Radio Shack 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

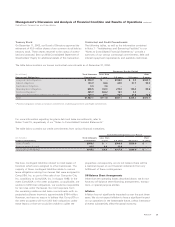

Management’s Discussion and Analysis of Financial Condition and Results of Operations continued

RadioShack Corporation and Subsidiaries

Year Ended December 31,

2004 2003 2002

% of Sales & % of Sales & % of Sales &

(In millions) Dollars Revenues Dollars Revenues Dollars Revenues

Payroll and commissions $ 769.3 15.9% $ 751.9 16.2% $ 728.0 15.9%

Advertising 271.5 5.6 254.4 5.5 241.0 5.3

Rent 259.4 5.3 250.1 5.4 244.9 5.4

Other taxes (excludes income taxes) 105.9 2.2 106.9 2.3 105.9 2.3

Insurance 80.8 1.7 81.5 1.8 71.0 1.6

Utilities and telephone 72.9 1.5 75.8 1.6 74.9 1.6

Credit card fees 37.7 0.8 36.1 0.8 35.8 0.8

Lawsuit settlement –– – – 29.0 0.6

Stock purchase and savings plans 20.2 0.4 21.5 0.4 20.8 0.5

Repairs and maintenance 12.4 0.3 11.6 0.2 12.0 0.3

Printing, postage and office supplies 9.6 0.2 10.0 0.2 10.5 0.2

Travel 9.6 0.2 8.6 0.2 9.6 0.2

Loss on real estate sub-lease –– 5.6 0.1 6.0 0.1

Bad debt (0.3) – 0.4 – 4.7 0.1

Other 125.8 2.6 125.6 2.7 134.5 2.9

$1,774.8 36.7% $1,740.0 37.4% $1,728.6 37.8%

Sales in our service platform (which includes prepaid

wireless airtime, bill payment revenue and warranty service

plans) decreased in dollars and as a percentage of net

sales and operating revenues in 2004, compared to 2003.

These decreases were primarily due to a decrease in

wireless-related services.

Sales in our technical platform (which includes wire and

cable, connectivity products, components and tools, as

well as hobby and robotic end-products) decreased in

both dollars and as a percentage of net sales and operating

revenues in 2004, compared to 2003. These decreases

were primarily due to a sales decline in wire and cable

products and the related connectivity products.

Gross Profit

Gross profit for 2004 was $2,434.5 million or 50.3% of net

sales and operating revenues, compared with $2,315.7

million or 49.8% of net sales and operating revenues in

Our SG&A expense increased 2.0% in dollars, but decreased

as a percent of net sales and operating revenues to 36.7%

for the year ended December 31, 2004, from 37.4% for the

year ended December 31, 2003. The dollar increase for 2004

was primarily due to an increase in both payroll and com-

missions and advertising.

Payroll expense increased in dollars, but decreased as a

percentage of net sales and operating revenues. This dollar

increase was due to the higher sales-based compensation

we paid as a result of our 3% increase in company comparable

store sales, as well as our acquisition of the SAM’S CLUB kiosk

locations and related personnel in October 2004. We expect

payroll expense to increase in 2005 due to the full-year effect

of the acquisition of the SAM’S CLUB kiosk business and our

planned increase in the number of Sprint kiosk locations.

2003, resulting in a 5.1% increase in gross profit and a

50 basis point increase in our gross profit percentage.

These increases over the prior year were primarily due to

significantly less margin erosion from price markdowns;

we sold over 40% less in discontinued and devalued

merchandise in 2004 versus the prior year. In addition,

the benefits of centralized procurement and better vendor

management enabled us to sell like-products year over

year at higher gross margins.

These increases were partially offset by a change in mer-

chandise mix among platforms, resulting in increased sales

of lower margin products, notably wireless, and decreased

sales of higher margin products like accessories.

Selling, General and Administrative Expense

The table below summarizes the breakdown of various com-

ponents of our consolidated SG&A expense and its related

percentage of total net sales and operating revenues.

21

AR2004