Radio Shack 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During 2004, we substantially completed construction of our

new corporate campus. These expenditures, including capital-

ized interest of $6.6 million and $2.6 million for the years

2004 and 2003, respectively, are the principal reasons for the

increases in buildings and furniture, fixtures and equipment.

From time to time, we enter into store operating lease

agreements that provide for landlord-funded construction

allowances for the purchase and installation of leasehold

improvements. Prior to January 2004, we accounted for these

construction allowances as a reduction of leasehold improve-

ments; however, beginning January 1, 2004 all construction

allowances received were recorded as deferred rent and are

ratably amortized as a reduction of rent expense over the

lease term. We believe our prior accounting for construction

allowances had no material impact on our consolidated

financial statements for 2003 and 2002, and therefore no

accounting adjustments are necessary or have been made.

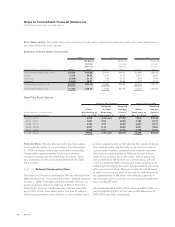

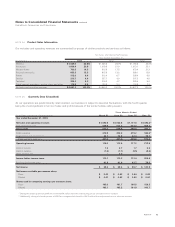

NOTE 5 Other Assets, Net

December 31,

(In millions) 2004 2003

Notes receivable $10.6 $ 9.8

Goodwill 26.8 2.9

Deferred income taxes –22.2

Intangibles 19.9 –

Other 32.3 29.3

Total other assets, net $89.6 $64.2

The increase in goodwill and intangibles was the result of

the acquisition of the SAM’S CLUB kiosk business.

The changes in the carrying amount of goodwill are as follows:

(In millions)

Balance at December 31, 2003 $ 2.9

WRI asset acquisition 23.1

Other, net 0.8

Balance at December 31, 2004 $26.8

During the third quarter of fiscal year 2004, we acquired

certain assets and assumed certain liabilities of Wireless

Retail, Inc. (“WRI”). These assets included wireless kiosks

and inventory located within SAM’S CLUB retail locations.

This acquisition enables us to leverage our retail support

infrastructure to expand into other retail channels more

rapidly. The acquisition was accounted for using the pur-

chase method of accounting as prescribed in SFAS No. 141,

“Business Combinations” (“SFAS No. 141”). In accordance

with SFAS No. 141, the purchase price was allocated to the

assets acquired and liabilities assumed based on estimates

of their respective fair values at the date of acquisition.

Fair values were determined principally by independent valu-

ations and supported by internal studies. The total purchase

price of $59.1 million was allocated primarily to fixed assets,

goodwill and a separately identifiable intangible asset, which

is our contract with SAM’S CLUB. The preliminary purchase

price allocation to goodwill was $23.1 million and to intangi-

bles was $25.2 million. Although the purchase price alloca-

tion is preliminary, we do not anticipate any significant

adjustments at the finalization of this process. If necessary,

however, we may record adjustments to these intangible bal-

ances in subsequent periods.

This SAM’S CLUB intangible is being amortized over five years

and the estimated amortization for years ended December 31,

2005, 2006, 2007, 2008, and 2009 is $5.3 million, $5.3 million,

$5.3 million, $5.3 million, and $4.0 million, respectively.

NOTE 6 Impairment of Long-Lived Assets

AmeriLink was acquired in 1999 to provide us with residential

installation capabilities for the technologies and services

offered in our retail stores. From the time of its acquisition,

AmeriLink incurred operating losses and negative cash flows.

In 2000 and in 2001, we attempted to restructure and reor-

ganize AmeriLink, but due to the overall slowdown in the

economy and the market decline for professionally installed

home Internet connectivity services, AmeriLink continued to

report losses. During the fourth quarter of 2001, we prepared

a revised analysis of estimated future cash flows for

AmeriLink, which indicated that its long-lived assets were

impaired. The carrying value of AmeriLink's long-lived assets

(principally goodwill and fixed assets) exceeded the discount-

ed present value of the estimated future cash flows by

approximately $37.0 million. An impairment of goodwill for

that amount was recorded for 2001. As a result of continued

difficulties in the DTH business and a refocus during the

fourth quarter of 2002 on our satellite installation strategy,

together with a revised cash flow projection for our overall

installation business, we determined that the remaining long-

lived assets associated with AmeriLink were impaired. We

compared the carrying value of these long-lived assets with

their fair value and determined that the remaining goodwill

balance of $8.1 million was impaired and we, therefore,

recorded an impairment charge for this amount in the accom-

panying 2002 Consolidated Statement of Income. As of

December 31, 2002, there was no remaining goodwill on our

balance sheet related to AmeriLink. In September 2003, we

sold AmeriLink, resulting in a loss of $1.8 million which was

recorded in other income in our Consolidated Statement of

Income for 2003.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

43

AR2004