Radio Shack 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

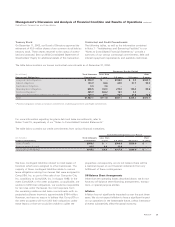

Advertising expense increased in dollars and as a percentage

of net sales and operating revenues in 2003. These increases

related to an increase in television advertising, as well as a

decrease in contributions from vendors.

Rent expense increased in dollars for 2003 due primarily to

lease renewals and relocations at higher rates, as well as a

slight increase in the average store size. Rent expense as a

percent of net sales and operating revenues remained the

same for 2003, compared to 2002, due to fewer company

stores and our continued rent reduction efforts.

Insurance expense increased in both dollars and as a

percent of net sales and operating revenues in 2003,

when compared to 2002.

Depreciation and Amortization

Depreciation and amortization expense decreased $2.7

million to $92.0 million and remained at 2.0% of net sales

and operating revenues for both 2003 and 2002.

Gain on Contract Termination

RadioShack and Microsoft mutually agreed during 2002 to

terminate their agreement and settle the remaining commit-

ments each had to one another. The termination of this

agreement took effect at the start of the fourth quarter of

2002, upon satisfaction of several contractual obligations.

The net financial result was an $18.5 million gain (principally

cash received), driven primarily by the settlement of a

multi-year obligation Microsoft had to connect our stores

with broadband capabilities.

Impairment of Long-Lived Assets

AmeriLink was acquired in 1999 to provide us with residen-

tial installation capabilities for the technologies and services

offered in our retail stores. As a result of continued difficul-

ties in the DTH business and a refocus during the fourth

quarter of 2002 on our satellite installation strategy, together

with a revised cash flow projection for our overall installation

business, we determined that the remaining long-lived assets

associated with AmeriLink were impaired. We compared

the carrying value of these long-lived assets with their fair

value and determined that the remaining goodwill balance

of $8.1 million was impaired and we, therefore, recorded

an impairment charge of this amount in the accompanying

2002 Consolidated Statement of Income. As of December

31, 2002, there was no remaining goodwill balance on our

balance sheet relating to AmeriLink. We sold AmeriLink in

September 2003.

Net Interest Expense

Interest expense, net of interest income, was $22.9 million

for 2003 versus $34.4 million for 2002, a decrease of $11.5

million or 33.4%.

Interest expense decreased to $35.7 million in 2003 from

$43.4 million in 2002 primarily as a result of a reduction in the

average debt outstanding throughout 2003. In addition, our

interest rate swap instruments and the capitalization of $2.6

million of interest expense related to the construction of our

new corporate campus also lowered overall interest expense

for the year ended December 31, 2003, when compared to

the same prior year period.

Interest income increased over 42% to $12.8 million in 2003

from $9.0 million in 2002, primarily as a result of a $5.6 mil-

lion increase in interest received from income tax settlements

in 2003, as compared to 2002.

Other Income, Net

In July 2003, we received payment of $15.7 million resulting

from the favorable settlement of a lawsuit we had previously

filed. We recorded this settlement in the third quarter of 2003

as other income of $10.7 million, net of legal expenses of

$5.0 million paid as a result of the lawsuit.

In September 2003 we sold our wholly-owned subsidiary

AmeriLink to INSTALLS inc, LLC in a cash-for-stock sale,

resulting in a loss of $1.8 million, based on AmeriLink’s book

value, which was recorded in other income.

For the year ended December 31, 2003, we received and

recorded income of $3.1 million owed to us under a tax shar-

ing agreement with O’Sullivan, compared to $33.9 million

received and recorded in the corresponding prior year period.

In the second quarter of 2002, we received and recorded

income of $27.7 million in partial settlement of amounts owed

to us under this tax sharing agreement. This partial settlement

followed a ruling in our favor by an arbitration panel. Future

payments under the tax sharing agreement will vary based on

the level of O’Sullivan’s future earnings and are also depend-

ent on O’Sullivan’s overall financial condition and ability to pay.

During the second half of 2002, we received two payments

totaling $6.2 million relating to quarterly payments under the

tax sharing agreement with O’Sullivan.

Provision for Income Taxes

Our provision for income taxes reflects an effective income

tax rate of 36.9% for 2003 and 38.0% for 2002. The decrease

in the effective tax rate for 2003, when compared to 2002,

was the result of a favorable tax settlement related to prior

year tax matters.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

RadioShack Corporation and Subsidiaries

24 AR2004