Radio Shack 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The change in net sales and operating revenue provides us

with an overall indication of the demand for our products and

services. Comparable company store sales growth indicates

the extent to which sales were impacted by growth in existing

sales channels. Comparable company store sales include the

sales of any domestic, retail location where we have a physi-

cal presence, including company-operated stores and kiosks,

that has more than 12 full months of recorded sales. Average

tickets per store, in conjunction with average sales per ticket,

provide us with an indication of whether the changes in rev-

enues were generated by a higher volume of purchases or

by purchases of products with higher prices.

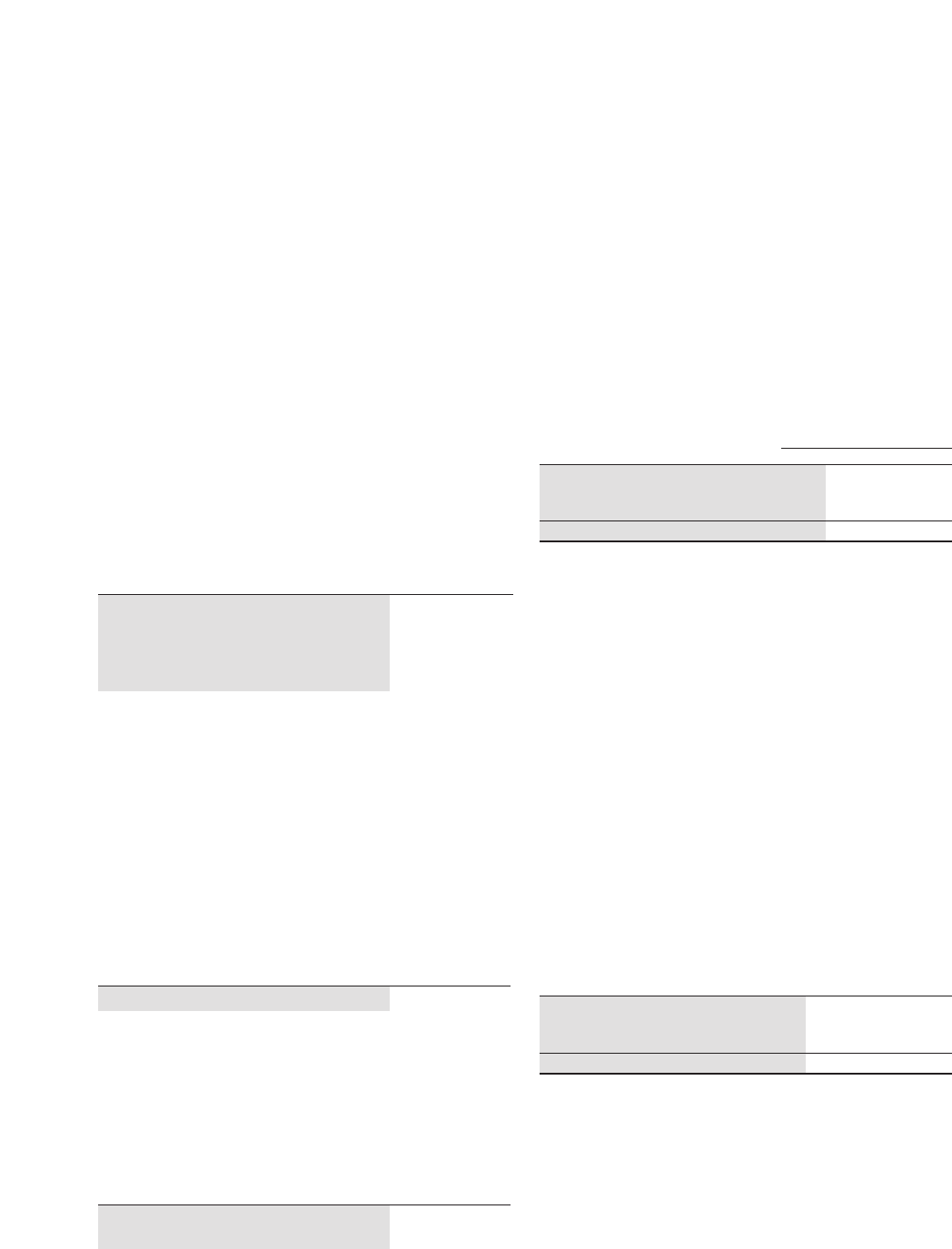

The table below summarizes these revenue metrics for the

years indicated:

