Radio Shack 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

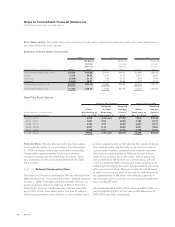

NOTE 8 Treasury Stock Retirement

In December 2003, our Board of Directors approved the

retirement of 45.0 million shares of our common stock held

as treasury stock. These shares returned to the status of

authorized and unissued. Additional details of the transaction

may be seen in our 2003 Consolidated Statement of

Stockholders’ Equity.

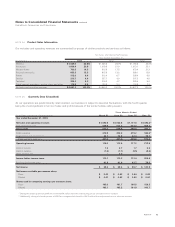

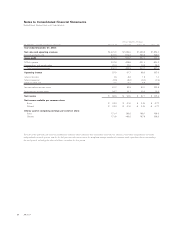

NOTE 9 Accrued Expenses and Other Current Liabilities

December 31,

(In millions) 2004 2003

Payroll and bonuses $ 86.0 $ 76.7

Insurance 74.8 70.0

Sales and payroll taxes 39.5 45.5

Rent 22.7 17.4

Gift card deferred revenue 18.8 14.3

Other 100.3 119.1

Total accrued expenses and

other current liabilities $342.1 $343.0

NOTE 10 Other Non-Current Liabilities

December 31,

(In millions) 2004 2003

Deferred compensation $ 78.2 $75.2

Deferred revenue 30.6 –

Deferred taxes 13.5 –

Other 8.0 –

Total other non-current liabilities $130.3 $75.2

Deferred revenue at December 31, 2004 was the result of

us receiving funds from wireless vendors in conjunction with

the acquisition of the SAM’S CLUB kiosk business.

NOTE 11 Business Restructurings

At December 31, 2004, the balance in the restructuring

reserve related to the closure in 1996 and 1997 of various

McDuff, Computer City and Incredible Universe retail stores

was $5.1 million. This reserve represents the expected costs

to be paid in connection with the remaining real estate lease

obligations. If these facilities’ sublease income declines in

their respective markets or if it takes longer than expected

to sublease or dispose of these facilities, the actual losses

could exceed this reserve estimate. Costs will continue to

be incurred over the remaining terms of the related leases.

During the year ended December 31, 2004, costs of $11.9

million were charged against this reserve, principally relating

to the settlement of one location in Miami, Florida.

NOTE 12 Gain on Contract Termination

RadioShack and Microsoft Corporation mutually agreed dur-

ing 2002 to terminate their agreement and settle the remain-

ing commitments each had to one another. The termination

of this agreement took effect at the start of the fourth quarter

of 2002, upon satisfaction of several contractual obligations.

The net financial result was an $18.5 million gain (principally

cash received), driven primarily by the settlement of a

multi-year obligation Microsoft had to connect our stores

with broadband capabilities.

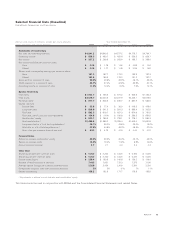

NOTE 13 Income Taxes

Deferred tax assets and liabilities as of December 31, 2004

and 2003, were comprised of the following:

December 31,

(In millions) 2004 2003

Deferred tax assets:

Insurance reserves $24.3 $ 22.4

Deferred compensation 25.5 23.8

Inventory adjustments, net 1.6 6.5

Restructuring reserves 2.6 6.5

Bad debt reserve 0.5 1.6

Other 12.9 29.0

Total deferred tax assets 67.4 89.8

Deferred tax liabilities:

Deferred taxes on foreign operations 16.2 14.5

Depreciation and amortization 24.1 10.3

Other 3.8 3.1

Total deferred tax liabilities 44.1 27.9

Net deferred tax assets $23.3 $ 61.9

The net deferred tax asset is classified as follows:

Other current assets $36.8 $ 39.7

Other (non-current liabilities) assets (13.5) 22.2

Net deferred tax assets $23.3 $ 61.9

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

46 AR2004