Radio Shack 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

48 AR2004

Additionally, in the second quarter of 2002, we received pay-

ments of $27.7 million in partial settlement of amounts owed

to us under a tax sharing agreement that was the subject of

an arbitration styled Tandy Corporation and T.E. Electronics,

Inc. vs. O’Sullivan Industries Holdings, Inc. This partial settle-

ment followed a ruling in RadioShack’s favor by the arbitra-

tion panel. This arbitration was commenced in July 1999 and

the settlement also requires O’Sullivan to make ongoing pay-

ments under this tax sharing agreement that was entered into

by the parties at the time of O’Sullivan’s initial public offering.

We are currently a party to various class action lawsuits

alleging that we misclassified certain RadioShack store man-

agers as exempt from overtime in violation of the Fair Labor

Standards Act, including a lawsuit styled Alphonse L. Perez,

et al. v. RadioShack Corporation, filed in the United States

District Court for the Northern District of Illinois. While the

alleged damages in these lawsuits are undetermined, they

could be substantial. We believe that we have meritorious

defenses, and we are vigorously defending these cases.

Furthermore, we fully expect these cases to be favorably

determined as a matter of federal law. If, however, an adverse

resolution of any of these lawsuits occurs, we believe they

could have a material adverse effect on our results of opera-

tions for the year in which resolution occurs. However, we

do not believe that such an adverse resolution would have

a material impact on our financial condition or liquidity. The

liability, if any, associated with these lawsuits was not deter-

minable at December 31, 2004.

We have various other pending claims, lawsuits, disputes

with third parties, investigations and actions incidental to

the operation of our business. Although occasional adverse

settlements or resolutions may occur and negatively impact

earnings in the period or year of settlement, it is our belief

that their ultimate resolution will not have a material adverse

effect on our financial condition or liquidity.

NOTE 15 Commitments and Contingent Liabilities

Lease Commitments: We lease rather than own most of our

facilities. Our lease agreements expire at various dates

through January 2016. Some of these leases are subject to

renewal options and provide for the payment of taxes, insur-

ance and maintenance. Our retail locations comprise the

largest portion of our leased facilities. These locations are

primarily in major shopping malls and shopping centers

owned by other companies. Some leases are based on a

minimum rental plus a percentage of the store's sales in

excess of a stipulated base figure (“Contingent Rent”).

Certain leases contain escalation clauses. We also lease

distribution centers and office space. Additionally, we lease

automobiles and information systems equipment.

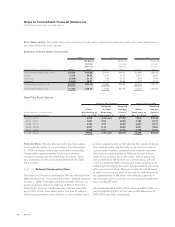

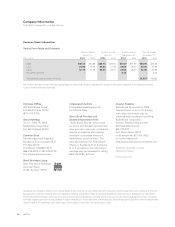

Future minimum rent commitments at December 31, 2004,

under long-term non-cancelable operating leases (net of

immaterial amounts of sublease rent income) are included

in the following table.

(In millions)

2005 $182.3

2006 155.0

2007 115.2

2008 81.3

2009 55.1

2010 and thereafter 80.6

Total minimum lease payments $669.5

Future minimum rent commitments in the table above exclude

future rent obligations associated with stores closed under

the 1996 and 1997 restructuring plan. Estimated payments

to settle future rent obligations associated with these stores

have been accrued in the restructuring reserve (see Note 10).

Rent Expense

Year Ended December 31,

(In millions) 2004 2003 2002

Minimum rents $203.0 $201.4 $197.0

Occupancy cost 45.3 44.3 43.9

Contingent rents 11.1 4.4 4.0

Total rent expense $259.4 $250.1 $244.9

From time to time, we enter into store operating leases that

provide for free or reduced rental periods, usually during the

finish-out of our retail locations before the store opens for

business. These periods are commonly referred to as “rent

holidays” and average 60 days. Prior to January 2005, we did

not recognize straight-line rent expense during the pre-open-

ing rent holiday period but rather began recording rent

expense from the day the store opened. Beginning January 1,

2005, we have changed our accounting policy by including

the rent holiday period in our straight-line rent calculation.

We do not believe that this change in policy will have a mate-

rial effect on our future consolidated statements of income

or balance sheets, and will have no effect on our cash flows.

Furthermore, we believe that the impact of our prior account-

ing for pre-opening rent holiday periods on current and

prior periods is immaterial and therefore no accounting

adjustments are necessary or have been made.

Contingent Liabilities: We have contingent liabilities related

to retail leases of locations which were assigned to other

businesses. The majority of these contingent liabilities relate

to various lease obligations arising from leases that were

assigned to CompUSA, Inc. as part of the sale of our

Computer City, Inc. subsidiary to CompUSA, Inc. in August

1998. In the event CompUSA or the other assignees, as