2004 2003 2002

Net sales and operating

revenues growth 4.1% 1.6% (4.2%)

Comparable store sales growth 3% 2% (1%)

Average tickets per store per day 66 72 73

Average sales per ticket $34.17 $30.77 $ 29.40

In addition to the metrics above, we review the revenue per

square foot of our various channels of distribution to deter-

mine productivity of our product assortment and the overall

distribution channel.

Gross Margin Metrics

We also view our gross margin as a key metric of our finan-

cial performance, as it indicates the extent to which we are

able to reduce our product costs and optimize product mix.

The table below summarizes gross margin for the

years indicated:

2004 2003 2002

Gross margin 50.3% 49.8% 48.9%

SG&A Expense and Operating Margin Metrics

We believe that our ability to leverage our fixed expense base

and, accordingly, increase operating margin is an important

indicator of our financial performance and process efficiency.

The table below summarizes these metrics for the

years indicated:

2004 2003 2002

SG&A expense as a percentage of sales 36.7% 37.4% 37.8%

Operating margin 11.5% 10.4% 9.3%

Retail Outlets

The table below shows our retail locations broken down

between company-operated stores, kiosks and dealer outlets.

While the dealer outlets represented approximately 24% of

RadioShack’s total retail locations at December 31, 2004, our

product sales to dealers are less than 10% of our total net sales

and operating revenues (see “Results of Operations” below).

Average

Store Size At December 31,

(Sq. Ft.) 2004 2003 2002

Company-operated stores (1) 2,529 5,046 5,121 5,161

Kiosks (2) 89 599 9–

Dealer outlets (3) N/A 1,788 1,921 2,052

Total number of retail locations 7,433 7,051 7,213

(1) Over the past two years, we have closed over 100 company-operated

stores, net of new store openings and relocations. This trend is due to not

renewing locations that fail to meet our financial return hurdles. It is antici-

pated that company-operated stores will decline in 2005 by about 50 stores.

(2) Kiosks consist of 546 SAM’S CLUB locations and 53 Sprint locations at the

end of 2004 and 9 Sprint locations at year end 2003. SAM’S CLUB has the

unconditional right to assume the operation of up to 75 locations (in total)

and to date has provided us with notice that, effective April 2005, SAM’S

CLUB will assume operation of 23 kiosk locations previously operated by

us. We expect the number of Sprint kiosks to increase by approximately

150 during 2005.

(3) Over the past two years, we have closed over 250 dealer outlets, net of

new outlet openings or conversion to company-operated stores. This trend

is due to the closure of smaller outlets that failed to meet our minimum

purchase requirements. It is anticipated that dealer outlets in 2005 will

not change materially from 2004.

Results of Operations

Net sales and operating revenues by channel of distribution

are as follows:

Year Ended December 31,

(In millions) 2004 2003 2002

Company-operated store sales $4,472.3 $4,342.6 $ 4,231.2

Kiosk sales 56.4 0.7 –

Dealer and other sales 312.5 306.0 346.0

Net sales and operating revenues $4,841.2 $4,649.3 $ 4,577.2

Dealer and other sales not only include our sales to the

independent dealers, but also include sales and operating

revenues generated from our www.radioshack.com Web

site, outbound and inbound call centers, and our retail

support operations.

Management’s Discussion and Analysis of Financial Condition and Results of Operations continued

RadioShack Corporation and Subsidiaries

19

AR2004