Radio Shack 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

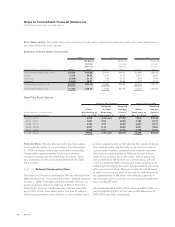

Medium-Term Notes: We also issued, in various amounts and

on various dates from December 1997 through September

1999, medium-term notes totaling $150.0 million under the

shelf registration described above. At December 31, 2004,

$5.0 million of these notes remained outstanding. The interest

rate at December 31, 2004, for the outstanding $5.0 million in

medium-term notes was 6.42%. These notes have a maturity

in 2008. As of December 31, 2004, there was no availability

under this shelf registration.

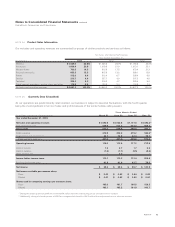

Short-Term Borrowing Facilities

Year Ended December 31,

(In millions) 2004 2003 2002

Domestic seasonal bank credit lines

and bank money market lines:

Lines available at year end $600.0 $700.0 $705.0

Loans outstanding at year end –––

Weighted average interest

rate at year end –––

Weighted average loans

outstanding $–$–$–

Weighted average interest

rate during year –––

Short-term foreign credit lines:

Lines available at year end $ 7.2 $ 7.2 $ 15.8

Loans outstanding at year end –––

Weighted average interest

rate at year end –––

Weighted average loans

outstanding $–$–$–

Weighted average interest

rate during year –– 2.1%

Letters of credit and banker’s

acceptance lines of credit:

Lines available at year end $168.5 $162.7 $167.4

Acceptances outstanding

at year end –––

Letters of credit open against

outstanding purchase

orders at year end $ 30.3 $ 20.0 $ 26.4

Commercial paper credit facilities:

Commercial paper outstanding

at year end $–$–$–

Weighted average interest

rate at year end –––

Weighted average commercial paper

outstanding $–$ – $ 0.1

Weighted average interest

rate during year –– 2.0%

Our short-term credit facilities, including revolving credit lines,

are summarized in the accompanying short-term borrowing

facilities table above. The method used to compute averages

in the short-term borrowing facilities table is based on a daily

weighted average computation that takes into consideration

the time period such debt was outstanding, as well as the

amount outstanding. Our financing, primarily short-term

debt, if utilized, would consist primarily of commercial paper,

which is described in more detail below.

Commercial Paper: We have access to short-term debt instru-

ments, such as commercial paper issuances, available to

supplement our short-term financing needs. The commercial

paper program, when utilized, has a typical maturity of 90

days or less. The amount of commercial paper that can be out-

standing is limited to a maximum of the unused portion of our

$600 million revolving credit facilities described in more detail

below. We currently have no commercial paper outstanding.

Credit Facilities: In the second quarter of 2004, we replaced

our existing $300.0 million 364-day revolving credit facility

with a new five-year credit facility maturing in June 2009.

The terms of this revolving credit facility are substantially

similar to the previous facility. This credit facility, in addition

to our existing $300.0 million five-year credit facility which

expires in June 2007, will support our commercial paper

borrowings and is otherwise available for general corporate

purposes. As of December 31, 2004, there were no out-

standing borrowings under these credit facilities. Our out-

standing debt and bank syndicated credit facilities have

customary covenants, and we were in compliance with

these covenants as of December 31, 2004.

Other Indebtedness: We established an employee stock own-

ership trust in June 1990. Further information on the trust and

its related indebtedness, which we guaranteed, is detailed in

the discussion of the RadioShack 401(k) Plan in Note 19.

In the second quarter of 2002, we sold and leased back our

corporate technology center building, recording this transac-

tion as a financing obligation, because we retained certain

responsibilities during the lease term. Under a financing obli-

gation, the associated assets remain on our balance sheet.

This obligation has a three-year term expiring in 2005 with

renewal options. The lessors are unrelated third-parties. We

entered into this transaction in contemplation of and to facili-

tate the relocation of our corporate headquarters to a new

custom-built corporate campus, which was substantially com-

plete at December 31, 2004. We began to occupy the new

campus in the fourth quarter of 2004 and will be completed

in the first quarter of 2005.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

45

AR2004