51

AR2004