Radio Shack 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

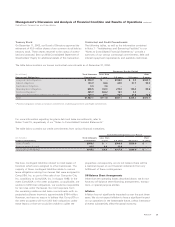

2003 COMPARED WITH 2002

Net Sales and Operating Revenues

Sales increased approximately 1.6% to $4,649.3 million in 2003

from $4,577.2 million in 2002. We had a 2% increase in com-

parable company store sales. These sales increases were possi-

ble because of an increase in average store volume, despite a

decrease in 2003 of 40 company stores, net of store openings.

Sales to our dealer outlets and other sales, including retail

support operations, were down for 2003, when compared to

2002. Sales to our dealer outlets remained substantially less

than 10% of our total sales. Retail support operation sales

were generated primarily from outside sales of our repair

centers, AmeriLink, and domestic and overseas manufactur-

ing. The decrease in retail support operations sales from 2003

to 2002 was primarily the result of an overall decline in our

AmeriLink commercial installation business, the closure of

several of our manufacturing facilities in the third quarter of

2003, and the sale of AmeriLink in September 2003.

Sales in our wireless platform increased in dollars and as a

percentage of net sales and operating revenues in 2003,

compared to 2002. This sales increase was due primarily to

an increase in the average selling price of our wireless hand-

sets as a result of our continued emphasis on national carrier

service and product offerings with desirable product features

and content, such as color screens and cameras.

Sales in our accessory platform increased in dollars, but

decreased as a percentage of net sales and operating rev-

enues in 2003, compared to 2002. The dollar increase in this

platform was primarily the result of increases in both wire-

less power and imaging accessories sales, but partially off-

set by a decline in sales of residential telephone and home

entertainment accessories.

Sales in our modern home platform decreased in both dollars

and as a percentage of net sales and operating revenues in

2003, compared to 2002. These decreases were primarily due

to decreased sales of satellite dishes and their related installa-

tion services, in addition to desktop CPUs and monitors.

Sales in our personal electronics platform increased in dollars

and as a percentage of net sales and operating revenues in

2003, compared to 2002. These increases were driven primari-

ly by sales increases in digital cameras and camcorders, micro

radio-controlled cars and, to a lesser extent, wellness products

sold under our LifewiseTM brand. This sales increase was

partially offset by decreased sales of educational toys.

Sales in our power platform increased in both dollars and

as a percentage of net sales and operating revenues in 2003,

compared to 2002. This sales gain was primarily due to

increased sales of general and special purpose batteries.

Sales in our service platform increased in dollars and as a

percentage of net sales and operating revenues in 2003,

compared to 2002. These increases were primarily due to

an increase in our wireless services sales.

Sales in our technical platform decreased in both dollars and

as a percentage of net sales and operating revenues in 2003,

compared to 2002. These decreases were primarily due to a

decline in sales of bulk and packaged wire, as well as sales

decreases for technical components and hobby products.

Gross Profit

Gross profit for 2003 was $2,315.7 million or 49.8% of net

sales and operating revenues, compared with $2,238.3 million

or 48.9% of net sales and operating revenues in 2002, result-

ing in a 3.5% increase in gross profit and a 90 basis point

increase in our gross profit percentage. These increases over

the prior year were primarily due to the following:

We experienced over $40.0 million in benefit from our supply

chain vendor and strategic pricing initiatives. In connection with

these initiatives, we utilized online reverse auctions, realized

more favorable terms from vendors, improved the impact of

markdowns, priced our products more appropriately, and uti-

lized other techniques and incentives to optimize gross profit.

We also improved our merchandise mix within platforms

by increasing the sales mix for many of our higher margin

products, while managing the mix down for many lower

margin products.

Selling, General and Administrative Expense

Our SG&A expense increased 0.7% in dollars, but decreased

as a percent of net sales and operating revenues to 37.4% for

the year ended December 31, 2003, from 37.8% for the year

ended December 31, 2002. The dollar increase for 2003 was

primarily due to an increase in both payroll and commissions

and advertising, partially offset by a litigation charge in 2002

related to the settlement of a class action lawsuit in California.

Payroll expense increased in both dollars and as a percentage

of net sales and operating revenues in 2003, due primarily to

an increase in incentive pay based on increased earnings, as

well as the 2.6% increase in company store sales.

Management’s Discussion and Analysis of Financial Condition and Results of Operations continued

RadioShack Corporation and Subsidiaries

23

AR2004