Radio Shack 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ing revenues. We had $437.9 million in cash and cash equiva-

lents as of December 31, 2004, as a resource for our funding

needs. Additional capital is available under our $600 million

commercial paper program, which is supported by a bank

credit facility that could be utilized in the event the commercial

paper market is unavailable to us. We currently do not expect

the commercial paper market to become unavailable to us nor

that; we will need to utilize our credit facility. As of December

31, 2004, we had no commercial paper outstanding, nor had

we utilized any of our credit facility.

During the year ended December 31, 2004, $161.8 million

more in cash was provided by accounts payable as a result

of effective management of our payables in 2004 and an

increase in inventory levels, when compared to the prior year.

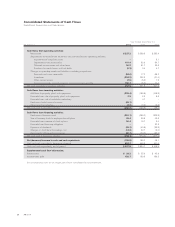

Cash Flow – Investing Activities

Cash used in investing activities in 2004 was $290.2 million,

compared to $188.9 million and $99.0 million used in 2003

and 2002, respectively. Capital expenditures for 2004 and 2003

increased over 2002, primarily due to the continued construc-

tion of our new corporate campus in 2004 and 2003, while

capital expenditures for 2002 were primarily for our retail store

expansions and remodels and information systems upgrades.

We also had capital expenditures relating to retail stores and

information systems in both 2004 and 2003. We anticipate

that our capital expenditure requirements for 2005 will be

approximately $200.0 million to $240.0 million. Although

capital expenditures for 2005 will be about the same as 2004,

expenditures will occur in different areas. Company-operated

store remodels and relocations, approximately 150 new Sprint

kiosks and updated information systems account for the major-

ity of our anticipated 2005 capital expenditures. See further

discussion on our new corporate headquarters below in the

section titled “Capital Structure and Financial Condition.”

During the fourth quarter of fiscal year 2004, we acquired

certain assets and assumed certain liabilities of Wireless Retail,

Inc. (“WRI”). These assets included wireless kiosks and inven-

tory located within SAM’S CLUB retail locations. The total

purchase price was $59.1 million. See further discussion on

our SAM’S CLUB kiosk business above in the section titled

“Overview.” As of December 31, 2004, we had $437.9 million

in cash and cash equivalents. These cash and cash equivalents,

along with cash generated from our net sales and operating

revenues and, if necessary, from our credit facilities, are

available to fund future capital expenditure needs.

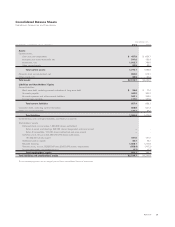

Cash Flow – Financing Activities

Cash used in financing activities was $259.1 million in 2004,

compared to $274.8 million and $377.5 million in 2003 and

2002, respectively. We used $251.1 million for the repur-

chase of our common stock in 2004 and $286.2 million

and $329.9 million for the repurchase of our common stock

in 2003 and 2002, respectively. Repurchases of common

stock were made under our share repurchase and employee

stock programs. See the further discussion of our stock

repurchase programs below in the section titled “Capital

Structure and Financial Condition.” The 2004, 2003 and 2002

stock repurchases were partially funded by $85.8 million,

$51.5 million and $49.6 million, respectively, received from

the sale of treasury stock to employee benefit plans and from

stock option exercises. The balance of capital to repurchase

shares was obtained from cash generated from operations.

We received $32.3 million from the sale and lease-back of

our former corporate technology center building during the

second quarter of 2002. This transaction was recorded as a

financing obligation due to responsibilities which we retain

during the lease period. Additionally, our net borrowings

decreased $54.1 million in 2004, compared to a slight

increase in 2003 and a decrease of $89.7 million in 2002.

Dividends paid, net of tax, in 2004, 2003 and 2002 amounted

to $39.7 million, $40.8 million and $39.8 million, respectively.

This change in dividends paid over the last three years was

affected by a dividend per share increase and yearly share

repurchases, resulting in fewer shares outstanding.

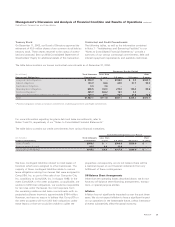

Free Cash Flow

Our free cash flow, defined as cash flows from operating

activities less dividends paid and additions to property, plant

and equipment, was $83.4 million in 2004, $421.5 million

in 2003 and $375.0 million in 2002. The decrease in free

cash flow in 2004 was the result of a cash usage in working

capital components, primarily inventory. The increase in

free cash flow between 2002 and 2003 was the result of

supply chain initiatives, including a greater focus on reducing

inventory weeks-of-supply. We expect free cash flow to

be approximately $200 million to $240 million in 2005. The

increase from 2004 is based substantially on the anticipated

increase in cash generated from working capital, primarily

from inventory reductions.

We believe free cash flow is an appropriate indication of our

ability to fund share repurchases, repay maturing debt,

change dividend payments or fund other uses of capital that

management believes will enhance shareholder value. The

comparable financial measure to free cash flow under gener-

ally accepted accounting principles is cash flows from operat-

ing activities, which were $352.5 million in 2004, $651.9 mil-

lion in 2003 and $521.6 million in 2002. We do not intend the

presentation of free cash flow, a non-GAAP financial measure,

to be considered in isolation or as a substitute for measures

prepared in accordance with GAAP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

RadioShack Corporation and Subsidiaries

26 AR2004