Radio Shack 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

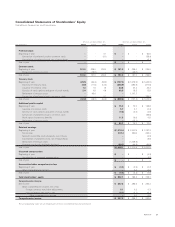

Consolidated Statements of Stockholders’ Equity

RadioShack Corporation and Subsidiaries

37

AR2004

Shares at December 31, Dollars at December 31,

(In millions) 2004 2003 2002 2004 2003 2002

Preferred stock

Beginning of year

–

– 0.1

$–

$ – $ 64.5

Conversion of preferred stock to common stock

–

– (0.1)

–

– (58.4)

Cancellation of preferred stock, net of repurchases

–

––

–

– (6.1)

End of year

–

––

$–

$–$–

Common stock

Beginning of year

191.0

236.0 236.0

$ 191.0

$ 236.0 $ 236.0

Retirement of treasury stock

–

(45.0) –

–

(45.0) –

End of year

191.0

191.0 236.0

$ 191.0

$ 191.0 $ 236.0

Treasury stock

Beginning of year

(28.5)

(64.3) (59.2)

$ (707.2)

$ (1,579.9) $(1,443.5)

Purchase of treasury stock

(8.0)

(11.5) (12.4)

(246.9)

(290.9) (317.8)

Issuance of common stock

1.3

1.5 1.6

33.8

37.4 43.3

Exercise of stock options and grant of stock awards

2.4

0.8 0.6

60.9

18.5 12.9

Retirement of treasury stock

–

45.0 –

–

1,107.7 –

Conversion of preferred stock to common stock

–

– 5.1

–

– 125.2

End of year

(32.8)

(28.5) (64.3)

$ (859.4)

$ (707.2) $(1,579.9)

Additional paid-in capital

Beginning of year

$75.2

$ 70.0 $ 138.8

Issuance of common stock

5.7

0.7 (0.3)

Exercise of stock options and grant of stock awards

(9.5)

(2.0) (2.5)

Conversion of preferred stock to common stock

–

– (66.8)

Stock option income tax benefits

11.3

19.6 0.8

Retirement of treasury stock

–

(13.1) –

End of year

$82.7

$ 75.2 $ 70.0

Retained earnings

Beginning of year

$ 1,210.6

$ 2,002.5 $ 1,787.3

Net income

337.2

298.5 263.4

Series B convertible stock dividends, net of taxes

–

– (2.9)

Cancellation of preferred stock, net of repurchases

–

– (8.5)

Retirement of treasury stock

–

(1,049.6) –

Common stock cash dividends declared

(39.7)

(40.8) (36.8)

End of year

$1,508.1

$ 1,210.6 $ 2,002.5

Unearned compensation

Beginning of year

$–

$ – $ (4.3)

Amortization of unearned compensation

–

– 4.3

End of year

$–

$–$–

Accumulated other comprehensive loss

Beginning of year

$ (0.3)

$ (0.5) $ (0.7)

Other comprehensive income

–

0.2 0.2

End of year

$ (0.3)

$ (0.3) $ (0.5)

Total stockholders’ equity

$ 922.1

$ 769.3 $ 728.1

Comprehensive income

Net income

$ 337.2

$ 298.5 $ 263.4

Other comprehensive income, net of tax:

Foreign currency translation adjustments

0.1

0.3 0.3

Loss on interest rate swaps, net

(0.1)

(0.1) (0.1)

Other comprehensive income

–

0.2 0.2

Comprehensive income

$ 337.2

$ 298.7 $ 263.6

The accompanying notes are an integral part of these consolidated financial statements.