Radio Shack 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

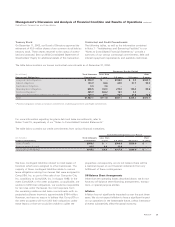

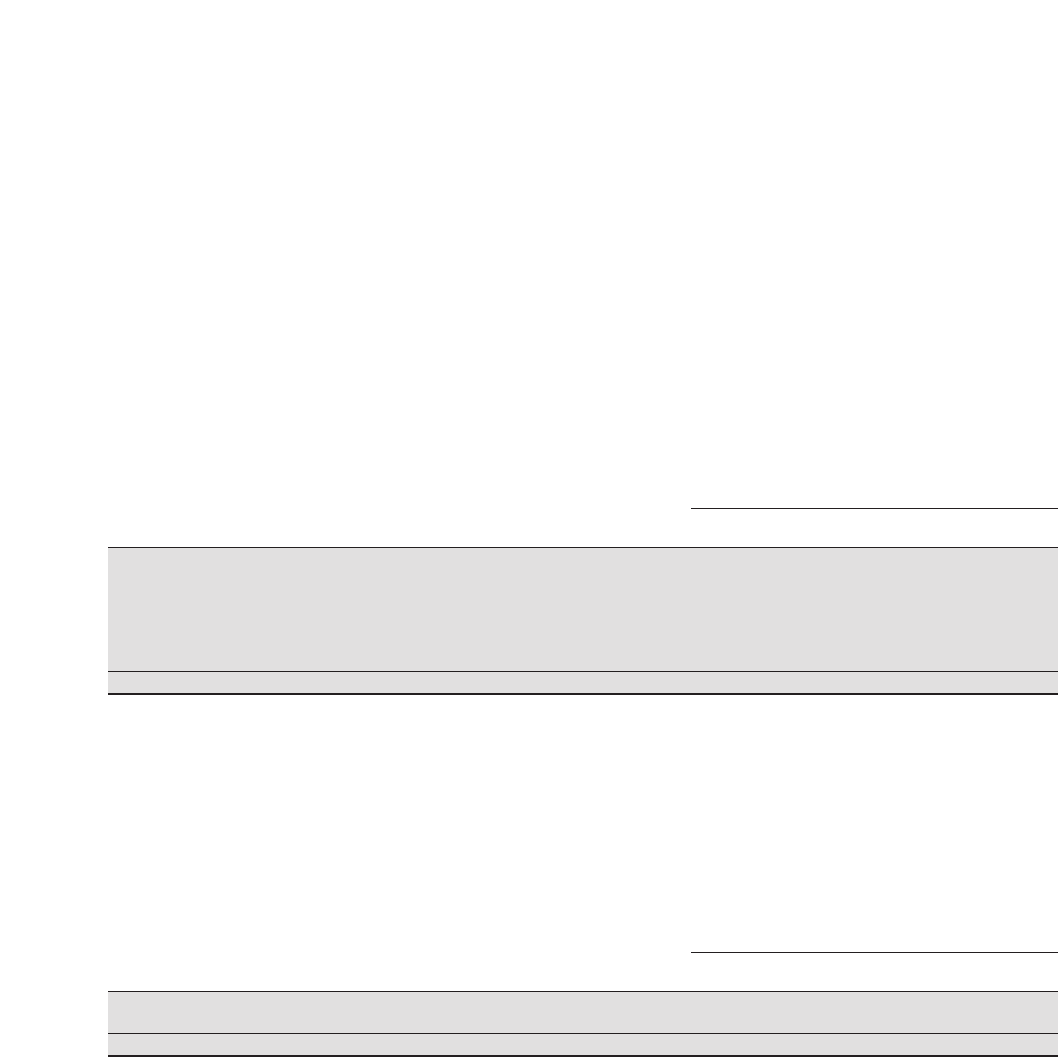

The table below contains our known contractual commitments as of December 31, 2004.

Payments Due by Period

(In millions) Total Amounts Less than Over

Contractual Obligations Committed 1 year 1-3 years 3-5 years 5 years

Long-term debt obligations $ 506.9 $ – $158.2 $ 5.0 $ 343.7

Interest obligations 193.9 36.8 69.9 51.7 35.5

Capital lease obligations 0.6 0.6 – – –

Operating lease obligations 669.5 182.3 270.2 136.4 80.6

Purchase obligations(1) 485.9 464.2 18.3 3.4 –

Other long-term liabilities reflected on the balance sheet 130.3 27.1 50.5 37.8 14.9

Total $1,987.1 $711.0 $567.1 $ 234.3 $ 474.7

(1) Purchase obligations include our product commitments, marketing agreements and freight commitments.

For more information regarding long-term debt and lease commitments, refer to

Notes 7 and 15, respectively, of our “Notes to Consolidated Financial Statements.”

The table below contains our credit commitments from various financial institutions.

Commitment Expiration per Period

(In millions) Total Amounts Less than Over

Credit Commitments Committed 1 year 1-3 years 3-5 years 5 years

Lines of credit $600.0 $ – $300.0 $300.0 $ –

Stand-by letters of credit 18.5 0.9 17.6 – –

Total credit commitments $618.5 $ 0.9 $ 317.6 $300.0 $ –

Management’s Discussion and Analysis of Financial Condition and Results of Operations continued

RadioShack Corporation and Subsidiaries

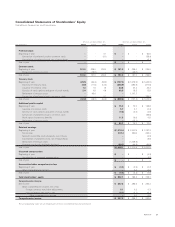

Treasury Stock

On December 11, 2003, our Board of Directors approved the

retirement of 45.0 million shares of our common stock held as

treasury stock. These shares returned to the status of author-

ized and unissued. See our 2003 Consolidated Statement of

Stockholders’ Equity for additional details of this transaction.

We have contingent liabilities related to retail leases of

locations which were assigned to other businesses. The

majority of these contingent liabilities relate to various

lease obligations arising from leases that were assigned to

CompUSA, Inc. as part of the sale of our Computer City,

Inc. subsidiary to CompUSA, Inc. in August 1998. In the

event CompUSA or the other assignees, as applicable, are

unable to fulfill their obligations, we would be responsible

for rent due under the leases. Our rent exposure from

the remaining undiscounted lease commitments with no

projected sublease income is approximately $154 million.

However, we have no reason to believe that CompUSA or

the other assignees will not fulfill their obligations under

these leases or that we would be unable to sublet the

properties; consequently, we do not believe there will be

a material impact on our financial statements from any

fulfillment of these contingencies.

Off-Balance Sheet Arrangements

Other than the operating leases described above, we do not

have any off-balance sheet financing arrangements, transac-

tions, or special purpose entities.

Inflation

Inflation has not significantly impacted us over the past three

years. We do not expect inflation to have a significant impact

on our operations in the foreseeable future, unless internation-

al events substantially affect the global economy.

Contractual and Credit Commitments

The following tables, as well as the information contained

in Note 7 - “Indebtedness and Borrowing Facilities” to our

“Notes to Consolidated Financial Statements,” provide a

summary of our various contractual commitments, debt and

interest repayment requirements, and available credit lines.

29

AR2004