Radio Shack 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

There were no significant impairments for the year ended

December 31, 2004.

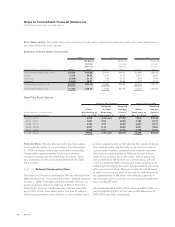

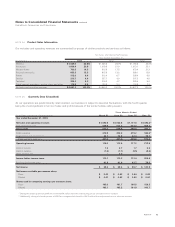

NOTE 7 Indebtedness and Borrowing Facilities

Short-Term Debt, Including Current Maturities

of Long-Term Debt

December 31,

(In millions) 2004 2003

Short-term debt $22.7 $36.8

Financing obligation 32.3 –

Current portion of long-term debt –39.5

Current portion of capital lease obligations 0.6 0.2

Fair value of interest rate swaps –0.9

Total short-term debt, including

current maturities of long-term debt $55.6 $77.4

Long-Term Debt, Excluding Current Maturities

December 31,

(In millions) 2004 2003

Ten-year 7 3/8% note payable due in 2011 $350.0 $350.0

Ten-year 6.95% note payable due in 2007 150.0 150.0

Medium-term notes payable with an

interest rate at December 31, 2004,

of 6.42% due in 2008 5.0 44.5

Financing obligation 32.3 32.3

Notes payable with interest rates

at December 31, 2004, ranging from

1.6% to 2.9% due from 2006 to 2014 6.1 6.1

Capital lease obligations 0.6 0.3

Unamortized debt issuance costs (4.7) (5.8)

Fair value of interest rate swaps 0.5 4.5

539.8 581.9

Less current portion of:

Notes payable –39.5

Financing obligation 32.3 –

Fair value of interest rate swaps –0.9

Capital lease obligations 0.6 0.2

32.9 40.6

Total long-term debt,

excluding current maturities $506.9 $541.3

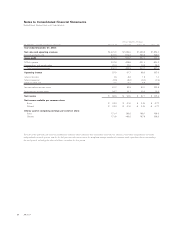

Long-term borrowings and financing obligation outstanding

at December 31, 2004, mature as follows:

Long-Term Capital Financing

(In millions) Borrowings Lease Obligation

Total

2005 $ – $0.6 $ 32.3 $ 32.9

2006 5.1 – – 5.1

2007 150.0 – – 150.0

2008 5.0 – – 5.0

2009 –– – –

2010 and thereafter 351.0 – – 351.0

Total $ 511.1 $0.6 $ 32.3 $544.0

The fair value of our long-term debt of $544.0 million and

$583.2 million at December 31, 2004 and 2003, respectively,

(including current portion, but excluding capital leases) was

approximately $629.7 million and $656.7 million, respectively.

The fair values were computed using interest rates which were

in effect at the balance sheet dates for similar debt instruments.

Our senior unsecured debt primarily consists of two

issuances of 10-year long-term notes and an issuance of

medium-term notes.

Long-Term Notes: We have a $300.0 million debt shelf regis-

tration statement which became effective in August 1997. In

August 1997, we issued $150.0 million of 10-year unsecured

long-term notes under this shelf registration. The interest rate

on the notes is 6.95% per annum with interest payable on

September 1 and March 1 of each year. These notes are due

September 1, 2007.

On May 11, 2001, we issued $350.0 million of 10-year 7 3/8%

notes in a private offering to initial purchasers who in turn

offered the notes to qualified institutional buyers under SEC

Rule 144A. The annual interest rate on the notes is 7.375%

per annum with interest payable on November 15 and May 15

of each year. The notes mature on May 15, 2011. In August

2001, under the terms of an exchange offering filed with the

SEC, we exchanged substantially all of these notes for a simi-

lar amount of publicly registered notes. Because no additional

debt was issued in the exchange offering, the net effect of

this exchange was that no additional debt was issued, and

substantially all of the notes were registered with the SEC.

During the third quarter of 2001, we entered into an interest

rate swap agreement with underlying notional amount of

$110.5 million with a maturity in 2007. In June and August

2003, we entered into interest rate swap agreements with

underlying notional amounts of debt of $100.0 million and

$50.0 million, respectively, and both with maturities in May

2011. These swaps effectively convert a portion of our long-

term fixed rate debt to a variable rate. We entered into these

agreements to balance our fixed versus floating rate debt port-

folio to continue to take advantage of lower short-term interest

rates. Under these agreements, we have contracted to pay a

variable rate of LIBOR plus a markup and to receive a fixed

rate of 6.95% for the swap entered into in 2001 and 7.375%

for the swaps entered into in 2003. We have designated these

agreements as fair value hedging instruments. We recorded an

amount in other assets, net, of $5.4 million and $4.5 million

(their fair value) at December 31, 2004 and 2003, respectively,

for the swap agreements and adjusted the fair value of the

related debt by the same amount. Fair value was computed

based on the market’s current anticipation of quarterly LIBOR

rate levels from the present until the swaps’ maturity.

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

44 AR2004